Private equity activity measures in 3Q22 fell from 2Q, although totals reflect reasonable pre-pandemic levels. The IPO market for both venture capital and buyouts increased but dollar volumes remained miniscule. The market is in the process of slowing from last year’s peak activity. Interest rate increases and price discovery are beginning to take hold and a risk-off sentiment appears to be building, with declining distributions leading the slowdown.

3Q22 Private Equity Activity in Detail

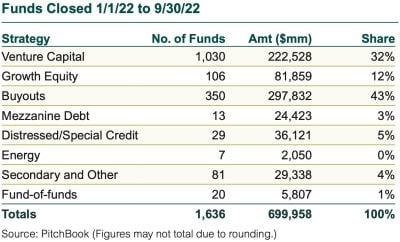

Fundraising: Based on preliminary data, private equity partnerships holding final closes in 3Q totaled $226 billion, with 484 new partnerships formed (unless otherwise noted, all data are from PitchBook). The dollar volume fell 6% from 2Q22, and the number of funds holding final closes declined 9%. So far, capital raised is running only 2% behind year-to-date (YTD) 2021, but the number of funds trails by 31%. The fundraising landscape is expected to slow further, as many investors are becoming over-allocated versus private equity target ranges due to large declines in asset owners’ public security portfolios.

Buyouts: New buyout transactions and dollar volume fell moderately. Funds closed 2,881 company investments with $152 billion of disclosed deal value, a 10% decrease in count and a 7% drop in dollar value from 2Q22.

Venture Capital: New financing rounds in venture capital companies totaled 9,985, with $97 billion of announced value. The number of investments was down 17% from the prior quarter, and the announced value plunged 32%. The median pre-money valuations of Seed through Series B rounds increased but C and D rounds fell in YTD 2022 versus 2021 pricing.

Exits: There were 594 private M&A exits of private equity-backed companies (excluding venture capital), with disclosed values totaling $128 billion. Exits were down 3% from the prior quarter and announced dollar volume dropped 10%. The YTD exit count is down 24%. There were 62 private equity-backed IPOs in 3Q raising $11 billion, up from 46 totaling $7 billion in 2Q.

Venture-backed M&A exits totaled 520 transactions with disclosed value of $24 billion. The number of sales declined 26% but announced dollar volume fell only 4%. The YTD exit count dropped 19%. There were 104 VC-backed IPOs with a combined float of $15 billion. For comparison, 2Q had 81 IPOs and total issuance of $12 billion.

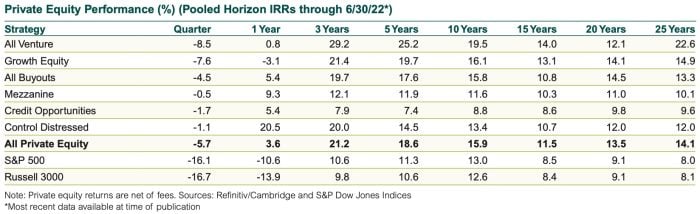

Returns: With the strong 2Q retreat in public equity markets, private equity outperformance has widened given private equity’s more gradual quarterly mark-to-market valuation methodology. While GPs have put forward persistently high valuations relative to public markets, continued declines are expected.

Disclosures

Certain information herein has been compiled by Callan and is based on information provided by a variety of sources believed to be reliable for which Callan has not necessarily verified the accuracy or completeness of or updated. This report is for informational purposes only and should not be construed as legal or tax advice on any matter. Any investment decision you make on the basis of this report is your sole responsibility. You should consult with legal and tax advisers before applying any of this information to your particular situation. Reference in this report to any product, service, or entity should not be construed as a recommendation, approval, affiliation, or endorsement of such product, service, or entity by Callan. Past performance is no guarantee of future results. This report may consist of statements of opinion, which are made as of the date they are expressed and are not statements of fact. The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to subsidiaries or parents, or post on internal web sites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.