Listen to This Blog Post

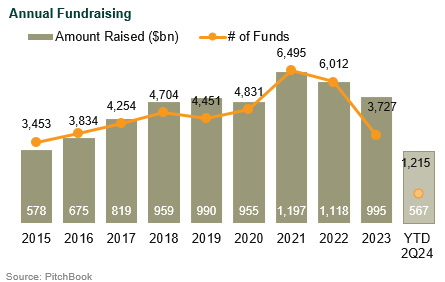

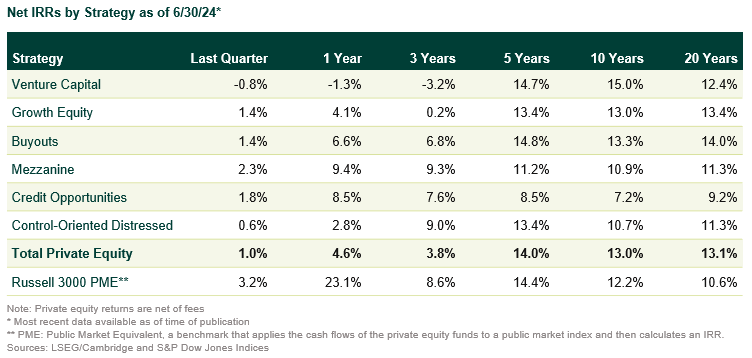

The number of private equity funds raised is significantly down, but the amount raised is higher than comparable periods in 2022 and 2023. Other activity has been similar to trends in 2023. Public equity outperformed private equity in the quarter, but not over longer time periods.

Details on 3Q24 Private Equity Activity

Fundraising | The first half of 2024 showed mixed signals in terms of fundraising. The number of funds raised is significantly down from years prior, but the amount raised actually exceeds the first halves of both 2022 and 2023. As was the case in 2023, capital continues to concentrate with larger funds. Small venture capital funds, which historically make up a large portion of the number of funds raised, have experienced the greatest challenges fundraising today.

Buyouts | Buyout activity levels in 2024 are similar to 2023, which represents a return to the pre-pandemic activity levels of 2019. In hindsight, 2021-22 appear to be the exceptional years, characterized by exuberance in deal activity, while 2023-24 are much closer to historical levels.

Venture Capital and Growth Equity | The first half of 2024 represents a continuation of the slower pace of activity in 2023, although managers are generally more optimistic about making new investments. This year has seen a notable recovery in late-stage valuations. Companies able to raise follow-on financing typically do so at an up round. Similarly, early-stage valuations in 2024 rose by 25% from the prior year.

Exits | The first half of 2024 represents a continuation of the slower pace of exits in 2023, although managers are generally more optimistic about seeking an exit this year. Both IPOs and M&A exits are down in 1H24 compared to 1H23 by roughly 10%. Persistent buyer-seller valuation gaps continue to dampen exit activity, and the interest rate cut is not yet reflected in the 2Q24 data.

Returns | Public equity’s exceptional performance in the first half of the year (led by the “Magnificent Seven” technology stocks) has left private equity in its wake. Private equity returns are not as volatile as the public markets, and private equity doesn’t typically outperform when public equity is at record highs (it likewise doesn’t drop as sharply when public equity drops). Over the long term, private equity consistently outperforms public equity by 1%-3%.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.