Listen to This Blog Post

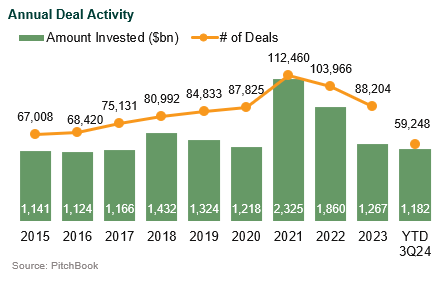

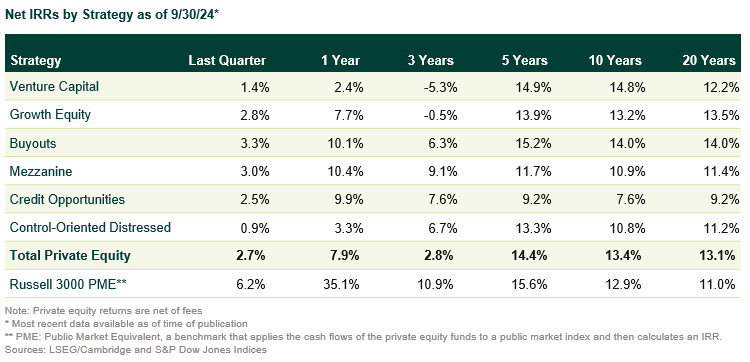

Fundraising is coming back close to the highs of 2021, but this is driven by fewer funds raising more money each. Both buyout and venture capital/growth equity activity is still off from the peaks of 2021. Short-term performance continues to lag public equity but shows strength over longer time periods.

Details on Private Equity Activity

Fundraising | By volume, 2024 fundraising has been creeping toward the highs of 2021 (only 3% off). And compared to the same time last year, volume is up by 7%. On the other hand, fundraising by count was down significantly: 23% fewer funds raised in YTD 3Q24 compared to the same time last year.

Buyouts | Buyout activity in 2024 was essentially flat compared to 2023, by both count and volume. Buyout valuations have started to creep back up, although still off by about a turn from the highs of 2021. They exhibited a large uptick in 3Q24, reflecting the Fed’s first interest rate cut that quarter.

Venture Capital and Growth Equity | Deal volume in 2024 was up from 2023 but still significantly depressed compared to the highs of 2021-22. Deal activity by count has declined each year, with the average deal size increasing. Early-stage valuations have reached record highs, up 28% from last year and 44% from 2021. This has been driven by today’s AI “supercycle,” with greater competition for AI startups pushing up valuations.

Exits | Volume has remained significantly depressed through 3Q24, down 13% from last year and at 43% of 2021 levels. Exit count is also down by 14% from last year and at 67% of 2021 levels.

Returns | Short-term performance continues to lag public equity (driven by the “Magnificent Seven”). Due to the smoothed nature of its returns, private equity doesn’t outperform when public equity is at record highs (it likewise doesn’t drop as sharply when public equity drops). By strategy type, venture capital and growth equity are still recovering after losses in 2022-23, while buyouts have proven to be much more resilient.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.