The market environment for hedge funds offered conflicting signals in the third quarter. Despite weakening economic strength abroad, particularly in China, the U.S. economy marched stridently ahead, still energized by recent tax cuts and falling unemployment. Better-than-expected corporate earnings pushed up U.S. stocks, despite a marginally stronger dollar. Anticipating inflationary risks, the Federal Reserve pressed forward with its long-stated intent to drain excess liquidity from the credit markets with higher short-term rates.

The mounting trade war between the U.S. and China added to China’s unsettled markets, but it did not negate the bullish U.S. sentiments. The S&P 500 Index jumped 7.7%, while the MSCI Emerging Markets Index fell 1.1%. Supported by a seemingly unstoppable technology sector, growth stocks continued to reign over value. While longer-term interest rates rose with the resilient U.S. economy (causing the FTSE 10-Year Treasury to lose 1.1%), credit spreads tightened marginally. Spot gold fell 4.6%.

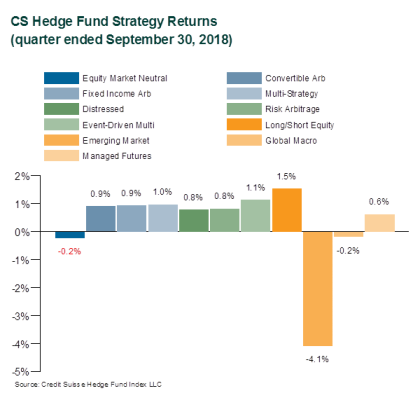

The divergent economic forces around the globe created a modestly profitable trading environment for most hedge funds. Illustrating raw hedge fund performance without implementation costs, the Credit Suisse Hedge Fund Index (CS HFI) gained 0.6%.

Aided by climbing U.S. stock prices, Long/Short Equity (+1.5%) gained the most among the CS HFI substrategies. Supported by the strong U.S. corporate environment, event-driven strategies, such as Event-Driven Multi-Strategy (+1.1%), Distressed (+0.8%), and Risk Arb (+0.8%), made modest but steady gains. As the quarter’s worst-performing subindex, Emerging Markets (-4.1%) apparently suffered more than explained by an emerging market beta of -1.1%, as the average hedge fund gave back some of its “alpha” from prior quarters.

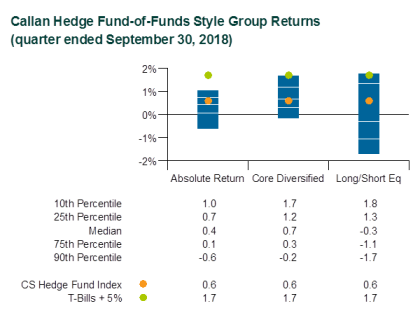

Representing actual hedge fund portfolios, the median manager in the Callan Hedge Fund-of-Funds Database forged ahead 0.4%, net of all fees and expenses. Within the database, market exposures were not the deciding factor this quarter. Despite the U.S. equity rally, the median Callan Long/Short Equity FOF (-0.3%) slipped behind the Callan Absolute Return FOF (+0.4%), which tends to benefit from event-driven deals and credit trades. With diversifying exposures to both non-directional and directional styles, the Core Diversified FOF gained 0.7%.

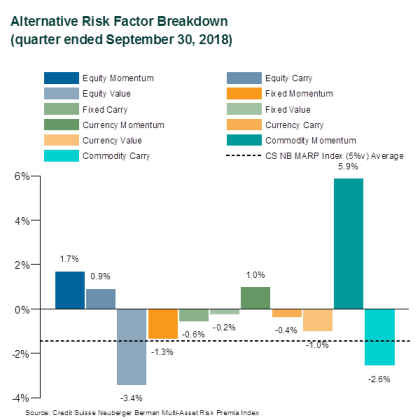

Liquid alternatives to hedge funds have become popular among investors for their attractive risk-adjusted returns that are similarly uncorrelated with traditional stock and bond investments but offered at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate known risk premia such as value, momentum, and carry found across the various capital markets. These alternative risk premia are often embedded, to varying degrees, in hedge funds as well as other actively managed investment products.

As a proxy for alternative risk premia performance, the Credit Suisse Neuberger Berman Multi-Asset Risk Premia Index fell 1.4% based upon a 5% volatility target. Within the underlying styles of the Index’s derivative-based risk premia, Commodity Momentum (+5.9%) was the outsized positive contributor, but it was not enough to offset losses from Commodity Carry (-2.6%) and Equity Value (-3.4%), among other marginally negative risk premia returns. Over the last seven quarters of consecutive losses, the equity value risk factor has fallen 23.6%, a move that has notably hurt many risk premia-based portfolios.

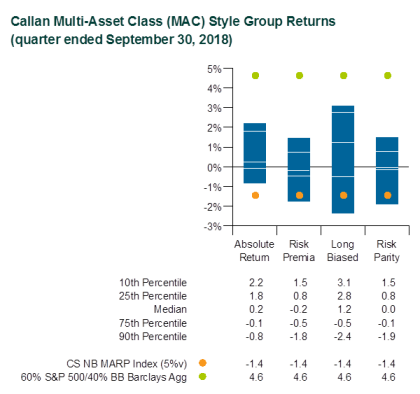

The median managers of Callan Multi-Asset Class (MAC) Style Groups generated marginal returns that were positive or negative depending on tilted risk exposures. For example, buoyed by its usually long equity bias within a dynamic asset allocation framework, the Callan Long-Biased MAC rose 1.2%, gross of fees, but trailed an unlevered benchmark of 60% MSCI ACWI and 40% Bloomberg Barclays US Aggregate Bond Index (+2.6%).

Likely impacted by underlying tilts to an equity value risk factor, the median Callan Risk Premia MAC slipped 0.2%. Typically targeting equal risk-weighted allocations to major asset classes with leverage, the Callan Risk Parity MAC (0.0%) was flat. As the most conservative MAC style focused on non-directional strategies of long and short asset class exposures, Callan Absolute Return MAC edged ahead 0.2%.