Developed in 1986, the index commonly known as the “Agg” started life as the Lehman Aggregate Index. But after Lehman’s ignominious end, it became the Barclays Aggregate Index, and is now formally known as the Bloomberg Barclays US Aggregate Bond Index.

Naming convention aside, the Agg represents the U.S. investment-grade broad fixed income benchmark used by institutional investors, asset managers, and consultants as a proxy for U.S. fixed income market exposure and as a way to measure performance.

The index constituents include U.S. Treasuries, agency debt, residential and commercial mortgage-backed securities, asset-backed securities, and corporate bonds. But more than the name has changed; in the time the index has gone through all this rebranding, it has evolved in three key ways, namely its yield, duration, and sector allocations. In this post I’ll outline what these changes mean for institutional investors.

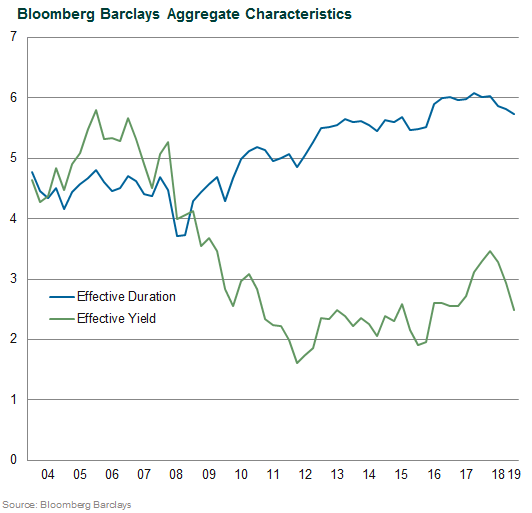

Looking at yield versus duration over the past 15 years (see chart below), what we find is that the duration of the index has extended while the yield has fallen. As a rule of thumb, for every 1% change in interest rates, the price of a bond will move in the inverse direction for every year of duration exposure. So a 1% increase in interest rates will reduce the price of a bond with a duration of 5 years by 5%, all else equal. The Agg’s duration extension comes with less yield cushion, as yields have dropped in this low interest rate environment.

Going back to 2004, the duration of the Aggregate was shorter (4.77 years versus 5.73 today), and the yield was higher (4.64% versus 2.49%). Aggregate exposure has become more interest rate-sensitive over time, and the lower yield provides less income and less of a cushion in the case of rising rates, suggesting lower return expectations going forward.

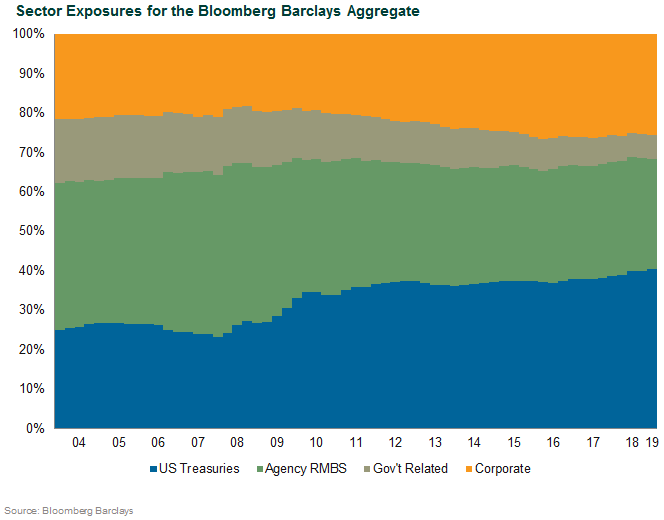

Looking at sector diversification, one pronounced change is how the Treasury allocation has increased, as the U.S. government has issued more debt. U.S. Treasury exposure is almost 40% of the index as of June 30, 2019, versus about 24% in 2004. It was not even 20 years ago when the U.S. Treasury said that it would no longer issue 30-year Treasury bonds! That seems like ancient history as U.S. government debt climbs, from $7.3 trillion in 2004 to $22 trillion now. One takeaway of this development is that the index is more concentrated in the lowest-yielding debt with the least credit risk.

This 15-year trip down Lehman/Barclays/Bloomberg Aggregate index memory lane has taught us that the index’s duration has extended, the yield of the index is now lower, and the underlying makeup of the sector composition has changed with greater concentration in U.S. Treasuries.

So what should investors do? We believe that one solution is conducting a review of their fixed income structure to determine their exposure within the asset class. Typically, the role of fixed income is to serve as a low-risk, diversifying anchor that protects principal and generates return mainly from income, against which an investor takes on riskier investments in assets such as equity.

The role of fixed income will also vary based on the size of the allocation within the total fund. For instance, a 10% allocation to fixed income is likely going to be more conservative than a 30% allocation that may include riskier, return-seeking areas of the market like high yield bonds. The standard benchmark for a plan’s fixed income exposure is the Aggregate.

The three main factors that define fixed income strategies are:

- Broad market exposure versus one narrowed by sector or duration

- Use of tactical “core plus” mandates that allow exposure outside of the Aggregate when a manager finds value versus dedicated allocations to “satellite” securities outside of the Aggregate benchmark, such as low-quality credit like high yield bonds or global bonds

- Active versus passive implementation

All of these options involve trade-offs. For instance, an investor that delves into below-investment-grade debt in search of higher yields may be concerned about the asset class outlook given tight spreads and late-cycle market dynamics and can generally expect its high yield exposure to have much higher correlation to equities and less protection in down markets. There is no one right answer.

But given the underlying changes in the Agg, it is good practice for fiduciaries to periodically review the structure of their fixed income asset class exposure, determine whether it still meets the investment strategy of the fund, and decide whether to make appropriate changes. Even if the end result is to stay the course with the Aggregate, the exercise serves to ensure that institutional investors know what they hold and are comfortable with those allocations.