First-half private equity fundraising and deal activity continued a declining trend, with only IPOs increasing slightly off a low base. LPs are consolidating and upgrading portfolios, and GPs are focusing on existing portfolio management with a view to eventually increasing exits and distributions.

2Q23 private equity activity, from fundraising to exits

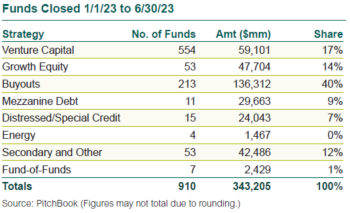

Fundraising | Final closes for private equity partnerships in 2Q23 totaled $170 billion of commitments in 470 partnerships. (Unless otherwise noted, all data in this commentary come from PitchBook.) The dollar volume was down 2% from 1Q23, but the number of funds rose 7%. For the first half, commitments are running 31% behind those of a year ago, with the number of funds down by 51%, and with venture capital commitment volumes falling most notably from about 34% a year ago.

Buyouts | New buyout transactions by count fell 13% from 1Q23 to 2,462, and disclosed deal value declined 18% to $122 billion. 1H23 numbers also saw declines of 30% in number of investments and 36% in disclosed value. YTD average buyout prices fell almost a turn (0.9x EBITDA) to 13.4x but remain high on an absolute basis. Average leverage levels YTD fell to only 31% of new deal capital structures, with interest costs rising and impinging company profitability.

VC Investments | New rounds of financing in venture capital companies totaled 9,955, with $86 billion of announced value. The number of investments preliminarily fell 20% from 1Q23, but announced value fell only 1%. 1H23 numbers plunged 33% for rounds and 48% for disclosed value compared to 1H22.

Exits | There were 472 private M&A exits of private equity-backed companies, with disclosed values totaling $90 billion. The preliminary private sale count fell 21% and the announced dollar volume dropped 13%. There were 46 private equity-backed IPOs in 2Q23 raising an aggregate $7 billion, up 15% by count, with issuance leaping 40% from 1Q23.

Venture-backed M&A exits totaled 541 transactions with disclosed value of $14 billion. The number of sales declined 18% from 1Q23, and announced value plunged 50%. There were 86 VC-backed IPOs in 2Q23 with a combined float of $12 billion; the count was up 19% and the issuance grew 71%.

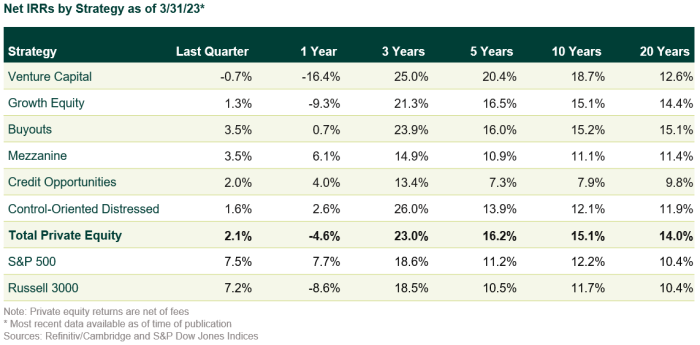

Returns | With a nice uptick in public equity markets in the last two quarters, private equity lagged in both periods but posted modestly positive returns in each. Tech-heavy venture capital and growth equity funds have been the greatest laggard for the past six quarters, with buyouts marking gains of about 3.5% in both the last two quarters.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.