Private equity showed a gradual decline in 2022, but fundraising and company investment and exit activity remain comparable to the pre-pandemic levels seen in 2018 and 2019.

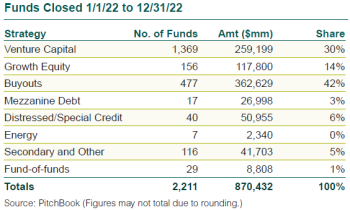

Fundraising: In 2022 private equity partnerships holding final closes raised $870 billion across 2,211 partnerships (unless otherwise noted, all data is from PitchBook and 4Q numbers are very preliminary). The dollar amount is 16% lower than 2021, but partnerships plunged by 47%. 4Q had final closes totaling $166 billion, down 21% from 3Q. The number of funds totaled 407, down 20%.

Buyouts: New buyout investments for 2022 totaled 12,985, down 14% from 2021. Dollar volume fell 9% to $837 billion. 4Q saw 2,625 new investments, a 20% decrease from 3Q, but dollar volume rose 27% to $239 billion.

VC Investments: The year produced 51,020 rounds of new investment in venture capital (VC) companies, down 16% from 2021. Announced volume of $509 billion was down 31%. 4Q saw 9,280 new rounds, a 20% decline from 3Q, and dollar volume fell 21% to just $81 billion.

Exits: Last year saw 2,901 buyout-backed private M&A exits, down 23% from 2021, with proceeds of $590 billion, down 26%. 4Q had 551 private exits, down 22% from 3Q, with proceeds of $132 billion, down 2%. The year’s 201 buyout-backed IPOs dropped 55% from 2021, with proceeds of $33 billion, down 75%. 4Q IPOs numbered 50, down 21% from 3Q, and proceeds of $8 billion declined 27%. Venture-backed M&A exits for the year totaled 2,625, down 24% from 2021. Announced dollar volume of $110 billion fell 57%. The final quarter had 462 exits, down 20% from 3Q, and value of only $7 billion, plunging 72%. The year’s 317 venture-backed IPOs sank 51% from 2021, with proceeds of $41 billion, falling 75%. There were 106 in 4Q, up 33% from 3Q, but the $8 billion of proceeds fell 47%.

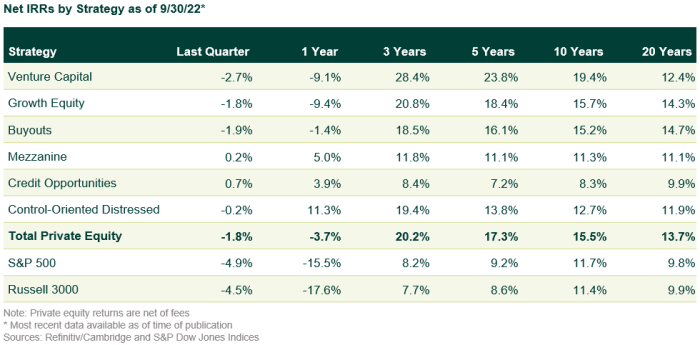

Returns: In 3Q, and in the two prior quarters, private equity fell by only about 35% of the public equity market’s decline. With the upcoming 4Q valuations being subject to annual audits, continued moderate declines are likely.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.