The NCREIF Property Index advanced 1.8% during the fourth quarter (1.2% from income and 0.6% from appreciation). This marked the 36th consecutive quarter of positive returns for the Index.

Industrial (+3.3%) was the best-performing sector for the seventh consecutive quarter. Office (+1.7%) and Apartments (+1.6%) also did well. Hotels (+1.0%) were the worst performer and the only property type to experience a negative appreciation return. Hotels only had one quarter of positive appreciation during 2017. The West region was the strongest performer for the fifth quarter in a row, returning 2.3%, and the Midwest lagged with a 1.3% return. The West also had the strongest appreciation return at 1.2%; all other regions had appreciation below 0.5%. Transaction volume fell slightly to $11.5 billion, a 3% decrease from the third quarter and an 18% decline from the fourth quarter of 2016. Appraisal capitalization rates rose 16 basis points to 4.55%. Transaction capitalization increased even more, rising 59 bps to 5.85%. The spread between appraisal and transactional rates increased to 130 bps.

Occupancy rates increased to 93.6%, up 20 bps from the third quarter and 37 bps from the fourth quarter of 2016. Industrial and Retail occupancy rates increased slightly while Apartment and Office rates decreased.

The NCREIF Open End Diversified Core Equity Index rose 2.1% (1.1% from income and 1.0% from appreciation), a 20 bps increase from the third quarter. The appreciation return increased for the second quarter in a row. Leverage ticked up 1 basis point to 21.4%.

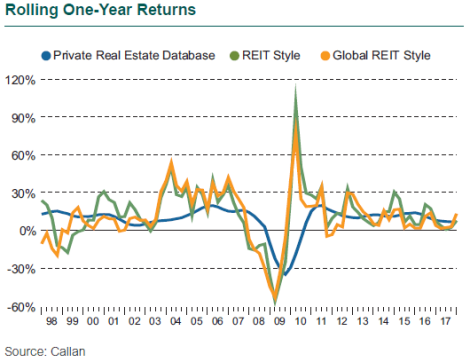

Global real estate investment trusts (REITs) tracked by the FTSE EPRA/NAREIT Developed REIT Index (USD) outperformed U.S. REITs and posted a 3.8% return. The median active global REIT manager, as measured by the Callan Global REIT Style Group, gained 4.6%, beating the Index. U.S. REITs, as measured by the FTSE NAREIT Equity REITs Index, advanced 1.5% for the quarter. The median active U.S. REIT manager, as measured by Callan’s U.S. REIT Style Group, returned 2.4%, also beating the Index.

In the U.S., a strong November helped REITs overcome negative performance in October and December. Infrastructure (+8.8%), Hotels (+5.4%), and Timber (+4.9%) made solid gains, while Health Care (-5.3%), Diversified (-2.0%), Specialty (-1.9%), and Residential (-0.2%) were the worst performers. Retail (+6.8%) bounced back from a dismal second and third quarter on the back of high M&A activity and a strong holiday shopping season.

Europe, as represented by the FTSE EPRA/NAREIT Europe Index, was the strongest-performing region for the third consecutive quarter, returning 7.6% in U.S. dollar terms. U.K. REITs outperformed their continental counterparts due to optimism over a “soft Brexit” and better than expected earnings from London-centric real estate proxies. Continental Europe continued to benefit from robust economic growth that was not fazed by the Catalonian election results, among other political surprises.

The Asia-Pacific region, represented by the FTSE EPRA/NAREIT Asia Index, jumped 5.5% in U.S. dollar terms, besting the U.S. but lagging Europe. Singapore was the strongest performer, helped by a rally in the broader Singaporean stock market. Hong Kong and Australia also had good quarters. Japan lagged behind, but was still positive.

7.6%

Return in U.S. dollars for the FTSE EPRA/NAREIT Europe Index, the strongest-performing region for the third consecutive quarter.