Global markets sold off significantly in 2Q22, as investors were concerned about high inflation and rising interest rates. The Russia-Ukraine war and geopolitical unrest continued to destabilize markets globally as ongoing supply chain disruptions persisted. The Federal Reserve raised policy rates by 50 basis points in May and a further 75 bps in June in an effort to ease inflationary pressures. Food and energy price increases weighed on consumer sentiment and spending throughout the quarter.

Despite this, the U.S. labor market remained stable with consistent job growth, rising wages, and a low unemployment rate. Europe continued to face challenges from the ongoing energy crisis and the impacts of the Russia-Ukraine conflict. Commodity prices kept climbing due to sanctions and supply shortages. COVID-19 lockdowns challenged markets in China, though there were signs of recovery in the latter half of the quarter as policymakers eased restrictions.

The S&P 500 Index fell 16.1% in 2Q22, and the index notched its worst first-half performance in over 50 years. As interest rates rose during the quarter, the repricing of assets affected all sectors, most notably in the technology, media, and telecom industries, with the average Nasdaq stock falling over 50% from its 12-month high. Small and mid-capitalization biotechnology stocks rallied toward the end of the quarter after nearly 18 months of consistent decline. Credit indices performed poorly, as yields continued to rise while U.S. high yield spreads widened by the end of the quarter. The commodity space gave back some gains during the quarter, as oil prices retreated from over $120 a barrel to $105.

2Q22 Hedge Fund Performance in Detail

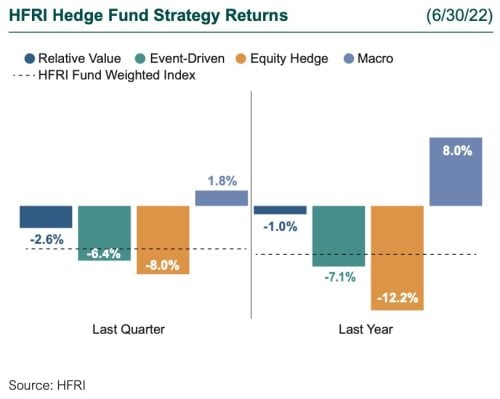

Hedge funds as a whole declined during 2Q, as equity hedge managers had a second quarter of disappointing returns, and as long biased growth managers were the largest drag on performance during the first half of 2022. Event-driven strategies continued to struggle, as their deep value equity positions were the main detractor during the first half of the year while their credit positions held up fairly well. Relative value strategies remained in positive territory, as some managers continued to profit off a rising rate environment while others were successful in capital structure arbitrage given the volatility in credit and equity markets. Macro managers remained the best-performing strategy for the first half of 2022, as commodity trading was the biggest driver of performance. Strong contributions also came from quantitative strategies.

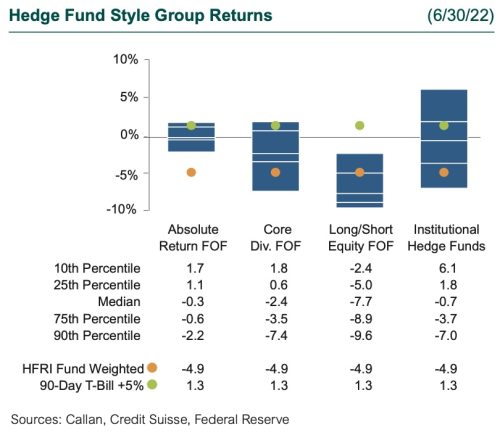

Serving as a proxy for large, broadly diversified hedge funds with low-beta exposure to equity markets, the median manager in the Callan Institutional Hedge Fund Peer Group fell 0.7%. Within this style group of 50 peers, the average rates manager gained 1.5%, driven by interest rate volatility, which provided trading opportunities for managers. Meanwhile, hedged credit managers lost 4.6% from both performing and distressed credit across a variety of industries. The average equity hedge manager gained 1.0%, as this style of managers tends to run with a low net exposure and lower beta to equity indices and was able to profit from the increased volatility and dispersion in equity markets.

Within the HFRI indices, the best-performing strategy last quarter was again macro (+1.8%), aided by its exposure to commodities and rates trading. Interest rate volatility hurt relative value managers as they ended the quarter down 2.6%. Event-driven strategies ended the quarter down 6.4% as their higher exposure to equities was a drag on performance. Equity hedge strategies had another difficult quarter (-8.0%), as growth-heavy managers experienced a sell-off along with the broader indices.

Across the Callan Hedge Fund-of-Funds (FOF) Database, the median Absolute Return FOF fell 0.3%, as a focus on lower beta strategies held up during the quarter. Meanwhile, the median Callan Long-Short Equity FOF dropped 7.7%, as a growth bias among managers continued to be a drag on performance. The median Callan Core Diversified FOF declined 2.4%, as macro strategies were able to offset some of the negative performance from equity hedge and event-driven managers.

Since the Global Financial Crisis, liquid alternatives to hedge funds have become popular among investors for their attractive risk-adjusted returns that are similarly uncorrelated with stock and bond investments but offered at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate risk premia such as value, momentum, and carry found across the capital markets. These alternative risk premia are often embedded, to varying degrees, in hedge funds as well as other actively managed investment products.

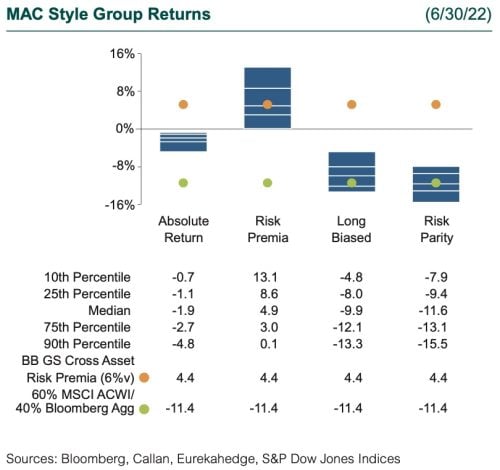

Measuring the quarter’s performance of these alternative risk premia, the Bloomberg GSAM Risk Premia Index increased 4.4% based upon a 6% volatility target. Within the underlying styles of the Index’s derivative-based risk premia, Bond Futures Trend (+5.3%), Commodity Carry (+5.1%), FX Carry (+4.0%), and FX Trend (+3.3%) profited off interest rate volatility, as well as commodity and currency exposure. The weakest risk premia strategies were Bond Futures Carry (-3.9%) and Commodity Trend (-0.8%).

Within Callan’s database of liquid alternative solutions, the median manager of the Callan Multi-Asset Class (MAC) Style Groups generated lower returns for the quarter, gross of fees, consistent with their underlying risk exposures. For example, the median Callan Long Biased MAC manager fell 9.9%, as exposure to equity and fixed income continued to be a drag on performance. The Callan Risk Parity MAC index, which typically targets an equal risk-weighted allocation to the major asset classes with leverage, was down 11.6%. The Callan Risk Premia MAC held up the best during the quarter, up 4.9%.

Through the first half of 2022, there has been an unusually high confluence of major macroeconomic forces that have been at work in this market. Fears of a recession continue to grow across an increasing number of developed market economies. Some of the supply chain issues, such as shortages in shipping and semiconductor chips, appear to be getting better, while other issues with energy and agricultural markets have become a major concern lately. All of this uncertainty is creating both opportunities and risks for hedge fund managers. A focus on risk management will be a key attribute for managers that have the ability to produce strong returns in this market environment. With increasing inflation, rising interest rates, and a possible recession on the horizon, this could all lead to more stressed and distressed credit opportunities for managers. As deglobalization trends continue to take hold, monetary and fiscal policies are becoming less tied together, which could allow macro managers to profit off this breakdown globally.