Fund sponsors are beginning to come to grips with lower capital market return expectations. Pension funds are reducing actuarial return assumptions, and endowments and foundations are discussing and making adjustments to spending rules. Some funds are addressing this issue by taking on substantial market risk (80%-85% in risky assets) to attempt to close a funding gap or meet spending needs without eroding the corpus. Fund sponsors are further focusing on diversification within each asset class to help mitigate their overall risk.

Fund sponsors face the challenge of looking for investments with attractive real return expectations while seeking at least some diversification to the beta of equities to smooth the ride within the growth allocation. By focusing on diversifiers, funds can consider adding investments like high yield, low-volatility equity, hedge funds, multi-asset class funds, and options-based strategies. This also allows for new strategies to be brought into the fold, based on anticipated diversification benefits or return enhancement. This broadening of growth assets can lead to a sharper focus on refining fixed income exposure to gain a “purer” exposure to interest rate sensitivity and to serve as an anchor to the portfolio in a bear market (e.g., allocating the fixed income portfolio to long-duration Treasuries).

At the same time, with U.S. equities continuing their unprecedented positive run, fund sponsors are asking the question “Why diversify?” The answer: While results in non-U.S. equity, real assets, and alternatives have lagged U.S. equities in the last five years, their longer-term diversifying characteristics warrant consideration.

The active/passive discussion continues to loom large. The argument to retain active managers to protect in a down market and be nimble in a volatile, low-return environment is compelling to some, but many fund sponsors are weary of historical underperformance by active equity managers. Additionally, the use of passive management helps control costs.

Callan has observed the following trends over the last five years:

- The U.S. fixed income allocations for corporate plan sponsors has increased overall and has become more widely dispersed as plans take different steps to de-risk plan assets.

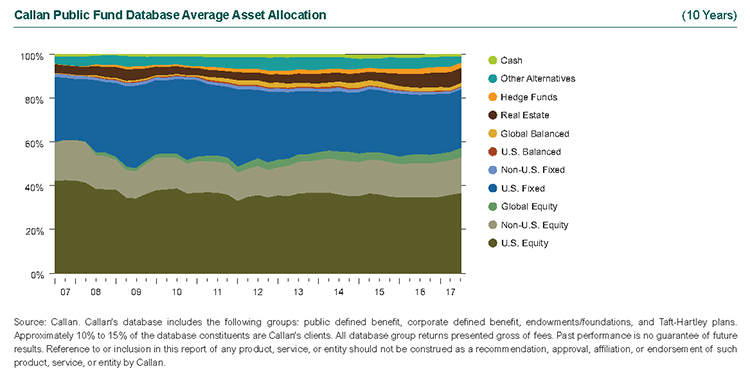

- Many public funds have increased their allocation to non-U.S. equity, real estate, and other alternatives at the expense of fixed income and U.S. equity. Simultaneously, some of the fixed income exposure has become more equity-like in nature, with allocations to areas like high yield.

- Endowments and foundations have continued to move assets from fixed income to asset classes with expectations for higher returns, such as global equity and real estate.

A 60% S&P 500/40% Bloomberg Barclays U.S. Aggregate Bond Index portfolio returned 10.4% over the year ended June 30, 2017. All of the broad fund sponsor groups tracked in Callan’s database topped the 60/40 portfolio over that period.

Endowments and foundations underperformed other fund sponsor groups over the past three, five, and ten years. But they did have the best performance over the last year.

Taft-Hartley plans were the best-performing group over the past three and five years. Corporate plans beat other groups over the last 10 years.