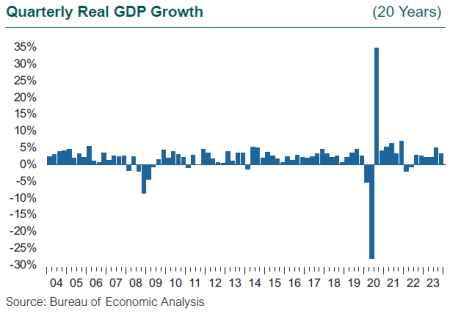

The U.S. economy grew by 3.3% in 4Q23, once again surprising to the upside. If you asked anyone who has to indulge in the hubris of forecasting the economy, all of 2023 has been a surprise. Last year was supposed to feature the recession caused by the Fed’s dedication to fighting inflation by raising interest rates; instead, the economy grew 2.5% for the year, up from the 1.9% rate in 2022. The job market has generated 5.4 million new jobs since the end of 2019, before the start of the pandemic. Real wages and real income growth turned positive in mid-2023 as inflation subsided but demand for workers remained. Workers feel confident in the tight labor market, and this confidence is driving consumer spending. Consumption expenditures accounted for half of GDP growth in 3Q and almost 60% in 4Q. The economy seemed to get stronger by the quarter in 2023.

U.S. Economy Weathered Rate Hikes Well

So why no recession? Underneath the mayhem that defined both 2022 and 2023—geopolitical uncertainty, spiking inflation, rising interest rates, and the volatility in the equity market—the U.S. and global economies remain in remarkably good shape. The U.S. economy weathered the rate hikes in 2022 and 2023 particularly well. The first reason is stimulus and lots of it, around the globe, which translated into pent-up demand. Second, the very tight labor market in the U.S. gives workers and their families confidence to spend. Third, despite the housing market taking a big hit as mortgage rates shot up, housing has not dragged down the economy as in rate hike episodes of yore. In addition, we do not have a mortgage crisis similar to the one that struck in 2008-09 and nearly took down the banking system.

However, we do have a commercial real estate tsunami working through offices in central business districts and retail trade, which will reshape the physical as well as business landscape of many communities in the U.S. Finally, we do have a housing shortage around the U.S. that may have long-term generational consequences for homeownership, wealth creation, and financial security for younger people.

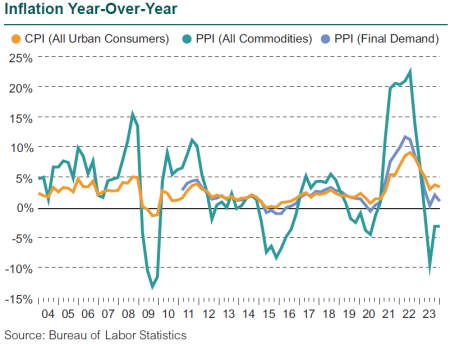

Inflation shot up to 9% in mid 2022, but the rate of price increases began to ebb in the second half of 2022 and declined steadily to 3% by the end of 3Q23. Unfortunately, headline inflation ticked back up to 3.5% by the end of the year, so we are not out of the inflation woods yet. Even as the rate of price increases comes down, prices are now “permanently” higher unless we see deflation. The level of the CPI-U index is up 10% since the start of 2022.

One key factor keeping inflation from falling back toward the Federal Reserve’s goal of 2% is the labor market. We ended 2023 with labor markets not only tight but tightening. Initial unemployment claims (measured on a weekly basis)—one of our few leading indicators—began climbing in 2Q, and by early spring weekly claims had surpassed the average set in 2019 of 218,000. As claims rose to 250,000 by August, the data appeared to show that interest rate hikes were finally starting to bite. Then initial claims fell back sharply and we ended the year at 203,000. Continuing unemployment claims also began to rise from a very low level starting in 4Q22 and ended the year about 9% higher than the pre-pandemic level. So initial claims show workers holding onto jobs, but the continuing claims show workers have a bit more trouble finding jobs once laid off. However, the unemployment rate remains low at 3.7%. The tightness in the labor market is inconsistent with the Fed’s goal of achieving its 2% inflation target. As continuing claims rose in 2023, bond markets read the data as the first sign of easing in the labor market, but the robust end-of-the-year GDP report, the lower initial claims, and the strong December job market report suggest labor market tightness is not yet easing.

The remarkable GDP growth is fueling continued demand for workers, and with inflation falling while wages are rising, workers saw real incomes (wages and salaries net of inflation) grow in each of the last three quarters of 2023, with a sharp gain of 2.5% in real disposable (after-tax) income in 4Q. Average hourly earnings growth slowed from 5% (annual growth) in 2022 to 4% by December 2023, but as inflation fell real wage growth finally turned positive starting in May, and this real growth carried through December (wage growth is exceeding inflation).

The upshot: it may take longer than many believed to unravel the current growth momentum in the U.S. economy. The Fed had stated earlier in 2023 a belief that rates would remain elevated, based on its economic expectation of “stronger for longer.” After the Fed reversed course in the November and December FOMC meetings, signaling rate cuts were likely in 2024, the economy reverted to stronger for longer on its own.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.