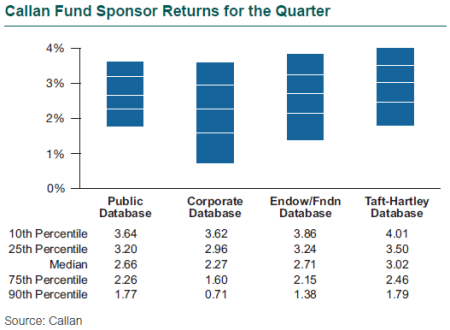

The median fund sponsor in Callan’s database gained 2.7% in the third quarter.

Taft-Hartley plans (+3.0%) were the best-performing sponsor by type, as they were the previous quarter; corporate plans (+2.3%) showed the lowest increase.

By size, the strongest returns came from small plans (under $100 million), which rose 2.9%, compared to a 2.6% gain for medium plans ($100 million-$1 billion) and 2.3% for large plans (more than $1 billion).

All types and sizes lagged a 60% S&P 500/40% Bloomberg Barclays US Aggregate benchmark, which rose 4.6%.

Over the last year, three years, and five years, Taft-Hartley plans had the strongest returns of all fund types, while public plans have done best over the last 10 years.

Investors are focused on concerns about equity exposure, market volatility, and how to mitigate risk in the event of an equity market correction in a rising interest rate environment.

But they face competing fears: an equity market downturn vs. the fear of missing out (FOMO!).

They are refining the definition of growth to include investments such as high yield, convertibles, low-volatility equity, hedge funds, multi-asset class strategies, and options-based strategies.

Many sponsors are seeking higher returns outside of traditional asset classes such as equity and fixed income, and worry about risk mitigation. The late stage of the economic cycle combined with elevated equity valuations and low bond yields is causing sponsors to explore allocations to U.S. Treasuries, managed futures, and tail risk hedging.

Concerns about fees and controlling costs continue among plan sponsors, and that issue has been an incentive to increase passive exposure.

For defined contribution plans, fee reduction and disclosure, compliance, and evaluating the structure of fund lineups are key areas of focus. Target date funds continue to dominate asset flows; they now account for almost 32.5% of DC assets, according to the Callan DC Index™.

Negotiating fee reductions and fee transparency is ongoing for DC plan sponsors, in some cases to a significant extent. Interest in institutional investment structures is increasing as another path to fee reduction.

Non-qualified deferred compensation (NQDC) plans are being evaluated on a standalone basis due to their design flexibility.

Some corporate plan sponsors have made large voluntary contributions in 2018. As a result, plans are reaching full funding. A glidepath strategy for gradual de-risking is no longer needed for some; these plans can fully de-risk immediately.

Endowments, foundations, and sovereign wealth funds saw a continuing focus on evaluating a sustainable distribution rate to balance intergenerational equity.

Interest in multi-asset class strategies continues, in particular from public and corporate defined benefit plans. Callan divides the multi-asset class universe into four categories: long biased, absolute return, risk parity, and risk premia.