Equity markets continued to march higher for the first half of this year, as growth equities surpassed expectations while the Federal Reserve paused the hiking cycle for the first time. Fading supply chain constraints drove a more moderate rate of inflation throughout the quarter. Concerns over the U.S. debt ceiling were alleviated when Congress passed legislation to suspend it, with minimal impact on economic growth. Treasury yields moved higher across the curve and the spread between 2-year and 10-year Treasuries further inverted in 2Q23.

The S&P 500 gained 9%, led by large-cap technology stocks, as the artificial intelligence (AI) theme continued to gather momentum during the quarter. European and Asian equity markets also posted positive results for the quarter. Strong performance from Japanese equities was supported by the weakened yen as well as higher corporate earnings. Chinese equities underperformed, as manufacturing and export activity declined. Credit indices generated mixed returns, as U.S. high yield indices were positive, while investment grade bonds posted negative returns.

2Q23 Hedge Fund Performance

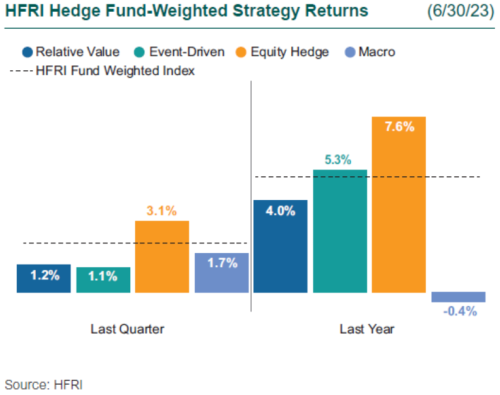

Hedge funds ended 2Q higher but unable to keep up with soaring equity indices, as equity market volatility subsided from 1Q. Equity hedge strategies had another strong quarter, as managers focused on technology and biotechnology companies, which drove performance. Event-driven managers ended the quarter higher, aided by liquid corporate credit and equities. Macro strategies ended with gains, bouncing back from a difficult 1Q. Managers profited from being long equities and short positioning across interest rates in the U.S. and the U.K.

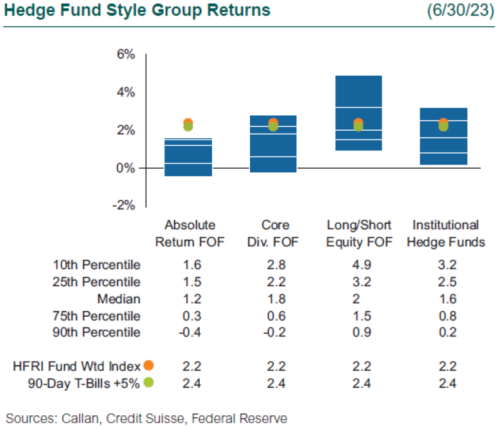

Serving as a proxy for large, broadly diversified hedge funds with low-beta exposure to equity markets, the median Callan Institutional Hedge Fund Peer Group rose 1.6%. Within this style group of 50 peers, the average hedged credit manager gained 2.1% as high yield credit performed positively, due to tightening credit spreads given better-than-expected corporate earnings, improved perceptions around the systemic risk of the U.S. banking crisis, and improved macro sentiment. Meanwhile, the average hedged equity manager added 1.7%, as managers with a focus on growth-oriented equities drove performance.

Within the HFRI indices, the best-performing strategy last quarter was the equity hedge index (3.1%), led by manager exposure to AI and growth-related sectors. Event-driven ended 1.1% higher, as both liquid credit and equities drove performance for the quarter. Relative value strategies ended the quarter up 1.2%, as managers benefited from elevated rates volatility. Macro strategies finished up 1.7%, as managers went long equities and short rates across the U.S. and Europe.

Across the Callan Hedge FOF Database Group, the median Callan Long-Short Equity Fund-of-Funds (FOF) ended up 2.0%, as managers benefited from large-cap technology companies soaring during the quarter. Meanwhile, the median Callan Core Diversified FOF gained 1.8%, as equity hedge, event-driven, and macro managers drove performance. The Callan Absolute Return FOF rose 1.2%, as a lower weight to equity hedge exposure led to a lower return compared to managers with more equity beta.

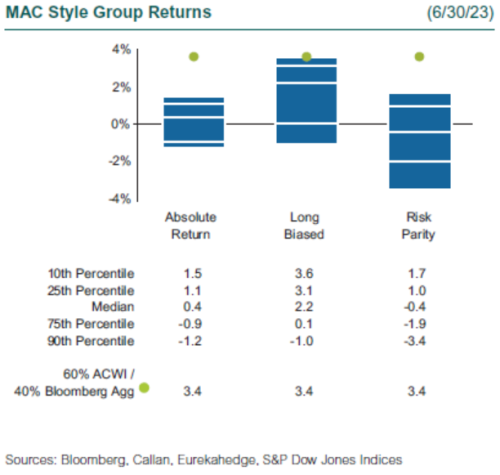

Since the Global Financial Crisis, liquid alternatives to hedge funds have become popular among investors for their attractive risk-adjusted returns that are similarly uncorrelated with traditional stock and bond investments but offered at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate known risk premia such as value, momentum, and carry found across the various capital markets. These alternative risk premia are often embedded, to varying degrees, in hedge funds as well as other actively managed investment products.

Within Callan’s database of liquid alternative solutions, the median Callan MAC Long Biased peer group gained 2.2%, as a bias toward equities drove performance. The Callan MAC Absolute Return peer group was up 0.4%, as credit markets rose modestly compared to equity markets. The Callan MAC Risk Parity peer group fell 0.4%, as commodities struggled throughout the quarter, offsetting the positive performance from equities and fixed income.

The strong equity rally during the first half of this year has been hard for hedge funds to keep up with, as many managers came into 2023 more defensive. Throughout the second quarter we began to see managers taking on more risk to catch some of this broader market move higher. As the macro outlook appears to be more benign going into the second half of this year, we continue to think fundamental long/short equity managers are well positioned to profit from this current environment. Long/short credit managers will be able to opportunistically allocate capital to credits they believe are over- or undervalued in this current environment. We continue to believe macro managers are well positioned to allocate capital across the most attractive asset classes.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.