Stock lovers embraced the slowly shifting narrative of global growth in the second quarter. Although hopes of a Trump bump faded further in the U.S. amid distracting Beltway theatrics, U.S. corporate profits remained resilient and credit spreads tightened modestly. Exhibiting little evidence of angst, the S&P 500 Index gained 3.1% while the Bloomberg Barclays Corporate High Yield Index advanced 2.2%. Elsewhere, the economic engines of Europe and Japan began to grind forward with slow but positive momentum. Even France lent a helping hand when its people elected Emmanuel Macron as president offering promises of economic reform. Sacré bleu!

The European Central Bank hinted at potentially tapering its bond purchase program, unsettling a fixed income market accustomed to the bank’s prior mantra of “whatever it takes.” Given the world’s anticipation of more economic juice coming from Europe, the dollar lost nearly 7% against the euro and weakened against other currencies, aside from the yen. Oil prices fell, leading commodities lower, with more evidence of inventory buildups and loosening discipline in the OPEC ranks. Global inflation settled down to levels well below central bank targets. Holding onto this constructive backdrop of improving fundamentals, MSCI EAFE jumped 6.1% in unhedged terms while the MSCI Emerging Markets Index surged 6.3%. The Citi 10-Year Treasury edged ahead 1.3%, while gold (-0.7%) fell slightly.

The quarter’s market conditions also provided a friendly setting for hedge funds seeking alternative risks. Illustrating raw hedge fund performance without implementation costs, though net of underlying hedge fund fees, the Credit Suisse Hedge Fund Index (CS HFI) rose 0.8%. As a live hedge fund portfolio, net of all fees and expenses, the median manager in the Callan Hedge Fund-of-Funds Database advanced 0.9%.

Within CS HFI, Long/Short Equity (+3.1%) repeated its performance rank from the prior quarter as the best-performing strategy. Within this hedged equity universe, as represented by HFRI, the average Fundamental Growth manager (+3.2%) outperformed Fundamental Value (+2.5%), aided by technology stocks that fueled much of the market’s rise.

Event-driven strategies continued to profit handsomely from near-term catalysts of corporate activity and other process-driven events affecting security pricing. Risk Arbitrage rallied 2.7% with robust merger deals while Distressed appreciated 1.6%. Relative value strategies, such as Convertible Arb (+0.2%) and Equity Market Neutral (+0.4%), experienced more modest gains.

In last place among hedge fund strategies for the second straight quarter, Managed Futures lost 3.4%. Sharp reversals in the bond market as well as currencies, particularly in Europe, caused most of the pain for these trend-following players. Even the more discretionary Global Macro (-1.8%) lost its footing with the unexpected turn of top-down themes.

Hedge fund size appeared to be a secondary factor driving performance for the quarter, as the equal-weighted HFRI Fund Weighted Composite (+1.1%) slightly beat the HFRI Asset Weighted Composite (+0.5%).

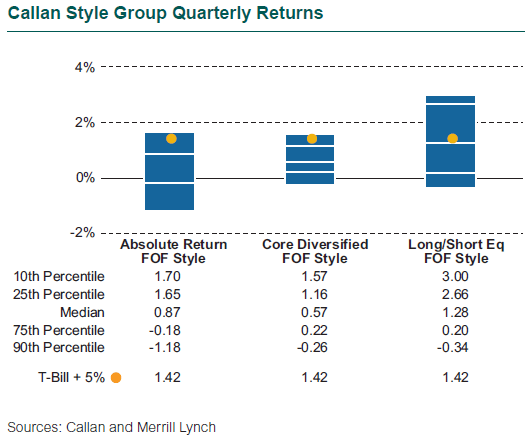

Within Callan’s Hedge Fund-of-Funds Database, market exposures marginally affected performance of different investment styles. With the benefit of net equity exposure, the median Callan Long/Short Equity FoF (+1.3%) outpaced the Callan Absolute Return FoF (+0.9%). With diversifying exposures to both non-directional and directional styles, the Core Diversified FoF gained 0.6%.

0.8%

The 2nd quarter return of the Credit Suisse Hedge Fund Index.