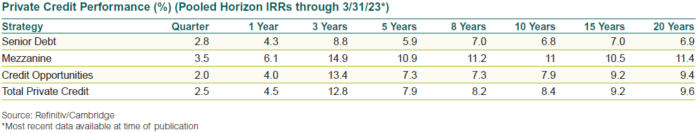

Private credit performance varied across sub-asset class and underlying return drivers. On average, the asset class has generated net IRRs of 8% to 10% for trailing periods ended March 31, 2023.

Key trends for private credit

- As interest rates declined after the GFC, private credit attracted increased interest from institutional investors.

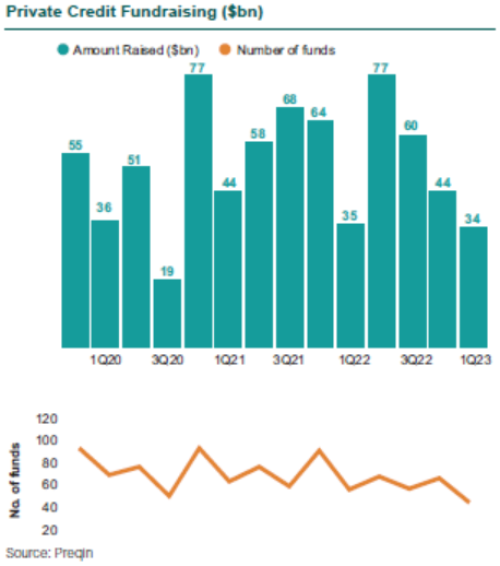

- Private credit fundraising was robust leading into the COVID dislocation with a particular focus on direct lending, asset-based lending, and distressed strategies.

- There is a renewed focus on relative value, downside protection, and managers’ internal workout resources.

- There is also interest in strategies with strong collateral protection such as asset-based lending as well as capital solutions and distressed/special situations strategies.

- Larger sponsor-backed lending is seeing a new focus due to the high yield/broadly syndicated loans disintermediation by private credit.

- U.S. sub-investment grade corporate yields rose dramatically at the beginning of 2022 with yields peaking in September. This was a combination of higher interest rates due to tighter Fed policy and a widening of high yield spreads.

- Spreads widened during the first half of 2022 due to weaker credit conditions as the U.S. economic outlook worsened. This has since moderated.

- Default rates for U.S. corporate bonds ticked up in 2Q but remained well below the historical average of 3%-4%. Callan expects defaults to increase somewhat in coming months as economic growth slows and potentially turns negative.

- The Corporate Bond Market Distress Index (CMDI) rose rapidly during the first nine months of 2022, especially for investment grade (IG) bonds, highlighting market volatility and a drying up of liquidity, but it has fallen since then.

- In 2023, as the IG component of the distress index continued to fall, the high yield bond indicator was roughly flat with the end of 2022. The CMDI incorporates a range of indicators, including new issuance and pricing for primary and secondary market bonds.

- During 2Q23, clients took a new look at upper-middle-market direct lending as all-in spreads have widened by over 500 bps and lenders are able to get tighter terms. Strong deal volume was driven partially by a shift from public to private market debt financings in the recent market environment.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.