While the March 29 deadline for the United Kingdom’s departure from the European Union (EU) has been extended to April 12, there is still no clear direction on its implementation, and even its timing remains uncertain. To better understand the ramifications, Callan conducted an extensive review of private equity activity since the June 2016 referendum that set this in motion and surveyed private equity firms on their concerns and their plans after the break.

We found four main trends:

- There is a wide range of estimates on the economic effects of Brexit, but most experts view it as a negative. The biggest impact will likely be on these sectors: Financial Services, Automotive, Agriculture/Food/Drink, Consumer Goods, and Chemicals/Plastics.

- Since the June 2016 referendum, there appears to have been little impact on credit conditions in the U.K., either absolutely or compared to Germany and France, the other two largest EU countries.

- Most private equity firms indicated it is very difficult to quantify the long-term impact of Brexit on targeted deals or the exit strategy for existing investments. But firms have felt the impact on their own operations. And the degree to which Brexit is incorporated into these firms’ due diligence process varies widely.

- Many expressed greater concerns over the economic health of Southern Europe, particularly Italy’s banking system.

Economic Impact

For background on the steps leading to Brexit, as well as a brief overview of the EU, please refer to the Appendix.

Estimates of the economic impact of Brexit on the U.K. vary and will ultimately depend on the customs (trade and migration) agreements negotiated with the EU and other countries. According to Oliver Wyman, a consultancy, the extra costs arising from increased trade barriers will largely be borne by the five sectors in the U.K. that are most dependent on trade with the EU: Financial Services, Automotive, Agriculture/Food/Drink, Consumer Goods, and Chemicals/Plastics. Firms in these sectors will likely need to reconfigure their supply chains and, potentially, adopt a more local presence across the EU or make more use of local suppliers and manufacturing capacity.

Economists differ greatly in their estimates of Brexit’s long-term impact on the U.K. economy, though most see it as a net negative. Since the Global Financial Crisis low point in 2009, the U.K.’s economy has grown every year, peaking at 3.1% in 2014. But GDP growth has declined since then: 2.3% (2015); 1.9% (2016); 1.8% (2017); and 1.4% (2018).

Callan reviewed transaction volumes (private equity and M&A), purchase multiples, and leverage (borrowing rates and leverage multiples) to measure the impact of Brexit on private equity and M&A activity within the U.K. and found that it appears to be marginal at best.

Transaction volumes and deal values within the U.K., according to PitchBook, declined 28% and 10% respectively in 2018 compared to 2017. In 2018 the total number and value of deals closed was 988 and £42.3 billion. In 2017, the deal number and value were 1,092 and £58.6 billion, an increase of 11% and 97%, respectively, over 2016. By comparison, the average number and value of deals from 2010-14 was 742 and £26.6 billion. So while the total number and value of U.K. PE deals declined in 2018, it was still well above the 2010-14 average.

Inbound M&A activity in the U.K. (i.e., foreign acquirers targeting the U.K. market) reached an all-time high of $251 billion in 2018, up a remarkable 151% from the prior year, according to Dealogic. While the value was driven by two huge deals (Takeda’s acquisition of Shire Pharmaceuticals for $81 billion and Comcast’s deal for Sky for $53 billion), there were still 25 other acquisitions of U.K.-based companies greater than $1 billion in value. This compares to 21 in 2017.

There are several reasons behind this perhaps counterintuitive trend, according to market observers:

- Since the referendum on June 23, 2016, the pound has depreciated roughly 10% vs. both the U.S. dollar and euro. The cheaper pound has made U.K. targets more attractive to foreign buyers.

- Nearly three-quarters of U.K. corporate revenue comes from overseas, limiting direct U.K. economic exposure for the acquirers.

- The economic impact of Brexit is concentrated in a handful of sectors and may not be long-lasting. Corporate acquirers are taking a long-term view, focusing on the strategic value of assets.

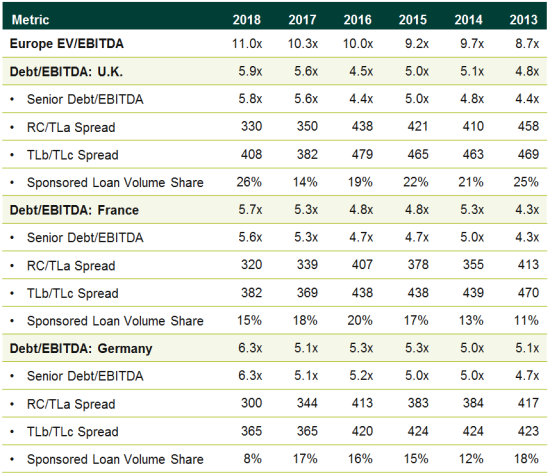

The table below reviews leverage multiples and borrowing activity across the three largest regions in Europe (U.K., Germany, and France). While purchase multiples have increased since 2013, so has borrowing capacity across all three regions.

Highlights from the table:

- The spread on revolving credit/term loan A (RC/TLa) and term loan B/term loan C (TLb/TLc) commitments has declined since 2016, with German borrowing rates decreasing the most, by 113 and 55 basis points, respectively. Spreads for RC/TLa and TLb/TLc loans have declined 108 and 71 bps respectively in the U.K., and 87 and 56 bps respectively in France. (TLa is typically an amortizing syndicated bank loan coupled with a revolving credit facility. TLb and TLc are subordinated non-bank loans, junior to the TLa/RC.)

- On a relative basis, the RC/TLa and TLb/TLc spreads have also decreased or remained relatively unchanged since 2016. The RC/TLa spread between the U.K. and France declined by 21 bps; between the U.K. and Germany, it increased slightly by 5 bps. Similarly, the TLb/TLc spread between the U.K. and France declined by 15 bps, and between the U.K. and Germany, by 16 bps.

The U.K. also led the market in total sponsored loan volume, with a 26% share relative to 15% for France and 8% for Germany. Of course this is not a coincidence; U.K./Ireland accounts for the largest share of deal volume across Europe. In 2017-18 U.K./Ireland deals were the largest percentage of the 2,983 deals transacted, at 22%, followed by France (18%) and the Nordics (14%), according to PwC.

What our analysis of the data found is that Brexit has not had a significant impact on credit conditions on an absolute or comparative basis in the U.K. compared to Germany or France.

Private Equity Impact

Callan spoke with several large buyout sponsors active in the U.K. and EU to assess how they are navigating through the current Brexit crisis. Consistent with the data above, while many are concerned, none seemed to be alarmed. General partners (GPs) are reviewing potential transactions that have exposure to the U.K. with these points in mind:

- The extent to which revenues are derived from the U.K. relative to other countries is a diligence item. If it is a U.K.-based company exporting product to the EU, the impact of potential tariffs will certainly be assessed in detail. One sponsor did indicate it is avoiding the U.K., preferring not to take the single-country risk.

- GPs will invest in companies whose growth will largely be immune to the impact of Brexit.

- GPs are estimating the impact of supply chain disruptions as they relate to the movement of goods and services as well as people. This could potentially be an issue for U.K. businesses with large EU workforces.

- In the near-term, and perhaps long-term, if a company’s natural exit option is an IPO in the U.K., the lackluster local market performance is seen as a significant issue. From June 23, 2016, to March 15, 2019, the FTSE 100’s annualized gain has been 4.9%, compared to 7.0% for the Euro Stoxx 50 and 13.5% for the S&P 500, measured in U.S. dollars.

Despite the attention Brexit has garnered, the most common refrain among private equity investors was that the lack of visibility on what might transpire with Brexit—including non-tariff barriers with the EU, how new trade deals with non-EU countries might be structured, and the impact on migration—makes it difficult to manage. Callan suggests that, as part of their own manager due diligence, clients should consider how a private equity sponsor incorporates Brexit into its assumptions as an indicator of the rigor of the manager’s underwriting process.

Where there may be bigger concern among U.K.-based GPs is how Brexit relates to their own businesses. These firms currently use the EU passport under the Alternative Investment Fund Managers Directive (AIFMD) and, post-Brexit, may no longer be able to do so. AIFMD is an EU regulation that applies to alternative managers and sets standards for marketing around raising private capital, remuneration policies, risk monitoring, reporting, and overall accountability. This will create additional complexity for U.K. fund managers that are based in Guernsey for tax purposes, as Guernsey is a U.K. domicile.

In addition, some U.K.-based fund managers already use Irish or Luxembourg alternative investment fund platforms, which enable them to market across Europe. Those that don’t and want to offer services to investors in the EU will have to obtain a license from a supervisory authority within the EU, for which they’ll also have to establish a physical presence, just like a U.S. firm. This could impact fund management platforms and, more broadly, financial services firms in Europe. It could also accelerate the trend of banks and other financial firms moving people out of the U.K. and into continental Europe.

Several sponsors noted their primary near-term concern is not Brexit, which they believe will get resolved, but rather the problems in Southern Europe and the health of Italy’s banking system. Italy’s issues could potentially lead to a banking and financial crisis that would overshadow the more abstract concerns of Brexit.

Conclusion

Brexit represents an important political and economic watershed for the U.K. and Europe, and many observers expect the economic effects to continue to be significant. However, in the near-term, benign credit conditions and robust M&A activity suggest a more muted impact. Private equity investors are factoring in the potential impacts of Brexit during their underwriting process, and U.K.-based companies that lack geographic revenue diversity are viewed with caution. But other near-term concerns such as Italy seem to weigh more heavily.

With respect to private equity firms, so far Brexit seems to have had a bigger impact on their own operations rather than re-shaping the long-term investment landscape. Callan suggests clients consider how the impact of Brexit is assessed when evaluating a U.K. or European private equity sponsor’s investment process.

Appendix: Background on Brexit and the EU

On June 23, 2016, by popular referendum the U.K. voted to leave the European Union (EU), an economic and trade organization it joined in 1973, commonly known as “Brexit.” Shortly after succeeding David Cameron as prime minister, in March 2017 Theresa May invoked Article 50 of the EU’s Lisbon Treaty, starting a process by which the U.K. was scheduled to formally leave the EU by March 29, 2019. Since that time May’s Conservative Party has lost its parliamentary majority, leaving May in a much-weakened political position and with little negotiating leverage over her own party or the EU.

As of this writing, Parliament rejected May’s plan to leave the EU for a third time. The U.K. now faces the possibility of a departure from the EU by April 12 with no deal unless it can negotiate a longer delay. If the deal had been approved, there would have been a transition period to Dec. 31, 2020 (which could be renegotiated), giving businesses and other groups more time to prepare for the new trade and customs rules and regulatory measures. During this time the U.K. would have sought to unilaterally negotiate its own trade deals outside of the EU.

The underpinnings of the EU were formed shortly after World War II when six nations signed an accord to pool certain economic resources. The EU single market was completed in 1992 and eventually expanded to include 28 European countries. It was designed to foster economic cooperation and trade through the free movement of goods, services, and people within the bloc. Member countries trade freely with one another without customs checks or borders, and all charge the same import duties to countries outside of the EU. However, members are limited in their ability to negotiate their own external trade deals.

According to the House of Commons Library, the EU is the U.K.’s largest trading partner, with 44% of the U.K.’s goods and services exports going to EU countries and conversely, 53% of the U.K.’s imports coming from other EU members.

For additional information on Brexit please read: https://www.nytimes.com/interactive/2019/world/europe/what-is-brexit.html

For additional information on the European Union please read: https://europa.eu/european-union/index_en