U.S. corporate yields rose dramatically at the end of 2021 and the first six months of 2022, due to higher interest rates from tighter Fed policy and a widening of high yield spreads. Spreads widened because of weaker credit conditions as the U.S. economic outlook worsened. The illiquidity premium between public and private credit had been whittled down close to zero, but we are seeing a slow adjustment with SOFR widening out 200 bps and new private loan pricing at a 75-100 bps wider spread. A full adjustment between the public and private markets may take several quarters.

2Q22 private credit trends

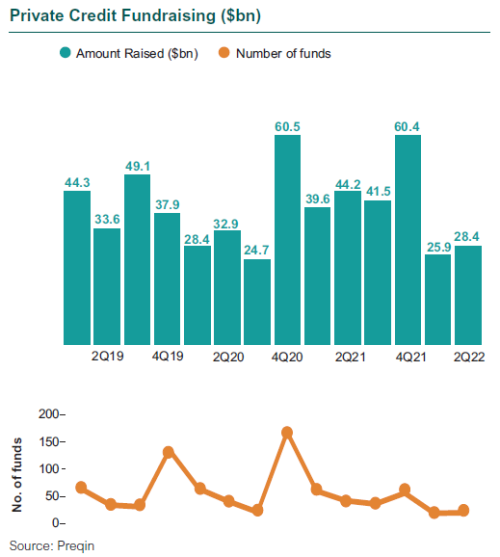

- Private credit fundraising was robust leading into the COVID dislocation, with a particular focus on direct lending and distressed strategies.

- Fundraising slowed in the first half of 2022 as rate hikes and market volatility led to investor uncertainty.

- For mature private credit programs, demand for diversifying strategies is increasing to capture opportunities outside of traditional sponsor-backed direct lending.

A permanent part of portfolios

- Core yield and income-generating characteristics remain attractive in private credit portfolios, in spite of the shrinking illiquidity premium.

- Despite the shift from a low-yield environment, private credit has become a permanent asset class in many portfolios.

- Many direct lending assets are floating rate, which can add protection against rising rates.

New opportunities on the horizon

- Distressed opportunities in U.S. and Europe are expected to increase across both corporate and non-corporate assets.

- Enhances importance of seasoned workout talent across sub-strategy types

- Brings the need for increased underwriting discipline

- Other opportunities include those that offer diversification through differentiated collateral and/or low correlation to public markets, including specialty finance, asset-backed lending, and niche areas.