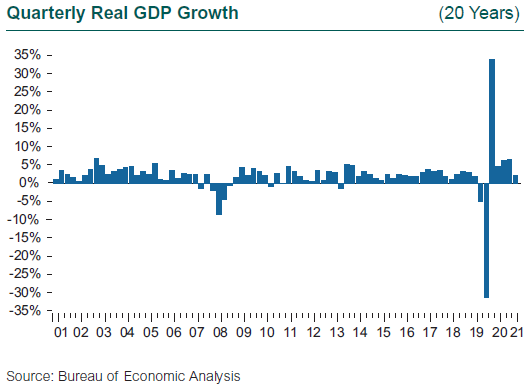

Global equity markets hit the pause button in 3Q21. Investors watched nervously as the economic data showed signs of softening: weaker job gains, slower output growth strangled by supply chain issues, a drop in income growth, and signs of waning consumer sentiment. As the quarter unfolded, supply chain issues and fears surrounding the end of fiscal stimulus, the surge in the Delta variant, and the return to a Fed taper slowed economic activity. Spiking inflation stirred even more anxiety, and the equity markets pulled back sharply in September in anticipation of weak reports for the economy. The market’s concerns appeared to be well-founded, as U.S. GDP came in at 2% growth for 3Q, down from the torrid 6.7% pace in 2Q and very much in line with reports of growth stalling in the euro zone and in Asia, particularly China.

Does the drop to 2% mean the recovery from the pandemic has been thrown off track? Recall that the global economy suffered disruption and volatility unprecedented in modern times: a stock market decline in the U.S. of 34% in just a handful of trading days, and the complete shutdown of industries such as hospitality, passenger transportation, in-person retail trade, and personal services. Global supply chains ground to a halt, and restarting everything was fully expected to result in a herky-jerky pattern of growth. That the recovery has gone as well as it has is a testament to the impact of the monetary and fiscal policy lavished during the upheaval by countries around the globe. That we are as far along as we are was not really considered likely just a year ago—vaccines were yet to be released; a second, much larger surge in COVID infections was spreading; and the notion of travel, of job recovery, and of a resumption of trade was a pipe dream. All of the supply/demand issues within almost every market—labor, raw materials, commodities, energy, intermediate and finished goods, services, travel capacity, shipping—were fully expected. Price dislocations were also expected, and we have come to see them in goods as disparate as timber products, gasoline, computer chips, automobiles, and consumer goods. A drop to 2% growth in 3Q following a robust 6.7% gain in 2Q is well within expectations for this lurching stop/start path toward normally functioning markets.

Unemployment in the U.S. dropped to 4.8% in September, but it is still above the pre-COVID rate of 3.5%. The economy added 194,000 jobs in September, down from 336,000 in August and a whopping 1,091,000 in July, and just one-third of the monthly average of 560,000 during 2021. The dislocation between employers looking for employees and those looking for work has become extreme. The job market is still almost 5 million jobs below the pre-pandemic peak. Yet employers across sectors and regions of the country struggle to fill positions, particularly in services, retail trade, and hospitality, but also in basic labor within manufacturing, wholesale trade, transportation, and distribution. The end of pandemic unemployment support in September means workers will soon be forced back into the labor market, which may help alleviate its kinks. Uncertainty about the future for those about to lose benefits certainly fed into consumer sentiment in 3Q. Personal income declined in September, even though wages and salaries rose a solid 0.8% in just one month. The rise in wage and salary payments was not enough to offset the loss of social benefits.

So what about 4Q21? Do we face more of the 2% solution or a rebound in growth? Signs point to a rebound: inventory investment has yet to take place, which could be a major driver of growth; the toll from the Delta surge has fallen sharply. High-frequency data in September and into the first month of 4Q suggest robust credit card spending, a renewed surge in air travel, and a rise in gasoline consumption to pre-pandemic seasonal levels. However, hotel revenues and restaurant spending have yet to recover from the flattening that occurred as the Delta variant hit in mid-summer—more fits and starts. The inflation surge that began in early 2021 continued through 3Q with a 5.7% rise; while disconcerting to many, the surge was completely expected. Going back to 4Q19, which takes out the base effect from the low readings in 2020, the price index rose at a 3.1% annual rate. Aggregate demand appears to have regained some strength at the very end of 3Q, as evidenced by a rise in real imports to levels above pre-pandemic levels. Overall, consensus estimates place 4Q GDP back at a 5% annual growth rate.