Private equity activity showed some small signals that it is rebounding, but many parts of the private equity “lifecycle” face challenges entering 2024.

Details on 2Q24 Private Equity Activity

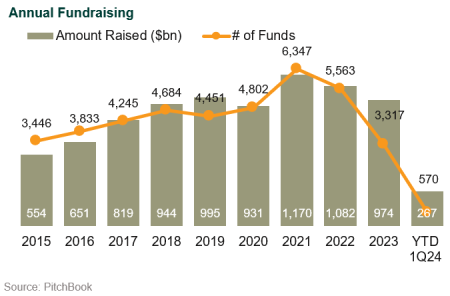

Fundraising | The 2023 vintage year experienced the full impact of the denominator effect, with sharp declines in fundraising for the year. The number of funds raised dropped by ~50% from the highs of 2021–22. Heading into 2024, fundraising continues to fall. The number of funds raised in 1Q24 was down by 42% compared to 1Q23, although the dollar amount raised is consistent.

Buyouts | 2023 represented the trough in buyout dealmaking, with early 2024 seeing improved liquidity conditions and higher public markets comps. Buyout activity was up by 7% in 1Q24 compared to 4Q23. Lower valuations, reflecting higher interest rates and a narrowing of the bid-ask spread, have led to greater activity.

Venture Capital and Growth Equity | Venture capital and growth equity have shown mixed signs of recovery but no large snapback, yet. 1Q24 deal activity was down by 9% from 4Q23. While venture capital activity was steady, there was a significant slowdown in growth equity, with no large growth equity deals during the quarter. 1Q24 exhibited a notable recovery in late-stage valuations. Similarly, early-stage valuations in 2024 also increased by 21% from the prior year.

Exits | In 2023, private equity exits declined dramatically by over 50% compared to their all-time record in 2021. Exit activity is up so far in 2024, by 15% compared to early 2023. IPO activity remains depressed, and the public offerings that do occur tend to be smaller in scale.

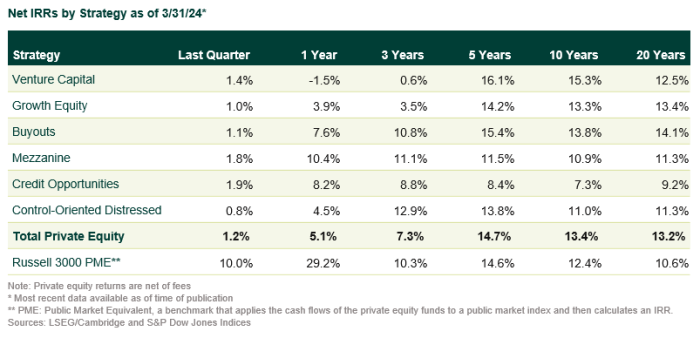

Returns | Public equity’s exceptional start to 2024 (led by the “Magnificent Seven” technology stocks) has left private equity in its wake. Over the long-term, private equity has outperformed public equity by 1%-3%.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.