Callan prepares long-term capital markets assumptions (CMAs) for use in guiding our institutional investor clients to an asset-allocation policy appropriate to their situation and tolerance for risk. We develop return, risk, and correlation estimates for a 10-year horizon. We cover a range of asset classes, including cash; publicly traded equity and fixed income; private assets such as private equity, private credit, real estate, infrastructure, and hedge funds; as well as inflation. In the background, we develop very long-term equilibrium assumptions that lean on mean reversion, leavened with plenty of judgment. Our 10-year projections balance what has just happened against our beliefs on how the capital markets will evolve from our starting point toward the longer horizon, with the equilibrium assumptions as a guide.

Callan releases our capital markets assumptions at the start of each year, after beginning work on our analysis in September of the previous year. Embedded in our 10-year assumptions is the expectation that we will certainly see one if not two economic recessions, as well as multiple downdrafts in the equity market. A key component to our fixed income assumption is our expected path for interest rates, and by extension the path for inflation. Underneath lies our assumption for central bank policy directed at both.

Callan has been preparing capital markets assumptions since the late 1980s. I took over direction of our CMAs in 1998, and we had never changed our assumptions mid-year, even after big market moves such as those following the onset of the pandemic in 2020, during the Global Financial Crisis, or in the midst of the Dot-Com Bubble bursting in 2000. We leave open the possibility of revisiting our assumptions if we believe the change in the capital markets is compelling, but we have not had to invoke the “compelling” clause during my tenure—until now.

So what makes this year different, and why did we change horses midstream? Built into our 2022 CMAs was a path to rising interest rates as telegraphed by the market and the Federal Reserve and other central banks when we developed the assumptions during 4Q21. Also built into our 2022 assumptions was the potential for equity to re-price from a very rich level of valuation, and for inflation to remain elevated through 2022, before moving back toward a 10-year average of 2.25%.

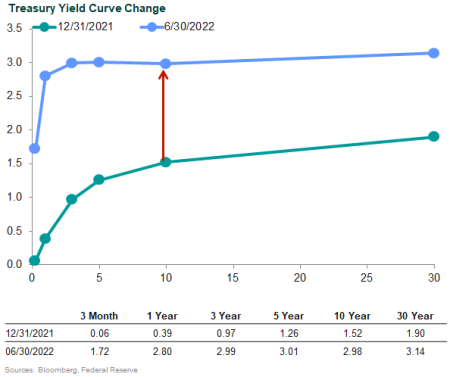

Then came February 2022. Russia’s invasion of Ukraine threw fuel onto the inflation fire and further tangled global supply chains that had been expected to untangle in 2022 and 2023. Market participants believed the Fed would act on its inflation-fighting rhetoric and immediately priced in large interest rate hikes, which were expected to be implemented in steps over the course of 2022. Bond yields shot up starting in February, and the yield for the Bloomberg US Aggregate Bond Index went from 1.75% to just over 3.7% by June 30. Spreads blew out on credit and high yield bonds. When bond yields rise, bond prices fall and the returns are typically negative. There was no place for investors to hide as virtually all asset classes fell, with those that didn’t simply waiting to be marked down when eventually repriced. The S&P 500 Index plunged just a hair shy of 20% through YTD June 30, the Aggregate was down 10.4%, and long bonds were down even more (-21.9% for the Bloomberg Long Government/Credit Index).

The Capital Markets Research group kept a close eye on these developments, and in April we began to run scenario testing on what the return for 2022 would look like if we assumed the yield at 3/31/22 held tight for the rest of the year and we recognized the 1Q22 loss. The answer: the return for the year would be the sum of the 1Q loss plus the higher yield going forward, and would be pretty close to our expected return if we pushed the forecast out to our 10-year horizon.

Then as 2Q evolved, bond yields continued to rise while equities kept falling. The critical question became: When do we need to acknowledge that the changes in the capital markets are large enough to meet our standard of “compelling”? The answer became clear as the yield on the Aggregate hit 2.6% by the end of April and then rose another 110 basis points by the end of June. Our Aggregate Treasury yield was not projected to be at 6/30 levels for another 13 years! A key tenet of our fixed income assumption is that future returns are greatly influenced by starting yield, and starting yields had risen far faster and to higher levels than we anticipated in our 2022 CMAs. The rate rise accounts for the majority of the 10.4% plunge in return for the first half of 2022.

In our judgment, the historic rise in yields was sufficient for us to prepare a preliminary set of 2023-2032 CMAs. Our reasoning traced a process that, first, acknowledged the yields in the bond market at 6/30/22; second, acknowledged the losses of the first six months for all asset classes and the subsequent repricing of equity assets; third, incorporated where the Federal Reserve is suggesting the federal funds rate will sit by the end of the year; and fourth, included a revised outlook for the long-term inflation expectation. Note that the drop in equity markets alone would not have driven our actions; our risk expectation for broad U.S. equity is 17.95%, and 20.7% for global ex-U.S. equity. A 20% decline is fully expected within our CMAs, and is barely beyond a one standard-deviation event.

For Callan’s strategic planning work, primarily asset/liability studies for defined benefit plans and asset-spending studies for a variety of non-pension investors, the preliminary 2023 assumptions posit that after the sharp losses in almost all asset classes and the sharp rise in bond yields, the outlook for return will be better than the one we released in January 2022, albeit the higher return expectations would be applied to a lower asset base. In other words, changing horses midstream offers a modest benefit. In this preliminary set, we addressed only the return expectations for each asset class. As we refine our 2023 assumptions later this year, we will tune the risk and correlation assumptions to complete the set.

Highlights of the Callan 2023 CMAs

Here are the key highlights of our preliminary 2023 CMAs compared to our 2022 assumptions:

- Increase inflation by 25 bps from 2.25% to 2.50%

- Increase cash by 120 bps from 1.20% to 2.40%

- Increase core fixed by 215 bps from 1.75% to 3.90%

- Increase U.S. large cap equities by 50 bps to 7.00%

- Reflects pass-through of our increased inflation assumption

- Removes the negative 25 bps valuation adjustment from higher valuations at the beginning of year

- All other asset class return assumptions adjusted as appropriate so they work together as a set

Callan expects to retain our annual CMA update schedule going forward. We emphasize that this period is unique in our capital markets experience, and that the shift in yields and implied returns for fixed income qualified as “compelling.” The shifts in the equity market since 6/30/22 support our argument that we would not consider the performance of equity as compelling enough on its own to warrant a change to our 10-year assumptions. After falling 20% through June, returns for the S&P 500 jumped 9.2% in July and inched up some more through August 22, for a quarter-to-date gain of 9.6% and a year-to-date loss of 12.3%, well within one standard deviation of our expectations. However, since we were opening up the return assumptions for fixed income, we addressed all asset classes.

How do we see the 2023 assumptions evolving as 2022 progresses? Several variables weigh on our expectations. First, we believe the Fed remains committed to raising the fed funds rate to 3.25%-3.5% by year end. Second, the market has revised expectations for growth and interest rates such that the yield curve has inverted. An inverted curve means the market is expecting a recession and a response from the Fed that includes cutting interest rates to stimulate growth. Third, inflation continues to show high year-over-year growth with an 8.5% read in July, while the month-to-month change was zero, which suggests inflation pressures may have peaked. Fourth, GDP came in with two quarters of consecutive losses in 1Q and 2Q22, which is not the technical definition of recession, but a handy rule of thumb. Who knows, we may already be in a recession (see my post on the topic here)! Other market indicators and a survey of forecasters suggest a recession is likely a year from now.

The importance of a recession to setting CMAs is not whether it occurs but what it means for the shape and path of the yield curve. Right now, even the Fed’s “dot plot” suggests higher short rates through 2022 and into 2023, and then the entire yield curve is expected to fall back over the next 10 years anchored to a fed funds rate of 2.5%. Once we include the losses for the first half of 2022, using the preliminary 2023 assumptions results in a return for the Aggregate index of 2.25%, which is not appreciably higher than our 1.75% assumption released at the start of 2022 and within one standard deviation of return.

Not to stretch our “horse in midstream” analogy too far, but at the beginning of the year we thought—and continue to think—that we had the right horse for our 10-year journey, given everything we knew at the time. The trail became far more challenging than anyone could have predicted, with a series of financial events that had not occurred in decades, and as a result we made the decision to find a new steed better-suited to continue the rest of our trek.

Disclosures

Certain information herein has been compiled by Callan and is based on information provided by a variety of sources believed to be reliable for which Callan has not necessarily verified the accuracy or completeness of or updated. This report is for informational purposes only and should not be construed as legal or tax advice on any matter. Any investment decision you make on the basis of this report is your sole responsibility. You should consult with legal and tax advisers before applying any of this information to your particular situation. Reference in this report to any product, service, or entity should not be construed as a recommendation, approval, affiliation, or endorsement of such product, service, or entity by Callan. Past performance is no guarantee of future results. This report may consist of statements of opinion, which are made as of the date they are expressed and are not statements of fact. The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to subsidiaries or parents, or post on internal web sites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.