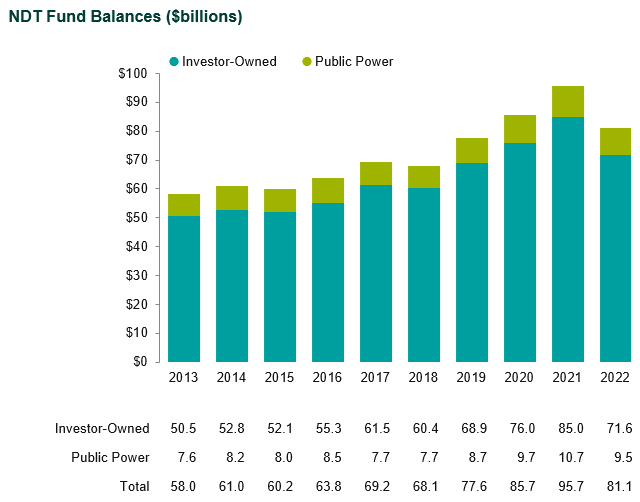

Callan’s annual Nuclear Decommissioning Funding Study offers key insights into the status of nuclear decommissioning funding in the U.S. to make peer comparisons more accurate and relevant. In our 2023 study, we found that nuclear decommissioning trust (NDT) fund balances totaled $81 billion in 2022. Assets were down over 15% from a year earlier largely due to stock and bond market performance, which saw the S&P 500 and Bloomberg Aggregate Indices down 18% and 13%, respectively, on the year. Those losses also hurt funding as a percentage of total decommissioning cost estimates, which fell to 83% in 2022, a 14 percentage point decrease from the previous year.

The 2023 study covers 26 investor-owned and 26 public power utilities with an ownership interest in the 92 operating and 16 of the non-operating nuclear reactors in the U.S. NDTs are created to pay for the costs of decommissioning a closed nuclear power plant, which involves safely removing it from service and reducing residual radioactivity to a level that permits release of the property and termination of the operating license.

Our study also found that decommissioning cost estimates totaling $98 billion were largely unchanged in 2022 compared to 2021 as ongoing decommissioning at non-operating reactors and updated cost figures offset one another. Total contributions from utilities into their NDTs rose to $371 million in 2022, a 28% increase from 2021.

Other key findings from our NDT study:

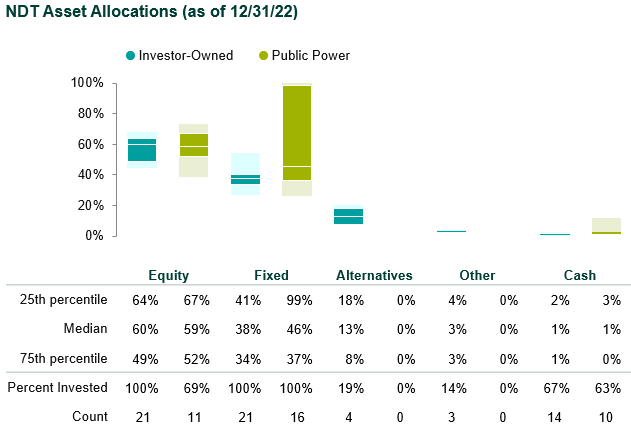

- The asset allocations for 21 investor-owned utilities showed median equity and fixed income allocations of 60% and 38%, respectively. While all 21 investor-owned utility NDTs were invested in equity, only 11 of the 16 public power utility NDTs reported having an equity investment. The median allocation of those with an equity investment was 59%.

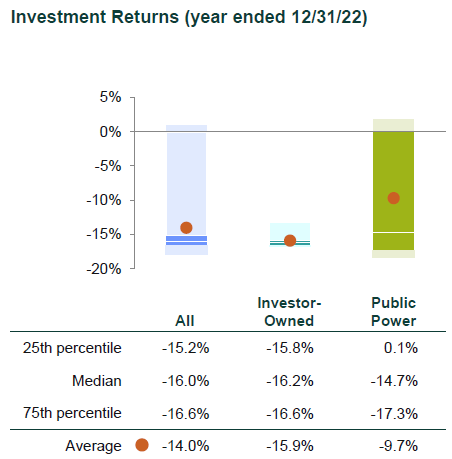

- The median investment return for all NDTs was -16.0% for 2022, with an average of -14.0%.

- Public power trust returns were 620 basis points above those of investor-owned trusts on average and exhibited a much wider range of results due to a number of trusts being 100% fixed income.

- The median escalation rate (used in forecasting future decommissioning expenditures given current dollar cost estimates) for all plants was 2.81% with an average of 3.28%.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.