The final quarter of 2017 demonstrated that less is more, especially when related to unemployment, taxes, and market volatility.

- Global unemployment continued to fall, bolstering consumer spending power.

- President Trump delivered on his promise of cutting corporate taxes, instantly helping the bottom line of stocks.

- With nearly all countries in sync with improving fundamentals, uncertainty about the consensus outlook dropped.

- Brief bouts with dysfunctional D.C politics, North Korea taunts, and Brexit doubts did little to disturb the positive mood across capital markets.

With this risk-on backdrop, stocks rallied globally. The S&P 500 Index jumped 6.6%, to finish the year’s 21.8% gain. The MSCI Emerging Markets Index vaulted 7.4%, capping a 37.3% return for the year. The 10-Year Treasury (-0.3%) slipped slightly as the Federal Reserve raised rates and stopped rolling over its balance sheet of maturing fixed income securities for the first time since it launched quantitative easing almost a decade ago. Although credit spreads tightened further, the Bloomberg Barclays US Corporate High Yield Bond Index eked out only a 0.5% gain. The safe-haven dollar fell modestly while oil prices rose with more global demand. Bitcoin and other crypto currencies captured the fantasy of speculators, while governments warily monitored this nascent alternative to fiat currencies.

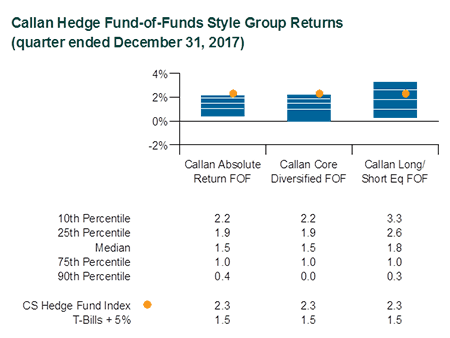

While raw equity beta surged, alpha-seeking hedge funds experienced positive but more modest results. Representing a paper portfolio of hedge fund interests without implementation costs, the Credit Suisse Hedge Fund Index (CS HFI) rose 2.3% in the fourth quarter. Actual hedge fund portfolios represented by the median manager in the Callan Hedge Fund-of-Funds Database advanced 1.5%, net of all fees and expenses.

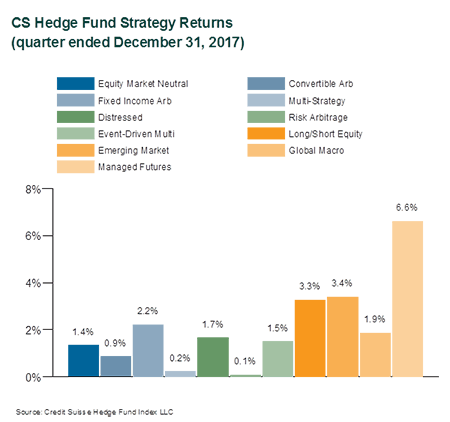

Within CS HFI, the best-performing strategy last quarter was Managed Futures (+6.6%), recovering enough from prior quarters to finish the full year in the black (+3.3%). Other strong hedge fund strategies were Emerging Markets (+3.4%) and Long/Short Equity (+3.3%), which earned a modest alpha on beta-adjusted returns.

Global Macro (+1.9%) also got some notable traction with its primarily top-down discretionary calls, but the full year’s 2.1% return was otherwise lackluster. Less directional strategies, like Fixed Income Arb (+2.2%) and Equity Market Neutral (+1.4%), benefited from their respective factor exposures. Less fortunate was Risk Arb (+0.1%) where some major pending deals, like AT&T/Time Warner, unexpectedly met with regulatory resistance, causing those deal spreads to widen significantly. M&A outlook for 2018, though, still looks healthy, especially given the better clarity provided by the recent corporate tax cuts to strategic decision-makers.

Within Callan’s Hedge Fund-of-Funds (FOF) Database, market exposures marginally affected performance in the fourth quarter. With the added momentum from equity markets, the median Callan Long/Short Equity FOF (+1.8%) beat the Callan Absolute Return FOF (+1.5%). With diversifying exposures to both non-directional and directional styles, the Core Diversified FOF gained 1.5%.

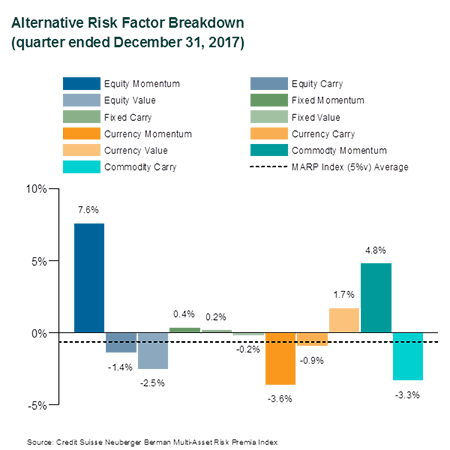

Since the financial crisis, liquid alternatives to hedge funds have become popular among investors for their attractive risk-adjusted returns that are uncorrelated with traditional stock and bond investments but derived at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate known risk premia such as momentum, carry, and value found across equity, fixed-income, currency, and commodity markets. These alternative risk premia are often embedded, to varying degrees, in hedge funds as well as other actively managed investment products.

As a proxy for these alternative risk premia in the fourth quarter, the Credit Suisse Neuberger Multi-Asset Risk Premia Index slipped 0.6% based upon a 5% volatility target. Within the underlying styles of the Index’s derivative-based risk premia, two notable winners were Equity Momentum (+7.6%) and Commodity Momentum (+4.8%). The rest were negative or marginally positive.

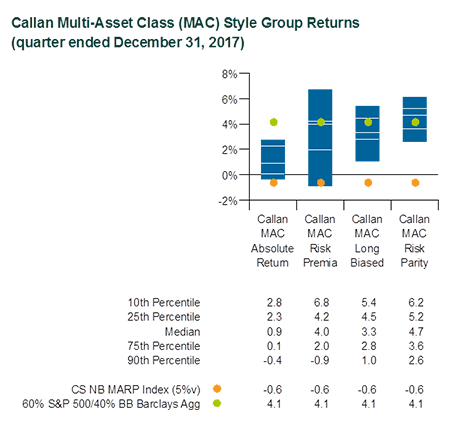

Within Callan’s Multi-Asset Class (MAC) Database group of liquid alternative solutions, gross of fees, the median Callan Risk Premia MAC gained 4.0%, aided particularly by equity and commodity momentum (such as those in the CS Neuberger Index noted above). Typically targeting equal risk-weighted allocations to major asset classes with leverage, the Callan Risk Parity MAC gained 4.7%, beating a traditional 60% stock/40% bond benchmark (+4.1%). The Callan Long-Biased MAC (+3.3%) also performed well, given its dynamic asset allocation mandate with a typically long equity bias, but trailed the 60/40 benchmark. As the most conservative MAC style focused on non-directional strategies of long and short asset class exposures, the Callan Absolute Return MAC added 0.9%.