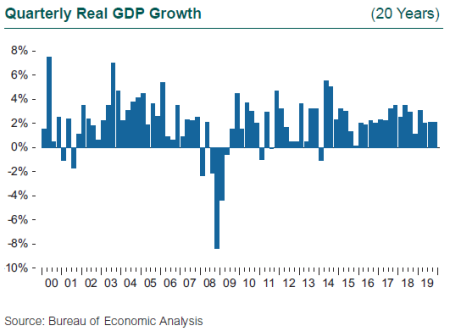

Real GDP grew at 2.1% for the fourth quarter of 2019, capping off a year pretty much no one anticipated for growth or the capital markets. GDP growth for the year came in at 2.3%, unemployment fell to yet another generational low, wages and incomes continued to show robust gains, and yet inflation remained contained. The Fed paused on its path to interest rate normalization in January 2019, cut rates twice in the third quarter and once more in October, before declaring its work done. The trade war dominated headlines and jerked around market sentiment, but the actual impact on U.S. GDP growth has been held below a cumulative hit of 1 percentage point.

Stock markets around the globe rallied during 2019, with the S&P 500 climbing 31.5%, MSCI ACWI ex-USA up 21.5%, and MSCI Emerging Markets up 18.4%. The most eye-opening development of the year was the bond market rally following the Fed pivot in policy, driving a gain of 8.7% for the Bloomberg Barclays US Aggregate Bond Index and almost 20% for the Long Government/Credit Index. So much for the most anticipated recession in history.

Many analysts have begun touting that we already touched bottom in the global growth cycle during the fourth quarter of 2019. The “growth recession” was over before we knew it was fully upon us. The consensus short-term outlook is far more bullish than it was a year ago, although the medium-term outlook (three to five years) contains more concerns. Persistent low inflation gives central banks the cover to continue supportive monetary policy, but this support could evaporate if inflation is resurgent. The volume of corporate credit has exploded, and much of it is lower rated; any sign of real weakness in the economy raises concerns about quality and spread widening. Finally, it is entirely unclear how the current negative interest rate environment across much of Europe evolves.

Buried in the GDP numbers are several developments that support continuing growth in the U.S. economy, at least over the shorter term. First, the 2.1% increase in the fourth quarter includes the drag on growth from the GM strike and the slowdown in Boeing 737 Max production.

Second, inventory accumulation slowed substantially in the fourth quarter, another drag on growth. The end of the GM strike, the eventual resumption of 737 Max production, and the rebuilding of inventories all point toward sustained growth in the U.S. in 2020.

Consumer spending remains strong, fueled by buoyant consumer confidence, a strong labor market, a generational low unemployment rate (3.5%), and personal income growth of just under 4%. The reversal in interest rates will find its way into lower debt costs for consumers, and household debt levels are far below pre-GFC levels. The Fed lowered the federal funds rate by 75 basis points, and given expectations for three rate INCREASES a year ago, rates now sit 150 bps lower than expected. This Fed pivot has greatly benefited interest-sensitive sectors of the economy and consumer balance sheets.

One more support for GDP growth has been a reduction in imports (which are a negative in the GDP calculation), and a corresponding increase in net exports. Imports surged in advance of the application of tariffs early in 2019. U.S. suppliers appear to have quickly found alternatives to China, increasing our imports from Asian countries ex-China to offset some of the decline in imports from China.

Not only did the recession not appear in 2019, near-term recession risks are abating. The announced phase one trade deal between the U.S. and China will suspend some tariffs and address issues of intellectual property and forced transfers of technology. The largest impact is on investor and business sentiment. World GDP growth slowed from 4% at the end of 2017 to below 3% by mid-2019, as a collection of negative shocks (Brexit, trade, geopolitical uncertainty) and lagged effects of monetary tightening hit some of the world’s largest economies. The drag from these shocks has faded and monetary policy has loosened around the world. The emerging markets have already embarked on a cyclical upturn, and the developed economies are about to join them, led by the U.S. The fourth quarter of 2019 likely marked the trough in global GDP growth. The recovery in trade should help lead the way, after the collapse in trade volumes in late 2018.