This blog post is an excerpt from our white paper on the subject, “A Guide to Implementing a China A-Shares Allocation.”

Over the past decade, Chinese regulators have reformed and liberalized the China A-shares equity market, which includes the stocks of mainland Chinese companies that trade on the country’s two major exchanges (Shanghai and Shenzhen), to improve its accessibility for non-Chinese investors. This effort led to the gradual inclusion of China A-shares, the second-biggest and second-most liquid equity market in the world, into global indices starting in 2018.

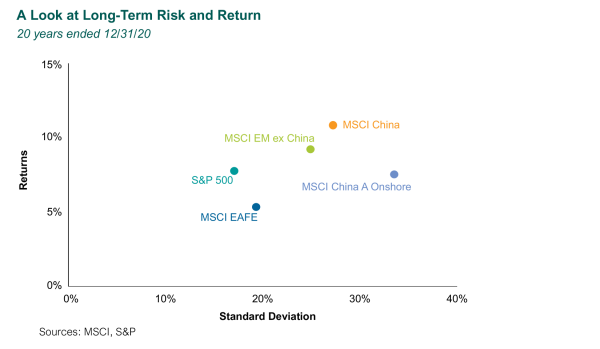

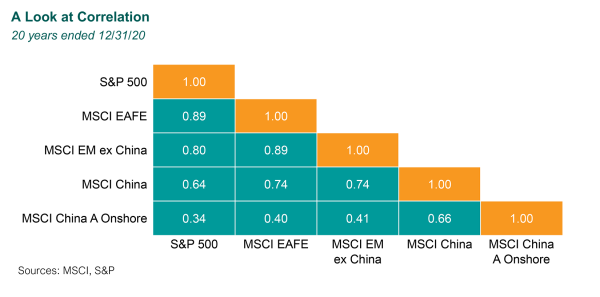

This “institutionalization” of the China A-shares market, which orients to the higher-value sectors (e.g., Health Care and Information Technology), provides U.S. institutional investors an avenue to exploit the investment opportunity as China transitions from an export- and investment-driven economy to one focused on consumption and services, with the potential for higher returns and lower correlations to other equity asset classes, albeit with greater volatility.

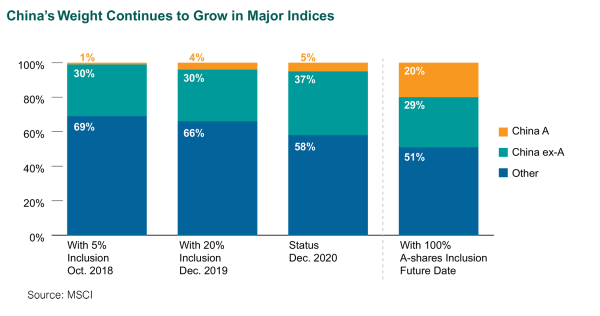

Most institutional investors employ an equity structure consisting of three regional allocations (i.e., U.S., developed ex-U.S., and emerging markets). Exposure to China is primarily gained through emerging markets. Over the past five years, China’s importance has grown within emerging markets and will continue to grow with the addition of China A-shares. At full inclusion, China is expected to be nearly 50% of the emerging market index, 20% of which will stem from A-shares.

As a result, the management of China onshore exposure is going to play a bigger role in the overall equity structure. Here are three potential paths to a China A-shares allocation:

- Path #1 is the most seamless as the appropriate incumbent passive and active managers organically manage the China A-shares exposure. With the inclusion process by the index providers, managers will have greater access to Chinese onshore names over time. Although this path is not disruptive to the equity structure and is cost effective, it does not maximize the return and risk benefits of China A-shares. The allocation to China A-shares is bounded by the inclusion factor of index providers, and selection is typically managed by non-specialists.

- Path #2 may offer a better return and risk solution relative to Path #1 by supplementing the emerging market structure with a dedicated allocation to China A-shares. While many active emerging market managers have a sizable exposure to Chinese offshore stocks (i.e., H-shares and ADRs), they have limited and narrow exposure to onshore securities. China A-shares constitute approximately 5% of the MSCI Emerging Markets Index, but that is expected to swell to 20%. Therefore, a dedicated allocation to China A-shares may yield gains not only from positive stock selection by China A specialists but also from flow activity as the asset class gains traction with every incremental increase in the inclusion factor by the index providers. This implementation with an active weight in China A-shares adds complexity to the equity structure as the allocation size, generally driven by the marginal contribution to the overall tracking error of the equity structure, will be managed by the asset owners. Guidelines also should be appropriately managed to mitigate overlap risk between emerging markets and China A-shares managers. Furthermore, the cost of implementation is expected to be higher than path #1.

- Path #3 recalibrates the equity structure paradigm from three to four regional allocations: U.S., developed ex-U.S., emerging markets ex-China, and China. This structure allows asset owners to manage the allocation more explicitly relative to other paths and provides the ability to hire specialists to holistically manage China across share classes, enabling more breadth for positive stock selection. Also, a dedicated all-China allocation offers the capacity to generate more returns by exploiting arbitrage opportunities between about 110 dual-listed onshore and offshore securities. Although this structure may potentially achieve a higher risk/return profile and more precise exposure to China, implementation is challenging given the limited manager universe within emerging markets ex-China. Moreover, the cost of the structure may be higher relative to other paths.

Our white paper has more about implementing a China A-shares allocation, including manager selection, monitoring, ESG considerations, and the performance of the market relative to other equity asset classes.