Because our world has changed so dramatically, Callan’s annual Defined Contribution Survey has evolved to fit the rapidly shifting landscape facing DC plan sponsors. Our 14th annual survey covers the SECURE and CARES Acts, and the impacts of the COVID-19 pandemic, along with the key tenets of DC plan management, financial wellness, and health savings accounts (HSAs) that have been staples of our surveys over the years.

The DC Survey is designed to provide valuable insights to plan sponsors, to identify meaningful trends, and to support governance of vital employee benefits. Some of the traditional activities we see in DC plans slowed this year while others required greater urgency, likely due to the twin forces of the pandemic and the resulting financial shocks.

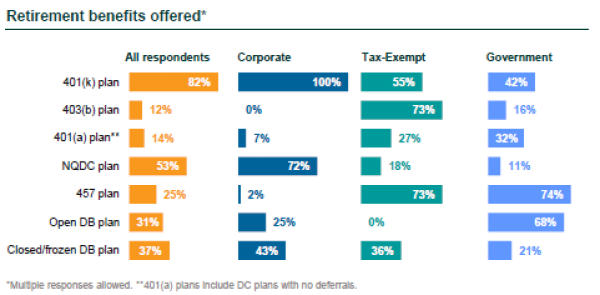

Callan’s annual DC Survey, which we have published since 2007, provides a benchmark for sponsors to evaluate their plans compared to peers, and to offer actionable information to help them improve their plans and the outcomes for their participants. This year respondents spanned a range of industries; the top industries represented are financial services/insurance, energy/utilities, government, automotive/construction and mining/manufacturing (combined into a single category given their workforce makeup), and health care. 82% of respondents offered a 401(k) plan, 12% a 403(b) plan, and 14% a 401(a) plan. 61% of respondents had more than $1 billion in plan assets. Roughly 7 in 10 corporate respondents offered a nonqualified deferred compensation (NQDC) plan, while a similar portion of tax-exempt (73%) and governmental (74%) entities offered a 457 plan.

Other highlights from this year’s survey:

Governance

- There was a 20% increase in total committee meetings in 2020. The effects of the pandemic were seen in a sharp increase in virtual meetings (up 86%), while in-person meetings decreased by 62%.

- We observed a sharp increase in internal legal counsel attending meetings (from 11% to 56%) and a slight increase in external legal counsel (21% to 25%) over three years.

- The top areas of fiduciary focus were governance and process; investment structure evaluation; and fund/manager due diligence.

- Fiduciary actions planned for 2021 include a review of plan fees; completing formal fiduciary training; and implementing, updating, or reviewing the investment policy statement.

- The events of 2020 seem to have slowed the pace of change in investment structures. Only 16% of plan sponsors reported making changes to the investment structure in 2020, down from 25% in 2019. Furthermore, more sponsors indicated they are planning to make a change—19% of all respondents, or 26% when excluding governmental plans, compared to 15% of respondents in last year’s survey, which did not include governmental plans.

- More than two-thirds of plan sponsors are either somewhat or very likely to conduct a fee study in 2021, an increase from the prior year’s DC Survey (56%). Most respondents also indicated that they are very or somewhat likely to review other fee types (e.g., managed account services fees) and indirect revenue (e.g., revenue shared from the managed account or rollover provider).

Plan Design

- Roth deferrals (79%) and automatic enrollment (70%) were the most common enhanced savings features available. Both features were formalized by the Pension Protection Act of 2006 (PPA). (Roth 401(k) deferrals were originally available in 2004, but had a five-year sunset; the PPA removed the sunset.) In comparison, our 2010 survey found that 37% of plan sponsors offered Roth deferrals.

- Among other savings features available in plans, traditional after-tax contributions (68%) saw a renaissance due in large part to the availability of Roth in-plan conversions, which were first available in 2010 on a limited basis and expanded in 2013.

- 1 in 10 plans reduced or suspended the match in 2020. More than 8 in 10 of that group will reinstate the match.

- 49% of plans reported offering managed accounts. Notably, the largest plans (>50,000 participants) were the most likely to offer managed accounts (87%).

- Nearly 7 in 10 respondents completed a plan design evaluation in the past three years.

Investment Trends

- Mutual funds (85%) and collective trusts (78%) continued to be the most prevalent investment vehicles. Over the past decade, the use of mutual funds fell by nearly 10% while the use of collective trusts increased by about 25%.

- Only 23% of respondents used their recordkeeper’s target date option in 2020, a sharp decrease from 67% a decade ago. That number is projected to decrease slightly in 2021 to 21%.

- The prevalence of mutual funds for the target date fund (TDF) is on the decline, as well. In 2010, 67% of plans used a mutual fund for their TDF compared to 42% in 2020.

- Notably, 15% of respondents indicated they were changing the TDF/manager in either 2020 or 2021.

Financial Wellness

- 7 in 10 employers offered financial wellness support.

- The top reason for offering a financial wellness program was that it was part of the organizational philosophy to support employees (89%).

- 14% offered a standalone financial wellness program and 36% have plans to develop one.

- Top financial needs were retirement savings, emergency savings, and debt management.

- Survey respondents ranked program effectiveness at 6.4, on average (1 to 10 scale with 10 = highest). Newer programs reported the lowest average effectiveness rate (5.7) while the most mature programs deemed their programs slightly more effective (6.4). The programs that had the highest ratings were those that had been in place between three and six years, suggesting that programs designed more recently with sufficient time to implement and socialize the programs are the most effective.

HSA

- 65% of respondents reported offering an HSA.

- An HSA was offered by 58% of respondents with a DC plan only; 44% of those with a closed DB plan; and only 19% with an open DB plan. This likely represents an overall benefits philosophy to share costs and responsibilities with participants.

- The benefits committee oversaw the HSA program for 6 in 10 survey respondents.

- Only 17% of sponsors selected the HSA provider and undertook the additional responsibility of selecting and monitoring underlying investments.

- 10% offered a DC plan investment menu mirror in the HSA and 6% plan to offer an investment menu mirror.

Legislation

- 32% of plan sponsors with a qualified automatic contribution arrangement (QACA) will increase their automatic escalation rate as a result of the SECURE Act.

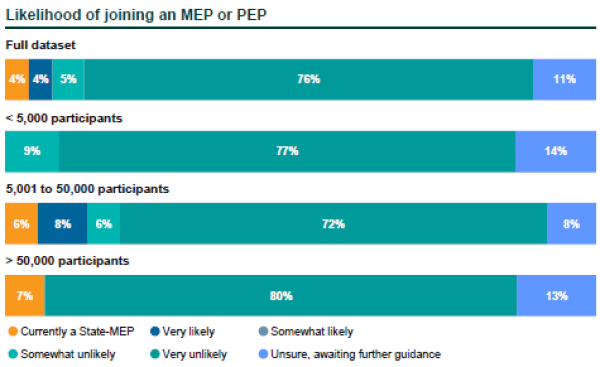

- 76% of DC plans signaled they are very unlikely to join a multi-employer plan (MEP) or pooled employer plan (PEP). The top concerns around MEPs/PEPs were: less control over plan administration (76%); complexity around administration (69%); competitiveness relative to existing plan (67%). Additionally, the largest plans reported being concerned about cost efficiency compared to their current plan.

- 73% adopted coronavirus-related distributions (CRDs) under the CARES Act, while only approximately 40% increased loan maximums.

- Employers that reported taking a workforce action (e.g., salary reductions, layoffs) were more likely to adopt CARES provisions. Employers that had furloughed employees were more likely than other groups to add the CRD provision (88%). Furloughed employees technically remain employed, leaving them with fewer distribution options than a person who is laid off. Employers that had salary reductions were the most likely to suspend loan repayments (70%). Maintaining loan payments could be a burden for employees who had reduced paychecks.

This blog post summarizes the key findings of our survey, but the full survey contains far more detail, including breakouts based on plan size, organizational type (e.g., corporate, government), and industry.

The DC Survey is the work of Callan’s Defined Contribution Consulting Group, which provides specialty research and expertise around DC plan trends, aspects of compliance and administration, behavioral aspects of structure design specific to DC plans, and vendor and fee management. Our long-tenured team works with a wide variety of plan sponsors and recordkeepers, which provides valuable context and expertise for our research efforts.