U.S. equity markets moved higher during 2Q24, driven by a few large technology and AI-related companies along with generally healthy corporate earnings. Interest rates were volatile as signs of sticky inflation drove bond yields sharply higher. However, as the quarter wore on, softer macroeconomic data points and lower inflation readings reversed much of the move. The 10-year U.S. Treasury rose from 4.21% to 4.36%, and the 30-year from 4.34% to 4.51%, as Fed minutes indicated an eagerness to cut rates in September.

2Q24 hedge funds performance

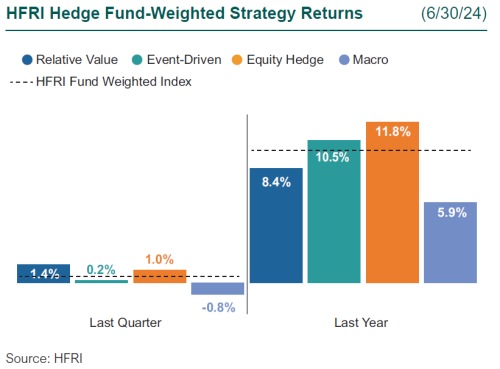

Hedge funds ended 2Q higher, as strategies with a higher correlation and a material beta to equities were successfully able to capitalize on volatility in markets. Equity hedge funds again saw positive performance; managers that focused on technology saw the biggest gains. Managers with more directional equity exposure and those with more of a market-neutral focus also had a solid quarter. Relative value strategies also gained; credit relative value and merger arbitrage strategies added to that performance. Macro strategies ended the quarter lower, as long positioning in developed market front-end rates detracted from performance, along with shorts in U.S. equities and long Japanese yen exposure.

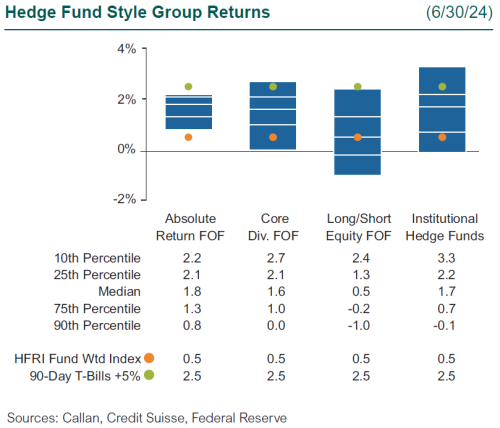

Serving as a proxy for large, broadly diversified hedge funds with low-beta exposure to equity markets, the median Callan Institutional Hedge Fund Peer Group rose 1.7%. Within this style group of 50 peers, the median hedged credit manager gained 1.7%, the median hedged equity manager added 2.4%, and the median Callan Institutional hedged rates manager rose 1.2%.

Within the HFRI Indices, the best-performing strategy was relative value, which was up 1.4%. Equity hedge gained 1.0%, while macro strategies ended the quarter slightly negative, as rates trading and long U.S. equities drove performance lower.

The median Callan Long-Short Equity FOF ended 0.5% higher, as managers with a focus on the Technology sector drove performance. The median Callan Core Diversified FOF rose 1.6%, driven by equity and event-driven strategies. The Callan Absolute Return FOF ended up 1.8%; equity beta strategies were behind this move.

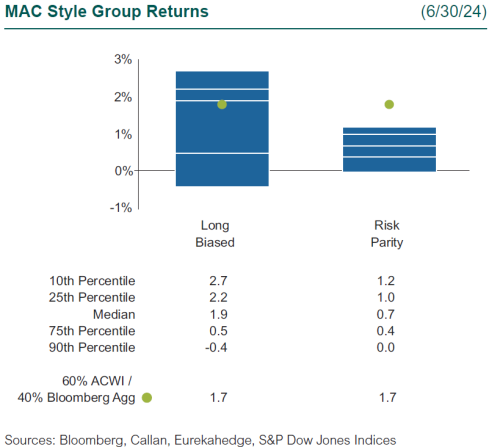

The median Callan MAC Long Biased manager rose 1.9%, as the strong equity rally pushed performance higher. The median Callan MAC Risk Parity peer group rose 0.7%, as equities and fixed income drove the gains.

As inflationary concerns continue to subside, market expectations for the Federal Reserve to begin cutting interest rates grow. Recessionary concerns from a year ago have dwindled as the economic expansion continues, though there remain several concerns from market procrastinators. The potential for alpha generation through long-short strategies remains strong, supported by significant dispersion among sectors and diverse macro trading opportunities.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.