With fears of softening manufacturing hanging over global equity markets, particularly in Asia and Europe, many central banks actively cut rates to allay economic concerns in the third quarter. Falling yields for sovereign debt and higher-rated credits also helped to soothe concern about the prolonged trade battle between the U.S. and China. Regional flare-ups, like the Saudi-Iran confrontation and the unexpected populist resurgence in Argentina’s elections, caused isolated turmoil in related markets. Comforting U.S. equity and dollar investors, the trend of resilient American consumer spending and employment continued unabated.

While the MSCI Emerging Markets Index sank 4.2%, the S&P 500 rose 1.7%. As a safe-haven asset, the FTSE 10-Year Treasury gained 3.2%. However, a brief but violent rebound in yields during September was the catalyst for a dramatic equity factor rotation from growth to value. The flight to quality in credit markets propelled the Bloomberg Barclays Credit Baa (+3.3%) while undermining Bloomberg Barclays US High Yield Caa (-1.8%). Geopolitical tensions coupled with central bank easing helped gold (+4.2%) as another safe-haven play.

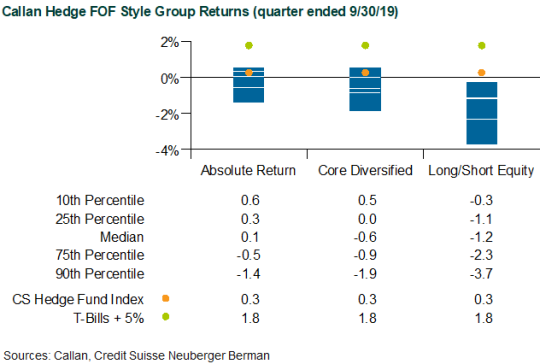

Amid this backdrop of market tensions somewhat controlled by easing monetary policies, hedge funds struggled to find profitable opportunities. As a paper portfolio of hedge fund interests, the Credit Suisse Hedge Fund Index (CS HFI) inched ahead 0.3%.

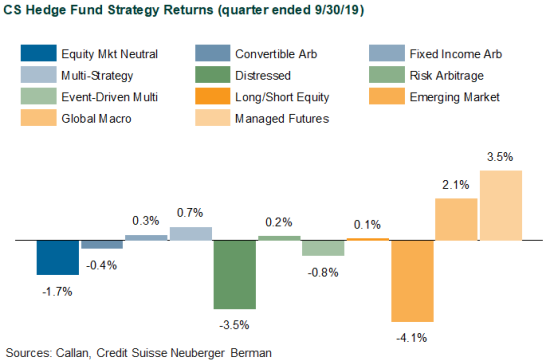

Within CS HFI, widening spreads in lower-rated credits did not help Distressed (-3.5%), despite its more idiosyncratic risks. Long/Short Equity (+0.1%) benefited little from its net long beta positioning and was caught flat-footed by September’s sudden pivot from growth stocks. Similarly, Equity Market Neutral (-1.7%) slipped hard, especially affected by September’s violent factor rotation. Convergence trades outside of equity fundamentals, like Fixed Income Arbitrage (+0.3%) and Risk Arbitrage (+0.2%), managed to eke out a modest living.

The quarter’s bright spots within CS HFI were Managed Futures (+3.5%) and Global Macro (+2.1%), supported by the extended trend of falling rates. Currency carry also helped systematic top-down allocators. However, the Argentine election surprise, which crushed its debt and currency markets in August, badly hurt some discretionary macro traders.

Representing actual hedge fund portfolios, net of all fees, the median manager in the Callan Hedge Fund-of-Funds Database slipped 0.6%. Given the equity market’s fundamental churn with little beta support during the quarter, the median Callan Long/Short Equity FOF dropped 1.2%. Focused on relative value and conservative event-driven strategies, the Callan Absolute Return FOF (+0.1%) held its ground better. With its mix of both non-directional and directional strategies, the Callan Core Diversified FOF lost 0.6%.

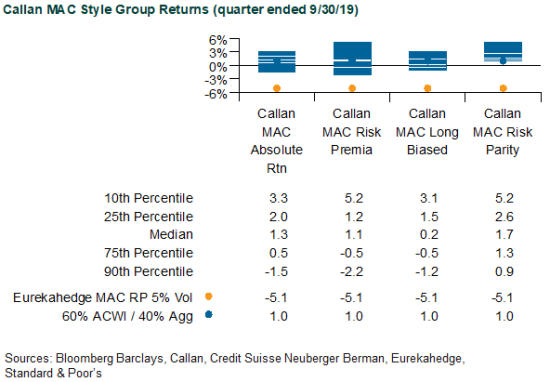

Since the financial crisis, lower-fee liquid alternatives to hedge funds have become popular among investors for their attractive return profiles that have varying degrees of correlation with traditional stock and bond portfolios. Within Callan’s database of these multi-asset class (MAC) solutions are four style groups using different degrees of market exposure as well as styles of implementation. Given last quarter’s market environment, performance varied widely across these four styles.

For example, the median Callan Risk Parity MAC, which typically targets equal risk-weighted allocations to major asset classes with leverage, gained 1.7% versus the 1.0% return of an unlevered benchmark of 60% MSCI ACWI Index and 40% Bloomberg Barclays Aggregate Bond Index. Given its usually heavy equity exposure within a discretionary asset allocation framework, the Callan Long-Biased MAC (+0.2%) underperformed the 60%/40% index.

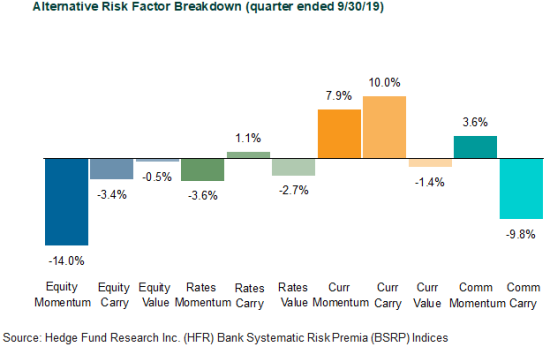

Using a systematic process to target alternative betas of value, carry, momentum, and other non-market risk factors, the median Callan Risk Premia MAC accrued 1.1% versus a 5.1% loss based on the Eurekahedge Multi-Factor Risk Premia Index. Within risk premia, equity momentum was a key detractor, driven in part by September’s factor reversal. Rates momentum was an offsetting contributor given the trend of falling yields. As the most conservative MAC style focused on non-directional strategies of long and short asset class exposures, the Callan Absolute Return MAC edged ahead 1.3%, benefiting from its typical long bias to higher-quality assets.

Despite geopolitical uncertainties, capital markets remain mostly constructive with key monetary policymakers actively easing. Tangible progress in reducing trade tension will renew animal spirits in global equity beta, likely leading most hedge funds to lag traditional markets again. If global economic indicators soften further, thereby overwhelming the effects of central bank easing, hedge funds are positioned reasonably well to benefit from the uptick in perceived risks ahead.