In March 2020, when American businesses were ordered to shut down by state and local governments to stem the coronavirus, many thought their losses would be protected under their commercial business interruption insurance policies. But for most policy holders, pandemics were excluded, and the risk mitigation they thought they had in place did not cover their business losses.

Enter captive insurance. Captive insurance is different from commercial insurance because the parent insures itself against its own risk. A captive can provide coverage for expensive or uninsured lines and can reduce insurance costs, and any profit stays in the company via the captive investment assets. Captives have been around since the early 1960s, and there were 7,000 globally as of February 2020, and approximately 3,100 in the United States.

By accessing permissible capital invested in the captive investment portfolio, some captive insurers have been able to support their parent organizations during COVID-19 by providing relief from business interruption losses. Given the state of the hard commercial market—with its higher insurance premiums, more stringent underwriting criteria, reduced capacity, and less competition—more companies are considering the benefits of adopting captive insurance. In fact, many already have; there were 76 new captives formed in 2020 globally, a 200% year-on-year increase, according to insurance broker Marsh.

As dependence on captive insurance increases, the demand for higher investment returns from the captive investment portfolio also increases. This can be even more challenging in cases where asset pools have declined due to claims being paid out to the parent. The fiduciary role encompassing the oversight of the insurance asset allocation, investment policy statement, asset manager performance, and cash flows is critical—especially as we enter 2021.

With a “lower for longer” rate environment, reduced expected return on risky assets, and demand for yield, there will be more pressure on the captive board to determine if the investment portfolio can bear the additional risk necessary to increase yield and achieve returns similar to recent history. This low-rate environment, coupled with extra pressure on captive insurers, is an ideal time to revisit the captive investment portfolio.

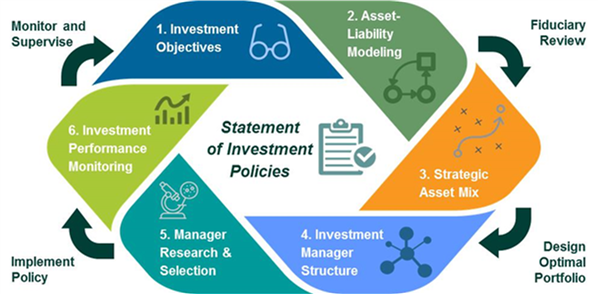

Callan recommends that captive boards use an independent fiduciary framework to make the right investment decisions, by following the series of steps outlined in this graphic. And while every step is independent, each is related to the previous step.