With massive U.S. fiscal and monetary stimuli beginning to fade, capital markets experienced serious withdrawal pains in the fourth quarter, especially after Thanksgiving. The global capital markets suffered more when the Federal Reserve coldly applied another rate hike despite a mounting trade war and slumping China growth. Unfortunately, inside these chilling markets, the mix of volatile prices and tightening liquidity became too hot for many hedge funds to handle.

After defying recent bearish market trends elsewhere, U.S. equities bore the brunt of investor scorn in this latest quarter. The S&P 500 Index slumped 13.5%, while the Russell 2000 Index collapsed 20.2%. The MSCI Emerging Markets Index (-7.5%) dropped much less in the fourth quarter, although it had fallen 7.7% in the prior three quarters. High yield spreads widened, especially among lower credits. While BBB-rated credits yielded flat returns, CCC-rated credits dove almost 10%.

Another casualty of the quarter was commodities, as reflected in the Bloomberg Commodity Index (-10.0%). Oil’s sudden reversal in October from its cyclical highs was particularly unsettling for the recovering energy sector as well as trend-followers. Playing their expected role as safe-haven assets, Treasuries rose (FTSE 10-Year Treasury: +3.9%) and gold prices jumped about 7%.

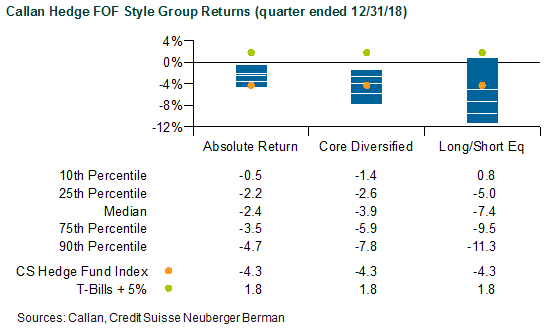

With equities and commodities leading markets down in the quarter, hedge funds long on such risks lost ground. As an unmanaged proxy of the hedge fund universe, the Credit Suisse Hedge Fund Index fell 4.3%. For the year, the index finished down with a 3.2% loss. Reflecting live hedge fund portfolios, net of all fees, the median manager in the Callan Hedge Fund-of-Funds Database (-4.9%) declined marginally more than the unmanaged Credit Suisse index proxy. For the year, it did relatively better, sinking 1.4%.

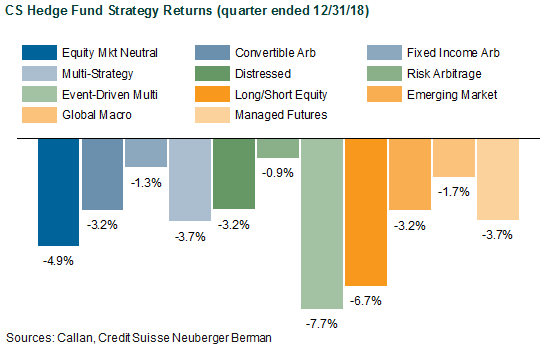

Heavily exposed to equity beta, Long/Short Equity (-6.7%) and Event-Driven Multi Strategy (-7.7%) succumbed the most among the Credit Suisse index’s sub-strategies. Given the quarter’s sharp reversals in stocks and commodities, Managed Futures gave up 3.7%. Despite little beta exposure, Equity Market Neutral (-4.9%) was caught flat-footed in the market’s hot-and-cold turmoil. Longs sold off more aggressively than shorts, delivering unusually large negative alphas for investors in this strategy seeking immunity from beta downdrafts.

More process-driven or hard-catalyst hedge fund strategies, like Risk Arbitrage (-0.9%) and even Distressed (-3.2%), held ground better. Other relative value trades, particularly those further away from liquid stocks, like Fixed-Income Arbitrage (-1.3%), were less impacted.

Within the Callan FOF database, portfolios with a long bias to U.S. equities and related risks suffered the most, while those with relative value, conservative event-driven, and discretionary macro strategies performed relatively well. For example, the Callan Absolute Return FOF suffered only a 2.4% loss. However, the median Callan Long/Short Equity FOF fell 7.4%, reflecting the unusually painful concoction of negative alpha and beta. With exposures to both absolute return-oriented and long-biased hedge fund styles, the Core Diversified FOF slumped 3.9%.

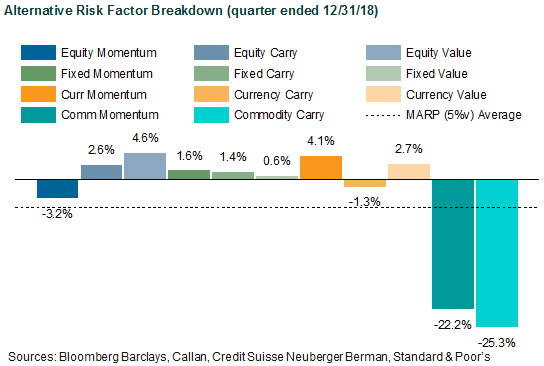

Since the financial crisis, liquid alternatives to hedge funds have become popular among investors for their attractive risk-adjusted returns that are similarly uncorrelated with traditional stock and bond investments but offered at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate known risk premia such as value, momentum, and carry found across asset classes. These alternative risk premia are often embedded, to varying degrees, in hedge funds as well as other actively managed investment products.

Measuring the performance of these alternative risk premia based upon a 5% volatility target, the Credit Suisse Neuberger Multi-Asset Risk Premia Index surrendered 4.7% in the fourth quarter. Within the underlying styles of the index’s derivative-based risk premia, the biggest losers were Commodity Carry (-25.3%) and Commodity Momentum (-22.2%). A distant third among other risk premia subindexes was Equity Momentum (-3.2%). Rebounding from prior quarters of dismal returns, Equity Value (+4.6%) was the quarter’s most positive contributor.

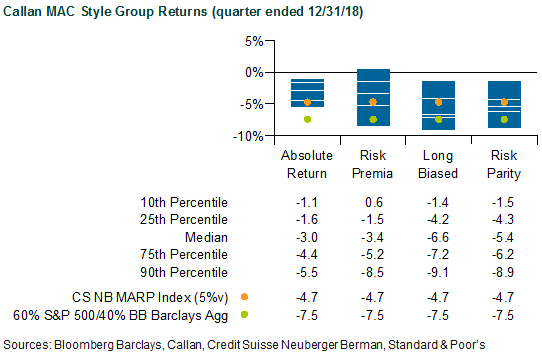

Beset by negative betas in both traditional and alternative markets, all of the Callan Multi-Asset Class (MAC) Style Groups struggled in the fourth quarter’s risk-off mode. The median Callan Risk Premia MAC retreated 3.4%, gross of fees, reflecting targeted exposures to alternative risk premia (such as those in the Credit Suisse Neuberger index noted above). As the most conservative MAC style focused on balanced portfolios of long and short asset class exposures, Callan Absolute Return MAC (-3.0%) suffered least but lost its opportunity to demonstrate positive alpha.

Typically pursuing equal risk-weighted allocations to major asset classes with leverage, the Callan MAC Risk Parity fund slipped 5.4%, gross of fees, hurt by both commodity and equity exposures. Given its long equity bias within a dynamic asset allocation framework, the Callan Long-Biased MAC dropped 6.6%, but less than a global balanced index proxy of 60% MSCI ACWI and 40% Bloomberg Barclays Global Aggregate (-7.2%).