The hunt for signs of the much-anticipated slowdown in the U.S. economy continues to be thwarted. Every data release is scrutinized: Is this the one that is finally the sign of a crack in growth?

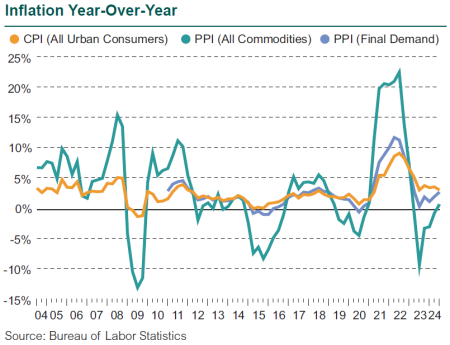

The economy is clearly set to slow compared to the surprise robust growth in the second half of 2023, but key measures like stubborn inflation, a job market that has yet to sag, and persistent growth in consumption spending have kept surprising to the upside.

Inflation eased from the worrisome rise in 1Q24, but still sits at 3.0% compared to a year ago, well above the Fed’s target. The job market looked like it finally cracked in April, creating just 108,000 jobs after adding 800,000 in the first three months of the year. Then job growth rebounded to 218,000 in May and 206,000 in June, clearly softer than the average monthly rate of 250,000 in 2023 and the surge in 1Q, but still solid. The unemployment rate remains low at 4.1%, although initial unemployment claims have been rising gradually since the recent low set in January. The labor market is indeed softening, which should reduce pressure on wage inflation at some point.

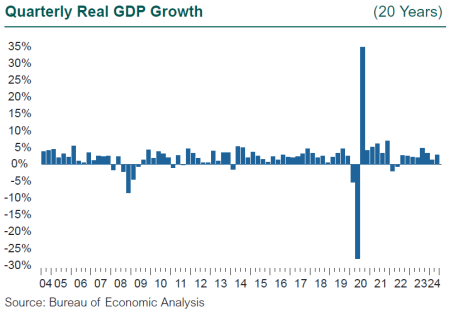

A softer labor market will likely dampen consumer demand, and therefore provide more relief to inflation pressures. Consumer spending slowed from a robust 3% growth rate in the second half of 2023 to 1.5% in 1Q, another potential crack in the façade. Then spending rebounded to a 2.3% gain in 2Q and drove a surprising 2Q GDP growth rate of 2.8%, about double the rate expected for the quarter.

In addition to consumer spending, GDP growth was driven by private inventory investment and business fixed investment, particularly in equipment and intellectual property. 1Q GDP growth came in at just 1.4%, the first sure sign of the anticipated slowdown—or so it seemed.

Interest rates have been higher for a longer period than many expected, including the Fed. There are surprisingly few signs that these higher rates have taken the expected toll on the economy. The economy does appear to be gradually slowing, current contradictory indicators like the strong GDP report aside. The cost of borrowing is sharply higher, and delinquencies in auto loans and credit cards are rising.

The real estate market is grappling with much higher mortgage rates, although the market is showing a few unexpected features. The sale of existing homes in 2023 fell by one-third from the peak set in 2021, and the rate of sales in 2024 is holding steady at the 2023 rate. However, home prices are rising around the country. As interest rates rose, homeowners were supposedly reluctant to sell and buy again with much higher mortgage rates. However, the supply of homes for sale is rising, alongside higher prices and high mortgage rates compared to 2021, a puzzling market dynamic.

Inflation cooled in May and June after throwing a scare into both the Fed and the capital markets during the first four months of 2024. CPI had inched up to an annual rate of 3.5% in March from 3.1% in January. Then gasoline prices fell 3.6% in May and 3.8% in June, enough to bring the monthly change in the CPI to zero in May and slightly negative in June. The annual rate eased to 3.0% in June.

Broad inflation may now be headed in the right direction for the Fed to act on rates. However, under the hood, inflation weighs heavily on basic items for lower- and middle-income households: shelter, food, motor vehicle insurance, and medical care. The shelter index rose 5.2% from June 2023 to June 2024 and accounted for over 60% of the increase in headline CPI this past year. While the spike in inflation may be past, the impact of prices now “permanently” higher on household budgets is likely to dampen the consumer spending that has driven the economy.

So what to make of all this contrasting economic data? Putting it in context, four years ago U.S. GDP dropped an incredible 28% in one quarter. While it quickly rebounded, the country suffered a pandemic of stunning cost, both economically and, more importantly, in terms of lost lives, severed social connections, missed education, and worsening mental health. And yet here we are, on the verge of something that’s never been done before: a soft landing for the U.S. economy, where inflation is brought down while growth gradually subsides, but we avoid a recession. It would be a remarkable achievement.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.