Risk assets rallied in 4Q22, as U.S. inflation showed a steady decline from the peak over summer, boosting hopes for fewer rate increases heading into 2023. In addition, corporate earnings were generally better than expected and China announced the lifting of its zero-COVID policy. As the quarter wore on, the Federal Reserve remained committed to tighter monetary conditions, signaling more rate hikes in 2023 in addition to the 50 basis point increase at its December meeting. Market volatility returned in December, following downward revisions to 4Q earnings, which reversed some of the earlier gains in the quarter.

Despite the sell-off in December, the S&P 500 gained 8% for the quarter, as equity markets finished on a strong note. U.S. equities rallied in October and peaked in November as a hawkish tone from central banks and signs of a global economic slowdown dampened investor optimism. Value significantly outperformed growth stocks, and stocks across most sectors rebounded, with the energy sector notably higher for the quarter. Global ex-U.S. equities outperformed U.S. equities, as cooling energy prices dragged down inflation, causing U.K. markets to stabilize and European currencies to strengthen against the U.S. dollar. China’s reopening and easing of the zero-COVID policy led to Asian equities recovering their initial losses from October.

Hedge Fund Performance in 4Q22

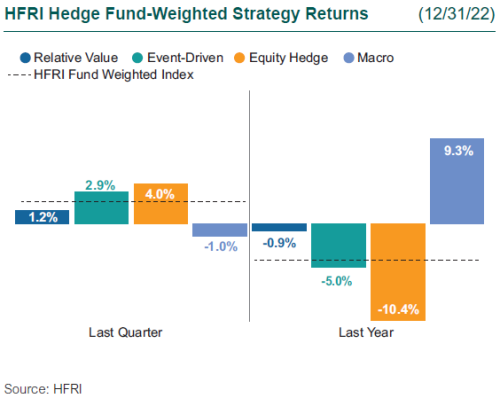

Hedge funds ended the final quarter on a positive note, as equity hedge managers clawed back some of their negative performance. Those with a focus on real estate, energy, and industrials saw positive gains while growth-focused managers continued to lag. Event-driven strategies had a nice quarter, driven primarily by their event equities that moved higher with the broader markets. Relative value strategies finished out the year on a strong note, as managers continued to benefit from elevated rate volatility levels, the convergence of key relative value relationships, global quantitative tightening, and uncertainty surrounding central bank actions. Macro strategies ended the quarter slightly lower, as losses were taken in short U.S. equities themes, along with short positions in the Chinese renminbi versus the U.S. dollar.

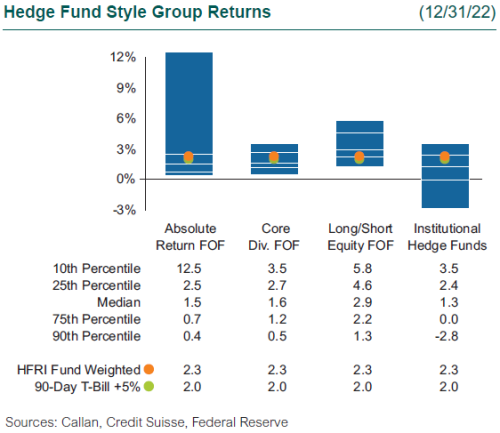

Serving as a proxy for large, broadly diversified hedge funds with low-beta exposure to equity markets, the median Callan Institutional Hedge Fund Peer Group rose 1.3%. Within this style group of 50 peers, the average rates manager gained 1.2%, as interest rate volatility continued to provide trading opportunities throughout the quarter. Meanwhile, hedged credit managers gained 0.9%, as illiquid credit allocations slightly outperformed liquid credit positions during the quarter. The average equity hedge manager gained 1.5%, as managers that had more of a value bent in their portfolio outperformed those with a growth bias.

Within the HFRI indices, the best-performing strategy last quarter was the emerging market index (+5.1%), as Asian equities rallied in November and December. Equity hedge managers ended the year on a strong note, finishing up 4.0%, as stock selection across energy, mining, travel, and leisure helped performance. Event-driven strategies ended 2.9% higher, as special situation equities moved up with the broader market indices.

Across the Callan Hedge FOF Database, the median Absolute Return FOF rose 1.5%, as their allocations to multi-strategy managers put up solid returns on the year. Meanwhile, the median Callan Long-Short Equity FOF increased 2.9%, as managers benefited from an equity rally in October and November. The Callan Core Diversified FOF gained 1.6%, as equity hedge exposure drove performance, offsetting some negative performance from macro managers.

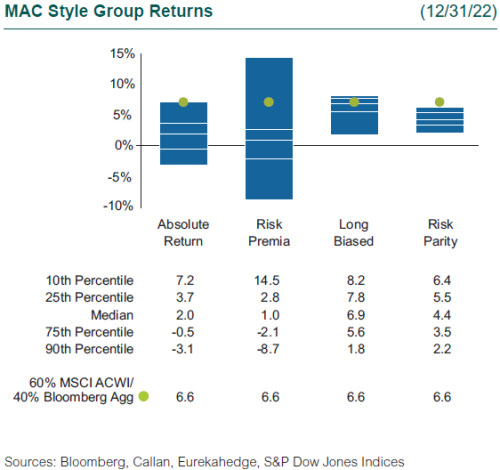

Since the Global Financial Crisis, liquid alternatives to hedge funds have become popular among investors for their attractive risk-adjusted returns that are similarly uncorrelated with traditional stock and bond investments but offered at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate known risk premia such as value, momentum, and carry found across the various capital markets. These alternative risk premia are often embedded, to varying degrees, in hedge funds as well as other actively managed investment products.

Within Callan’s database of liquid alternative solutions, the median Long Biased MAC manager generated a gain of 6.9%, as long equity exposure drove performance for the peer group. The Callan Risk Parity MAC index, which typically targets an equally risk-weighted allocation to the major asset classes with leverage, was up 4.4%. The Callan Absolute Return MAC peer returned a positive 2.0%, as a bias toward value equities and credit helped performance on the quarter. The Callan Risk Premia MAC peer rose 1.0%, as equity performance was slightly offset by currency exposure.

Last year was one of the most challenging years for investors in decades. There have been few instances where the combined performance of both equities and fixed income has been so poor. After years of the Fed expanding fiscal and monetary policy, surging inflation required a policy pivot. Global central banks have started on the most aggressive hiking cycles in decades, raising the benchmark policy rates by several percentage points in 2022, with the expectation for more in 2023. While signs pointed to inflation slowing down in 4Q, there has been concern across the market that tight monetary policy is laying the ground for a possible recession in 2023. We suspect this will lead to opportunities across stressed and distressed strategies. Higher volatility across interest rates and currencies should continue to create opportunities in macro strategies. Callan continues to believe that hedge funds can provide downside protection and be an uncorrelated source of return in a diversified portfolio.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.