As the global economy slowed further in the second quarter, central banks aggressively talked of easing again. Although resilient consumer spending continued to support corporate earnings, company outlooks were less positive due to growing trade war concerns. Across the capital markets, the cognitive dissonance within the investor community trying to interpret these mixed economic signals was deafening. Bond buyers hunkered down with safer credits while stock bidders wore “ear plugs of hope” with equities reaching cyclical highs.

Consequently, both optimists and skeptics were satisfied, however nervous, with the quarter’s results. The S&P 500 gained 4.3% and MSCI World ex USA advanced 3.8%. However, MSCI Emerging Markets (+0.6%) grew modestly, beset by China’s slowing growth story. Meanwhile, the FTSE 10-Year Treasury jumped 4.2%. The Bloomberg Barclays Baa Corporate Index rose 4.8% while junk bonds rated Caa were virtually flat (+0.3%). With visions of quantitative easing looming large again, gold vaulted 8.9%.

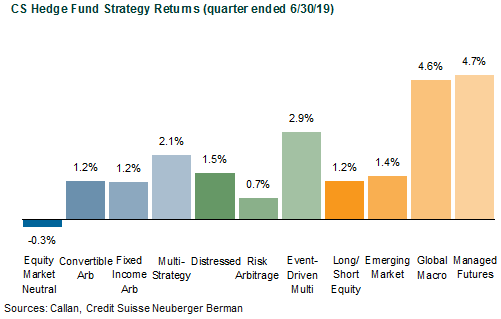

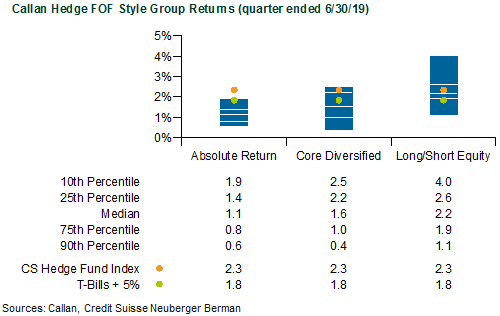

Amid these bullish, if divergent, sentiments running rampant across markets, virtually all hedge fund strategies were profitable. Representing a paper portfolio of hedge funds without implementation costs, the Credit Suisse Hedge Fund Index (CS HFI) gained 2.3%. Reflecting live hedge fund portfolios, the median manager in the Callan Hedge Fund-of-Funds Database advanced 1.7%, net of all fees and expenses.

Within CS HFI, the best-performing strategies last quarter were the top-down allocators of Managed Futures (+4.7%) and Global Macro (+4.6%), supported by continuing trends of falling bond yields.

Relative value strategies depending less on beta and more on bottom-up security selection, like Multi-Strategy (+2.1%), Convertible Arbitrage (+1.2%), and Fixed-Income Arbitrage (+1.2%), slogged forward. However, Equity Market Neutral (-0.3%) slipped, indicating challenges with stock selection.

Long/Short Equity (+1.2%) lagged the equity indexes; on a beta-adjusted basis, the average manager still underperformed investor expectations. Event-Driven Multi-Strategy (+2.9%) performed better with soft catalyst-driven stocks continuing to rebound from the fourth quarter sell-off. Relying less on beta, Risk Arbitrage (+0.7%) and Distressed (+1.5%) edged ahead with their more tangible event-driven trades.

Within Callan’s Hedge FOF Database, portfolios with more exposure to macro strategies or long-biased strategies beat the absolute return-oriented portfolios, particularly those trading equity fundamentals without beta exposure. Lifted by the stock market’s tailwinds, the median Callan Long/Short Equity FOF (+2.2%) outpaced the Callan Absolute Return FOF (+1.1%). With diversifying exposures to both relative value and beta-driven styles, the Core Diversified FOF gained 1.6%.

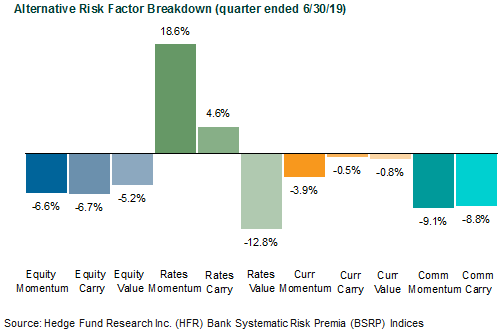

Since the financial crisis, liquid alternatives to hedge funds have become popular among institutional investors for their attractive risk-adjusted returns that are similarly uncorrelated with traditional stock and bond investments but offered at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate risk premia such as value, momentum, and carry found across the capital markets, whether equity, fixed income, currency, or commodities. These alternative risk premia are often embedded, to varying degrees, in hedge funds as well as other actively managed investment products.

Hedge Fund Research Inc.’s Bank Systematic Risk Premia (BSRP) Indices provide us with a view on how these alternative risk factors performed across markets. Within the BSRP family of alternative betas, the outsized contributor in the second quarter was BSRP Rates Momentum (+18.6%), as global yields accelerated their recent slide downward. Negative effects from equity-related risk premia, whether value, carry, or momentum, hurt overall performance in this alternative beta space.

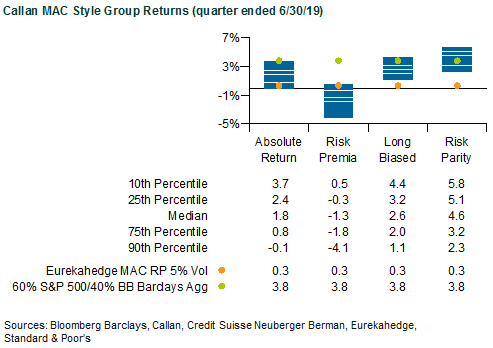

Within Callan’s database of liquid alternative solutions, most of the style groups within the Callan Multi-Asset Class (MAC) Database generated positive returns, gross of fees, as expected with their underlying risk exposures. For example, the Callan Risk Parity MAC surged 4.6%, propelled by rising stock and bond markets along with portfolio leverage, whereas an unlevered 60/40 benchmark of global stocks and bonds returned 3.8%. Given its typically long equity bias within a dynamic asset allocation mandate, the Callan Long-Biased MAC (+2.6%) marginally trailed the global 60%/40% benchmark. Focused on a non-directional mandate of long and short asset class exposures with relatively low leverage, the Callan Absolute Return MAC gained 1.8%. As the quarter’s laggard among MAC styles, the Callan Risk Premia MAC fell 1.3%, given its exposures to non-market risk premia described above.

Given the quarter’s divergent forces driving up both stocks and bonds, the outlook for hedge funds and alternative betas is ripe with more “alpha” potential. While falling short-term interest rates ahead will lessen returns from cash and margin account collateral, greater expected volatility in capital markets creates more profitable opportunity for risk allocators embodied in hedge funds and other liquid alternatives. In such a market setting, strategies of macro, relative value, and event-driven trades are well positioned to play a diversifying role for the traditional long-only investor facing muted return outlooks for both stocks and bonds.