It is no secret that China is becoming an important market for global investors. Major index providers are increasing the proportion and types of Chinese shares in their indices, and investment managers are launching strategies to take advantage of this growing market.

With the inclusion of China A-shares (i.e., ownership stakes in Chinese companies that trade on the Shanghai and Shenzhen stock exchanges and are quoted in renminbi) into a family of MSCI global and regional indexes including the MSCI Emerging Markets Index, investors are compelled to recognize the significance of this investment opportunity. China’s equity market is the second-largest in the world, measured by market value, and has grown rapidly since it opened in 1991. There are over 4,000 publicly traded Chinese securities with total market capitalization in excess of $12 trillion. And many of these companies are positioned to benefit from a burgeoning Chinese middle class, which is expected to reach over 350 million by 2030, according to the Brookings Institution.

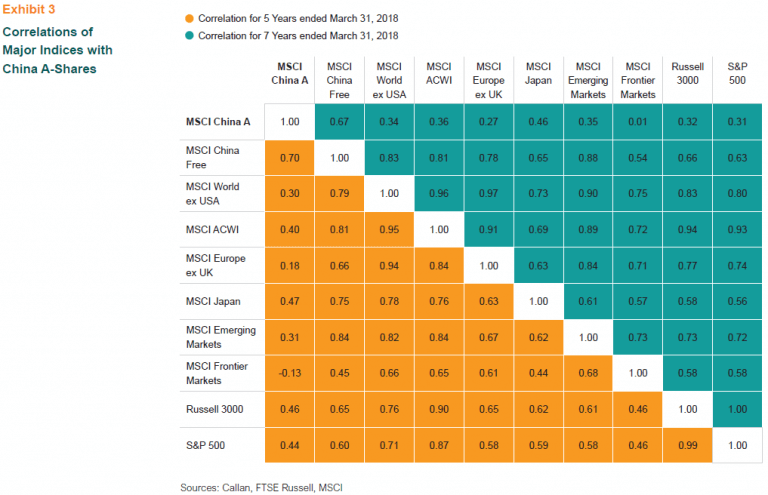

An allocation to China A-shares may provide benefits in the form of competitive long-term returns and low correlation to other equity markets. It is important to note that there are unique structural challenges with investing in China’s onshore equity market. These include significant market volatility, unfavorable capital structures (i.e., capital controls, trading suspensions, etc.), poor corporate governance, and inconsistent application of the rule of law.

The China A-shares market is currently dominated by retail investors. However, the institutionalization of the market as China continues to open to foreign investors will ultimately shift the composition of the investor base from retail to institutional.

As a result, access to China A-shares creates new opportunities for active investment managers to exploit and participate in the transition of the Chinese economy toward a services-led model.

For more on this issue, readers are invited to review my white paper, China A-Shares: Key Issues for Investors to Consider.

12$

The market value, in trilions, of the over 4,000 publicly traded Chinese securities in the A-shares market.