Equity markets ended the final quarter of 2023 with double-digit gains and, by the time the year ended, recouped all of 2022’s losses. This surge was marked by rising expectations that the Federal Reserve was done hiking interest rates and would begin easing monetary policy in the new year. Many market participants think the Fed may achieve a soft landing, getting inflation under control without causing a recession. The yield on the U.S. 10-year Treasury declined sharply to end December at 3.9%, the same level where it began the year.

The S&P 500 soared 11.7% as large cap Technology names led the charge, but other sectors like Real Estate, Financials, and Health Care all participated, ending the year with a gain. Outside the U.S., Asian and European markets were positive, while China finished in negative territory due to lackluster economic growth and property sector challenges. Credit in general had a positive quarter, driven by lower rates and tighter spreads. Investment grade outperformed high yield, as both indices ended the quarter positive.

4Q23 and full year hedge fund performance

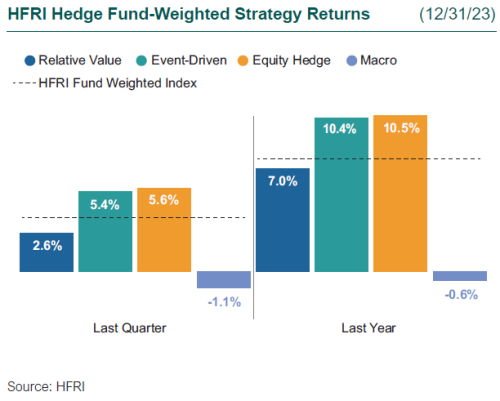

Hedge fund performance ended the year on a strong note. Equity hedge strategies were the best performing, as those with higher net long exposure performed better, along with strategies focused on health care and technology, media, and telecommunications (TMT). Relative value strategies generated positive performance during the quarter, driven by fundamental and systematic equity relative value strategies. Event-driven strategies also ended on a strong note, as interest rate volatility provided trading opportunities when credit spreads tightened going into year-end. Macro strategies ended the quarter slightly negative, as losses from short positions in U.S. equities and developed market rates were offset by long technology equities and long front-end rates positions.

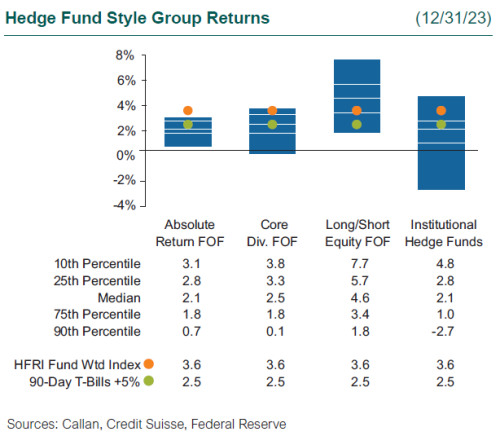

Serving as a proxy for large, broadly diversified hedge funds with low-beta exposure to equity markets, the median Callan Institutional Hedge Fund Peer Group rose 2.1%. Within this style group of 50 peers, the average hedged credit manager gained 2.6%, driven by actively trading around interest rate volatility. The median Callan Institutional hedged rates manager rose 2.3%, largely driven by relative value fixed income trades. Meanwhile, the average hedged equity manager added 2.2%, as sector-focused managers were able to profit from the broad market rally.

Within the HFRI indices, the best-performing strategy last quarter was equity hedge (5.6%), as health care-, financial-, and technology-focused strategies drove performance during the final quarter of the year. Event-driven strategies surged 5.4% during the final quarter, as equities, credit, and M&A all drove performance throughout the quarter. Macro strategies fell 1.1%, as short equity positions offset gains from front end interest rate trading.

Across the Callan Hedge FOF database, the median Callan Long-Short Equity FOF ended 4.6% higher, as sector-focused strategies drove performance during the quarter. Meanwhile, the median Callan Core Diversified FOF ended 2.5% higher, as equity and event-driven strategies spurred performance. The Callan Absolute Return FOF ended 2.1% higher, as lower equity beta strategies were behind this move higher.

Since the Global Financial Crisis, liquid alternatives to hedge funds have become popular among investors for their attractive risk-adjusted returns that are similarly uncorrelated with traditional stock and bond investments but offered at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate known risk premia such as value, momentum, and carry found across the various capital markets. These alternative risk premias are often embedded, to varying degrees, in hedge funds as well as other actively managed investment products.

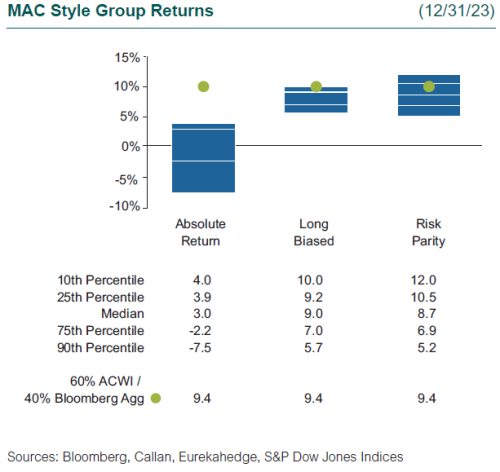

Within Callan’s database of liquid alternative solutions, the Callan MAC Long Biased manager rose 9.0%, as the broad-based equity rally moved performance higher. The Callan MAC Risk Parity peer group rose 8.7%, as equities and fixed income drove performance. The Callan MAC Absolute Return peer group rose, as broad markets had a strong end of the year.

2024 will continue to present a complex and potentially rewarding landscape for hedge funds. Overall, Callan remains constructive in 2024. Hedge funds have the ability to provide diversification across institutional portfolios. To do that, managers will have to navigate a confluence of macroeconomic, geopolitical, and fundamental crosscurrents to be successful investors over this next year.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.