The NCREIF Property Index advanced 1.7% during the third quarter (1.1% from income and 0.6% from appreciation). This marked the 35th consecutive quarter of positive returns for the Index. In the second quarter, appreciation return increased from the first quarter, the first such gain since the first quarter of 2015. But in the third quarter appreciation return resumed its declining pattern from the previous quarter’s level.

Industrial (+3.3%) was the best-performing sector for the sixth consecutive quarter followed by Hotel (+2.3%), Multi-Family (+1.7%), and Office (+1.4%); Retail (+1.2%) was the worst performer.

The West was the strongest region for the fourth quarter in a row, increasing 2.2%, and the East brought up the rear with a +1.3% return.

Transaction volume increased to $11.8 billion, up 53% from the second quarter and 22% from the third quarter of 2016. Appraisal capitalization rates fell 8 basis points to 4.39%. Transaction capitalization suffered a steeper decline, falling 83 bps to 5.26%. The spread between appraisal and transaction rates decreased to 87 bps.

Occupancy rates fell to 93.3%. Industrial and Retail occupancy rates increased slightly while Apartment and Office rates decreased.

The NCREIF Open End Diversified Core Equity Index rose 1.9% (1.1% from income and 0.8% from appreciation), a 17 bps increase from the second quarter. Appreciation return increased by 18 bps from the second quarter’s seven-year low.

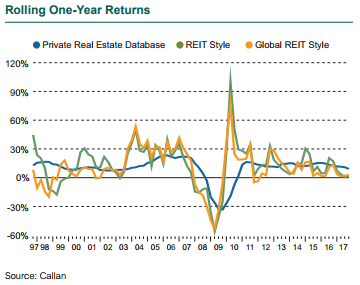

Global real estate investment trusts (REITs), tracked by the FTSE EPRA/NAREIT Developed REIT Index (USD), outperformed U.S. REITs and posted a 1.8% return. U.S. REITs, as measured by the FTSE NAREIT Equity REITs Index, advanced 0.9% for the quarter.

In the U.S., REITs started the quarter with a strong July but then surrendered most of the gains with poor showings in August and September. Sectors experiencing strong secular demand, such as Industrial (+6.5%) and Data Centers (+5.2%), were the best performers as the continued rise of e-commerce and cloud storage provided ample tailwind. Hotels (+2.8%) and Self-Storage (+4.7%) also did well, buoyed by expectations of inflation and rising interest rates. Health Care (-5.4%) was the worst-performing sector.

Europe, as represented by the FTSE EPRA/NAREIT Europe Index, was again the strongest-performing region, rising 4.8% in U.S. dollar terms. Strong, diversified growth across the majority of the region’s economies was the main driver of positive returns. The region largely shrugged off destabilizing political events such as the Catalonian independence referendum.

For the second quarter in a row, the Asia-Pacific region outperformed the U.S. but underperformed Europe. Hong Kong provided the best regional performance while Japan lagged behind, hurt by a strengthening yen.

1.7%

Third quarter return of the NCREIF Property Index