Confidence in the strength of the global economy evaporated suddenly in October 2018, leading to sharp declines in equity and commodity prices, widening interest rate spreads, and an appreciation of the U.S. dollar. Little in the underlying fundamentals of the U.S. economy had changed: GDP enjoyed solid gains of 4.2% and 3.4% in the second and third quarters of 2018, the robust labor market continued to create jobs at a rate of over 200,000 per month, and consumer spending was strong, fueled by rising wages. After two hiccups in the equity markets in February and March, confidence returned and equity markets steamrolled to a new peak in September.

So what changed? Emerging signs of slower growth in the global economy outside the U.S., rising concerns over a trade war, and fears that continued U.S. interest rate increases will slow growth both here and abroad eroded confidence. A slowdown in U.S. and global growth suddenly seemed inevitable as waning fiscal stimulus and rising interest rates weaken demand.

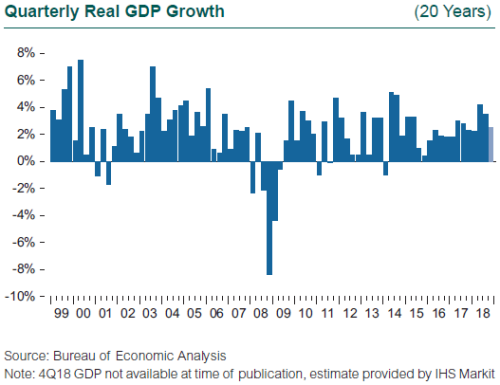

Despite the loss of confidence, data on U.S. economic growth largely remained solid through the fourth quarter, led by the labor market. The U.S. economy added over 2.6 million new jobs in 2018, up from 2.3 million in 2017. The unemployment rate fell to a generational low of 3.7% in September. The rate rose to 3.9% in December, but not because of weakening job growth—the tight labor market finally spurred an increase in the labor force participation rate. Fourth quarter GDP growth is projected to come in close to 2.5%, resulting in an annual rate of growth for 2018 of 3.0%. (The government shutdown delayed reporting of GDP; estimate provided by IHS Markit.) GDP growth of 3.0% for the year would mark the high point in the current expansion that began in 2009 after the Global Financial Crisis.

Not all of the economic data were positive. One of the biggest contributors to GDP growth in the third quarter was investment in inventory. Imports surged, likely ahead of the imposition of tariffs on Chinese goods, and much of these imports landed in inventories. Building inventories adds to GDP, while the working down of inventories in the coming months will subtract from GDP. Growth in business fixed investment—capital expenditures—stalled in the second half of the year, possibly discouraged by uncertainty over trade policy. Residential investment declined in each quarter during the year, as the housing market continues to sputter.

Housing has been a persistent disappointment. While demographic trends may appear to be favorable—the emergence of the millennial generation into prime home-buying age—housing faces several headwinds: strong prices and rising mortgage rates have made homes less affordable, several provisions of the 2017 Tax Act are unfriendly to housing, and builders complain about the scarcity of lots and skilled labor to build homes.

Inflation risks seemed to increase throughout the year. Average hourly earnings reached a 3% growth rate in January, igniting fears of the arrival, finally, of inflationary pressures. This wage report in fact was cited as one of the key instigators in the market sell-off in February. Growth in the CPI reached 3% by mid-year, and the long, mysterious absence of inflation after all that monetary and fiscal stimulus was thought to be over. Oil prices reached $84 in early October. But the risk of inflation lessened in the fourth quarter. Confidence in global growth collapsed and one of the first casualties was oil, whose price dropped to $52 in December. As a result, the broad consumer price index (CPI) dropped below 2% growth, and the landscape for inflation going forward changed.

The Federal Reserve has played a large role in the evolving market sentiment. The Fed raised short-term interest rates four times during 2018, resulting in a federal funds rate of 2.25%-2.5% by year end. The Fed continued to point to solid growth, a strong labor market and potential inflationary pressures as justification for a path to a long-term federal funds rate that at mid-year 2018 was projected to reach 3.25%. While the Fed has been clear in communicating its intentions to tighten, concerns rose during 2018 that the U.S. rate increases were slowing growth both in the U.S. and around the globe. In addition, U.S. policy has deviated from that of central banks in the euro zone, which have yet to shift from easing to tightening. The Fed did reduce its projected long-term target for the fed funds rate to 2.75%-3%, but sentiment took a dive when it raised rates as promised for a fourth time in December.