Callan develops long-term capital market assumptions at the start of each year, detailing our expectations for return, volatility, and correlation for broad asset classes. These projections represent our best thinking regarding a longer-term outlook and are critical for strategic planning as our investor clients set investment expectations over five-year, ten-year, and longer time horizons.

Our projections are informed by current market conditions but are not directly built from them since the forecasts are long term in nature. Equilibrium relationships between markets and trends in global growth over the long term are the key drivers, resulting in a set of assumptions that changes slowly (or not at all) from year to year. Our process is designed to insure that the forecasts behave reasonably and predictably when used as a set in an optimization or simulation environment.

Our process begins with estimates of major global macroeconomic variables, which are integrated into our equity, fixed income, and alternative investment models to generate initial forecasts. We then make qualitative adjustments to create a reasonable and consistent set of projections.

For the period 2020-2029, we made an evolutionary change to our capital market assumptions from our projections last year. Fed policy pivoted dramatically in 2019, shifting from a tightening bias to 75 basis points in rate cuts over the year, and bond yields saw a marked reduction. Interest rates have been reset to a lower level with the Fed pivot, and are now expected to rise more modestly over the next five years. We have lowered our fixed income assumptions to reflect lower starting yields compared to one year ago, including a lower return for cash. We did not change our equity return assumption. As a result, we have widened our equity return premium over cash and the equity risk premium over bonds. Our 10-year projections include a likely recession (or two) in the economy and a downturn in the capital markets, as such events are a normal part of the path to long-term returns. However, we only adjust our forecasts when we believe asset class prospects have materially changed.

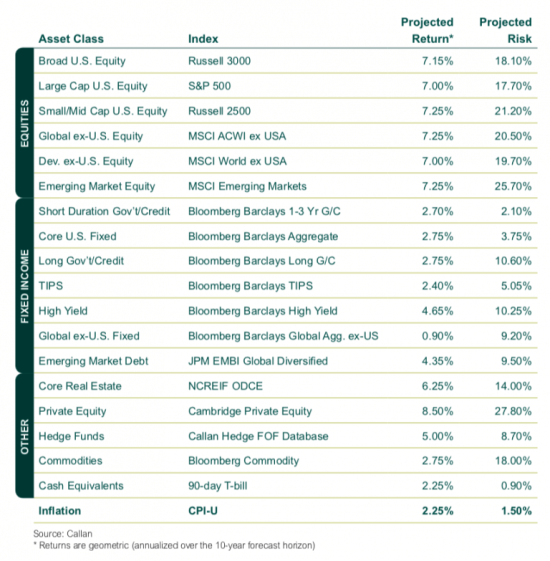

This table shows our detailed return and risk projections for all of the major asset classes:

In addition, we have created an interactive web page about the assumptions, and prepared this white paper and related charticle.