Conceived as supplements to pension plans, defined contribution (DC) plans have taken center stage in the retirement industry. That has led stakeholders (i.e., plan sponsors, consultants, investment managers, and policymakers) to continue to push for an evolution of the core investment menu.

Much of the discussion about DC plan design has focused on investment theory and behavioral science. Investment theory presents a starting point for decision-making about the lineup. Now, with more than a decade of experience since the passage of the Pension Protection Act, plan sponsors can analyze how participants actually use the lineup of their DC plan and make improvements.

The basic premise behind DC plan design stems from the behavioral finance argument that although people value choice, they are loath to make choices. Research on the topic signals higher participation in plans that offer fewer options, but over time, and with the best of intentions, plans have offered more choices. Callan’s DC Index™ reveals that the average number of non-target date options within DC plans has risen from 11 in 2006 to 14 in 2019.

DC plan committees structure core lineups so that those who wish to build their own portfolio can do so in a thoughtful manner. In most cases, each option in the lineup is intended to serve a specific purpose. For example, a global equity fund theoretically provides a “one-stop shop” for participants by providing broad global equity exposure via a single fund.

A look at the inner workings of most core lineups reveals that despite the well-meaning intentions of committees, there is a disconnect between how plans are designed to be used and how participants actually use the plan lineups. To assess what occurs at the participant level, Callan utilized a dataset of nearly 500,000 participants across 13 DC plans. The plans span various industries including technology, defense, financial services, manufacturing, and government.

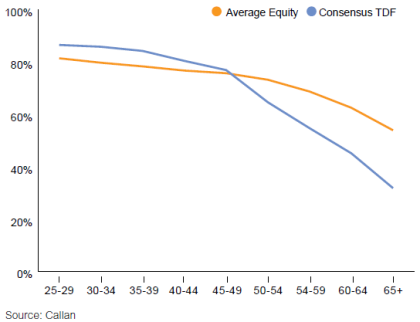

Examining participants’ average equity exposure by age provides some room for reassurance. Overall, the downward-sloping exposure to equity shows that the data bears out intuition: As participants age, they tend to decrease their allocation to equity (as indicated by the orange line in the exhibit). Yet, relative to the glidepath of the average target date fund (blue line), younger participants using the core lineup have a slightly lower risk exposure, whereas older participants have a relatively high risk exposure. The gap increases with those post age 45-49, primarily due to the steeper de-risking of target date funds.

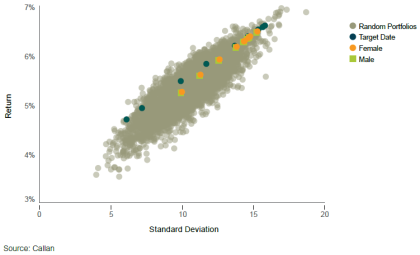

Digging further into the data, one can also examine how participants allocate to the underlying asset and sub-asset classes. To assess their ability to construct efficient, diversified portfolios, we examined participant-level holdings across nine broad asset classes. (We note that the use of managed accounts in this dataset was negligible.) Using the actual allocations of the 467,000 participants, we constructed average portfolios according to participants’ age and gender. We then compared these average portfolios to 5,000 randomly constructed portfolios using the same asset classes. Employing Callan’s capital market assumptions, we project the risk/reward profile shown below.

The results illustrate the challenges that participants have in constructing efficient portfolios. Across both age and gender, participants’ average allocations are not quite efficient. For the sake of comparison we also plotted the age-appropriate target date allocation, using the Callan consensus glidepath. For younger participants (those in the northeast of the scatter plot) there was little difference in efficiency. However as participants age (and often have higher balances) the average allocations begin to trail their target date equivalent by larger and larger margins. It could very well be that those constructing a portfolio on their own are doing so with other considerations (outside assets, presence of defined benefit plan, bequest preferences) than the assumptions underlying most target date funds (e.g., that the defined contribution plan along with Social Security are the sole methods of funding retirement). We certainly acknowledge these individual considerations may play a role.

With the disconnect between committees’ intentions and participants’ actual utilization patterns, there exists a potential bridge. With years of actual experience with DC plans, recordkeepers can now provide a high level of detail on participant utilization. Decisions should be made not only in light of investment theory but also informed by the reality of participant-level utilization. Having carefully gazed into the participant-level data, plan committees can then decide to address potential issues.

To bridge the gap between sponsor intent and participant action, sponsors can evaluate that detailed data about participants and their investment decisions and make their plans even better, in several ways:

- Investment Options: They can rethink their fund choices to reflect how participants are actually investing.

- Plan Lineup: They can see whether there are ways they can streamline the plan and cut the number of choices to reduce the potential for misuse.

- Plan Design: They can improve the structure of the plan and the way it is communicated to participants so that those contributing to the plan make better choices. There should be consistency in how the committee conceptually views the lineup (e.g., three-tier structure) and how the lineup is then portrayed to participants. Additionally, if the data reveal utilization patterns that appear worrying, remediation in the form of re-enrollment may be an option.