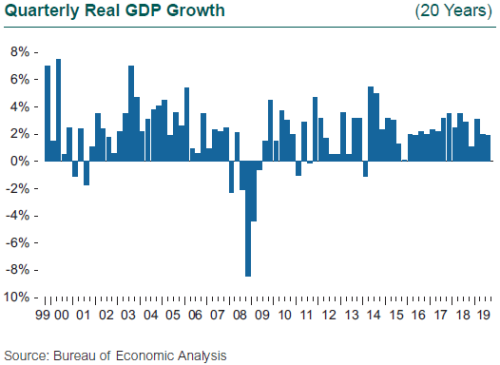

Third quarter U.S. GDP growth surprised on the upside, coming in at 1.9% and extending what is now the longest economic expansion on record to 124 months. While 1.9% sounds modest compared to past cycles, it is positively robust compared to developed economies around the globe. The U.S. economy, and to an extent the entire global economy, has defied fears of an imminent collapse all year. While the current expansion may appear long in the tooth, elapsed time is not an economic variable. This expansion has been far weaker than each of the past 10, whether measured by cumulative GDP growth (at just under 25%, it’s about half that of the 1990s), by job creation, or by investment. The overhang of the housing market collapse has weighed heavily on growth since 2009, and the measured pace of growth has in fact enabled the U.S. economy to maintain a slow burn.

Several long-held tenets of fundamental macroeconomics appear to be under serious re-consideration after the extraordinary 10-year period following the Global Financial Crisis: the cause (and the absence) of inflation; the execution of monetary policy; the role of central banks and in particular the pivot by the Federal Reserve at the start of 2019; and the business cycle. The new macroeconomic narrative says that first, the business cycle as we know it has been disrupted; second, the source and volatility of inflation has been altered going forward; third, central banks have added sustaining economic expansion to their official remit, therefore the quantitative easing (QE) genie is out of the bottle and we will not be stuffing it back in anytime soon. All of these changes to the macro world are interrelated, one sustaining the other, and are potentially pointing to a different path for the U.S. and global economy than would be expected, given past accepted relationships between inflation, monetary policy, and the business cycle.

“This time, it’s different” has been trotted out near the peak of most cycles to justify why the expansion can continue, at a time when imbalances typically push measures of economic soundness to their limits. This time, however, it may really be different. In the words of many analysts, the Fed rate hike in December 2018 may have been the end of an era. The Fed’s standard operating procedure until now has been to tighten preemptively before inflation takes off, and following the extraordinary period of zero interest rate policy, the Fed’s goal had been to normalize rates while inflation was low. The Fed pivot in January to pause on rate hikes, and then to implement two cuts in the third quarter while the expansion continues, indicates that preemptive tightening and rate normalization are over, and we may not see them again. The macro world as we know it may have changed.

The headlines of impending doom that have dominated 2019 make the coming recession, if it ever materializes, the most anticipated slowdown ever. The economic result so far in 2019 is that the U.S. economy has shrugged off slowing global growth, a prolonged trade war with China, and geopolitical uncertainty in the euro zone due to Brexit—and continued to steam along. The job market remains strong, and the unemployment rate is at a generational low of 3.6%. U.S. economic growth is clearly moderating, but the expected plunge has yet to materialize, in part because of the lack of obvious imbalances, and in part because of the relatively insular nature of the U.S. economy. The trade war with China is top of the news, yet the cumulative impact on GDP growth since 2018 is less than 1%, as estimated by Capital Economics. The rest of the world has clearly slowed, and global GDP growth looks ready to fall to its weakest pace (near 2% next year) since 2012.

The source of inflation has shifted from the goods and commodities sectors to the service sector. Goods and commodities have shown substantial variability, with the attendant impact on the business cycle and on prices. The service sector shows much more subdued cyclicality, and as a result both the business cycle and inflation may become irrevocably less volatile, with the boom and bust of past cycles no longer the expectation. Headline inflation came in at a 1.7% annual rate in the third quarter, still well below the Fed’s target of 2%, and producer price inflation in particular went negative during 2019, dragged down by commodity and goods prices. The persistence of low inflation in the face of continued expansion and a decade of accommodative monetary policy is one factor giving the Fed cover to cut rates while growth continues.