The fourth quarter saw a resurgence of COVID as the highly transmissible Omicron variant produced another wave of infections around the world, disrupting the positive momentum markets had experienced up to that point. Supply chain constraints continued, as the goods and services sectors were impacted by the new variant, and rising input prices persisted throughout the quarter. Further exacerbating market conditions were the hawkish comments made by Fed Chair Jerome Powell, opening the door to more aggressive tapering and rate increases in 2022. The confluence of a spike in COVID and the Fed now worried about curbing high inflation called into question the strength of economic growth moving forward. Managers of hedge funds and other investors grew concerned as they reassessed the probability of tighter monetary policy.

Despite increased market volatility during the final two months of the year, the S&P 500 (+11%) ended the quarter positive, shrugging off concerns. This equity market surge was aided by strength in U.S. mega caps, while risker equities underperformed in December, particularly within areas of technology such as software, fintech, and electric vehicles, all of which cooled off dramatically. U.S. small cap equities underperformed large cap due to concerns around future growth. The Bloomberg High Yield Index ended the quarter higher (+0.7%), as the U.S. yield curve flattened throughout the quarter, driven by concerns for future growth amid expected tightening policies from central banks.

Performance of Hedge Funds in 4Q21

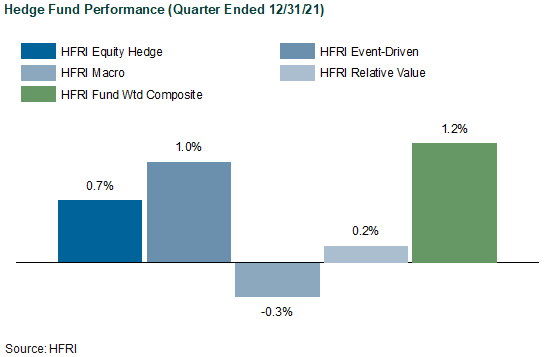

Representing hedge funds reporting performance without implementation costs, the HFRI Fund Weighted Composite Index gained 1.2% in 4Q21. Within the HFRI indices, the best-performing strategy was Event Driven (+1.0%), as the M&A market remained vibrant in 4Q. Macro strategies had a difficult quarter (-0.3%), as interest rate volatility went against some manager positions, while others were able to offset pain through global equity exposure.

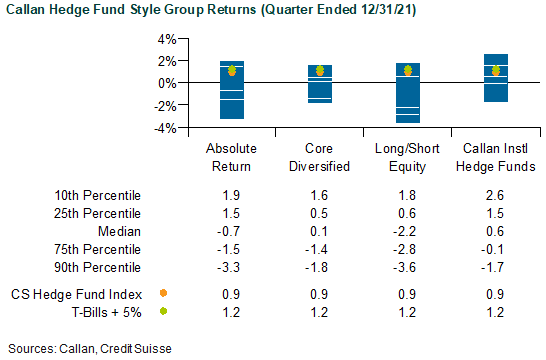

Across the Callan Hedge Fund-of-Funds (FOF) Database, the median Absolute Return FOF lost 0.7%. With exposures to non-directional and directional styles, the Core Diversified FOF rose 0.1%. Long/Short Equity FOF was negative at 2.2%, after a difficult December where an overweight to technology managers detracted from performance. Serving as a proxy for large, broadly diversified hedge funds with low-beta exposure to equity markets, the median Callan Institutional Hedge Fund Peer Group added 0.6%.

MAC Performance in 4Q21

Since the Global Financial Crisis, liquid alternatives to hedge funds have become popular for their attractive risk-adjusted returns uncorrelated with stock and bond investments but offered at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate risk premia such as value, momentum, and carry. These alternative risk premia are often embedded in hedge funds as well as other actively managed investment products.

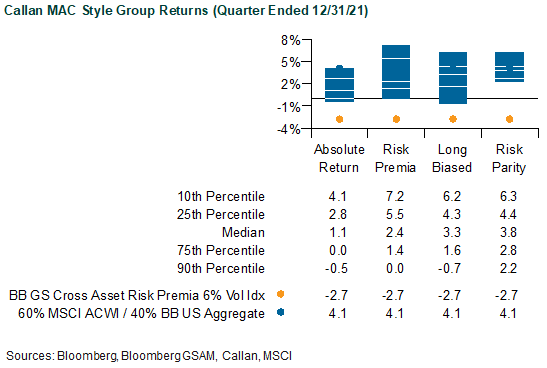

In 4Q, the Bloomberg GSAM Risk Premia Index fell 2.7% based upon a 6% volatility target. Within the underlying styles of the index, Equity Low Risk L/S (+5.9%) and Equity Trend (+1.6%) ended the quarter in positive territory as growth sold off relative to value in December. Equity Momentum (-4.8%) and FX Carry (-3.0%) had a difficult quarter as market volatility was elevated throughout the final month of the year. Currency positioning around the Japanese yen and the Swiss franc were behind the majority of volatility experienced during the quarter. Both currencies were impacted by their central banks during this period as the yen underperformed with little change in monetary policy and the franc outperformed as rising inflation reduced expectations for future foreign purchases by the Swiss National Bank.

The median managers of the Callan Multi-Asset Class (MAC) Style Groups generated positive returns gross of fees. The Callan Risk Premia MAC rose 2.4% based on its exposures to uncorrelated style premia targeting 5% to 15% portfolio volatility. The Callan Risk Parity MAC, which typically targets an equal risk-weighted allocation to the major asset classes with leverage, was up 3.8%. As the most conservative MAC style focused on non-directional strategies of long and short asset class exposures, the Callan Absolute Return MAC gained 1.1%. Equity beta was a positive for strategies that tended to favor value and defensive stocks during the quarter.

As the calendar flipped to 2022, the macro dynamics of markets changed as well. The Federal Reserve has telegraphed its desire to start raising rates and end its accommodative monetary and fiscal policies, which helped spur economic growth. As these market dynamics evolve, not all hedge funds will be positioned to profit during the initial market shift. Managers may have to deal with changing macro dynamics, factor rotations, and deleveraging as they search for alpha opportunities. If this environment plays out, equity hedge managers should be positioned to profit by going long undervalued companies and shorting those that are trading at inflated multiples. Event-driven strategies could be primed for another strong year if M&A activity remains robust, providing a strong backdrop for managers. Inflation sticking around at least in the short term and differing monetary policies from central banks create the perfect environment for macro managers to profit off the uncertainty globally.