Twenty years ago, U.S. stock prices were hitting record highs with nosebleed valuations based on a strong economy supported by rising corporate earnings and increasing productivity. Treasury bills then were yielding almost 5% (or 2% real), as the Federal Reserve was slowly taking away the market’s punch bowl by raising rates. Meanwhile, a federal budget surplus was not providing any net stimulus to the economy.

Fast forward to the closing quarter of 2019, we again found stock prices hitting record highs driven by optimistic valuations, but tepid earnings and minimal productivity growth in an otherwise steady economy were not helping investor’s risk appetite. Giving a boost to a weakened global manufacturing sector during the quarter, the U.S. announced a truce in its trade war against China, and U.K. elections provided more certainty on Brexit. Also encouraging investors to assume more risk—or face even more paltry cash yields—the Fed cut rates another 25 basis points. The Fed also began a new form of quantitative easing with T-bill purchases to bolster an underfunded repo market. In the background, a highly stimulating federal deficit helped to keep the U.S. economy moving forward, albeit slowly.

Risk markets in the fourth quarter did not seem to worry about the distant future, but they were definitely excited about the present. So, they partied! Both the MSCI ACWI and S&P 500 Indices jumped 9.1%. MSCI Emerging Markets (+11.8%) led the celebration, after lying relatively low in the prior three quarters. Credit spreads tightened marginally, lifting the Bloomberg Barclays High Yield Bond Index (+2.6%). Left behind from the risk-on celebrations, the FTSE 10-Year Treasury fell 1.8% as longer-term yields rose with the Fed’s determined liquidity push to promote more inflation. One risk-off market’s loss is another’s gain, as gold picked up another 3.4% from this potential inflation fear while the dollar weakened.

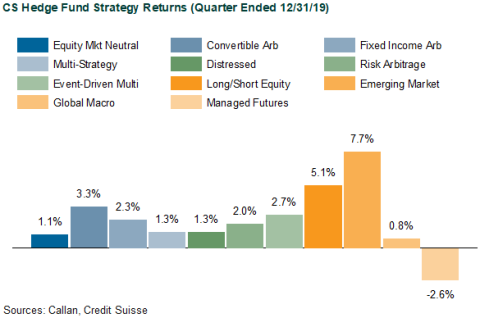

Amid these festive markets, hedge funds played the role of a designated driver, as they enjoyed some of the quarter’s party but did not go wild. Still concerned about looming downside risks, their hedges in most circumstances cost them a more attractive return. Illustrating raw hedge fund performance without implementation costs, the Credit Suisse Hedge Fund Index (CS HFI) rose 2.4% in the fourth quarter.

Within CS HFI, the strongest strategy was Emerging Markets (+7.7%), as it captured about two-thirds of the equity market upside at roughly half the volatility. Also benefiting from positive beta, Long/Short Equity (+5.1%) was the quarter’s next best contributor. Health care and technology specialists lifted the strategy’s average. For the full year, Long/Short Equity’s 12.2% advance trailed various equity benchmarks that gained roughly 30%.

Among relative value strategies, Convertible Arbitrage rose 3.3%, aided by a solid issuance calendar. Fixed Income Arbitrage added 2.3%, supported by the Fed’s aggressive liquidity support in the repo funding markets. Given its modest 1.1% increase, Equity Market Neutral barely generated enough alpha to recover its September loss stemming from a difficult style rotation between growth and value.

The quarter’s reversal of the prior year’s downtrend in long-term rates undermined Managed Futures (-2.6%), but the strategy still finished 2019 with a respectable 9.0% advance. Despite broadly rising risk markets that supported popular carry trades, Global Macro edged ahead only 0.8%.

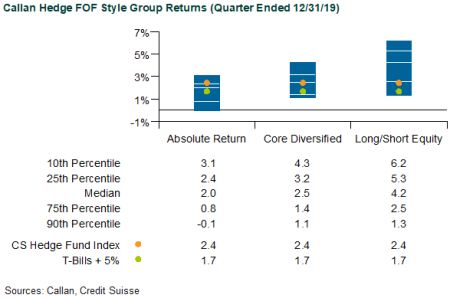

As a proxy for live hedge fund portfolios, the median manager in the Callan Hedge Fund-of-Funds Database advanced 2.7%, net of all fees and expenses. Driven by strong equity markets, the median Callan Long/Short Equity FOF advanced 4.2%, whereas the less-directional Callan Absolute Return FOF edged ahead only 2.0%. With its mix of both non-directional and directional strategies, the Callan Core Diversified FOF accrued 2.5%.

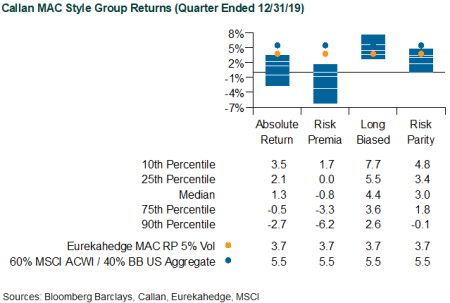

Since the Global Financial Crisis, lower-fee liquid alternatives to hedge funds have become popular among investors for their attractive return profiles that have varying degrees of correlation with traditional stock and bond portfolios. Within Callan’s database of these multi-asset class (MAC) solutions are four style groups using different degrees of market exposure as well as styles of implementation. With last quarter’s equity-dominated action, performance varied widely across these four styles.

As the quarter’s strongest style performer with its usually heavy equity exposure within a discretionary asset allocation framework, the median Callan Long-Biased MAC gained 4.4% versus the 5.5% return of its long-only benchmark of 60% MSCI ACWI Index and 40% Bloomberg Barclays US Aggregate Bond Index. With its typically equal risk-weighted allocations to major asset classes with leverage, the Callan Risk Parity MAC (+3.0%) underperformed the unlevered 60%/40% index.

Using a systematic process to target alternative betas of value, carry, momentum, and other non-market risk factors, the median Callan Risk Premia MAC slipped 0.8%, trailing the Eurekahedge Multi-Factor Risk Premia Index (+3.7%). Within risk premia, strong carry-based returns in currencies and commodities were key contributors, partially offset by losses from the rates momentum factor suffering from a reversal of recently falling yields. As the most conservative MAC style focused on non-directional strategies of long and short asset class exposures, Callan Absolute Return MAC (+1.3%) edged ahead with its typical long bias to higher-quality, more defensive bets.

With dampening geopolitical risks and highly supportive monetary policies, capital markets remain mostly constructive about the global economy regaining strength in the New Year. At the close of 2019, the S&P 500’s P/E to earnings growth ratio is at record highs going back to 1994, thanks to Fed-suppressed interest rates. Potential risks lie ahead in 2020, possibly causing hangovers for investors in the wake of 2019’s party. While 1999’s optimism was based on unbridled hope, today’s optimism is very different with investors facing a Hobson’s choice of either holding equity risk supported mostly by unprecedented central bank liquidity or suffering negative real returns from sitting on cash or even fixed income. In the meantime, hedge funds will likely earn modest returns for investors while waiting for more profitable trading opportunities when fundamentals or divergent trends reassert themselves.