Callan’s annual Nuclear Decommissioning Funding Study offers key insights into the status of nuclear decommissioning funding in the U.S. to make peer comparisons more accurate and relevant. The 2017 study covers 27 investor-owned and 27 public power utilities with an ownership interest in the 99 operating nuclear reactors and 11 of the non-operating reactors in the U.S.

The number of operating nuclear power reactors in the U.S. in 2016 remained the same as the year before, and declined by just one from when we first conducted our Nuclear Decommissioning Funding Study four years ago. And the health of nuclear decommissioning funding has remained fairly stable as well, hovering near 70% over the past decade. Other highlights from my study:

- Trust fund assets reached almost $64 billion in 2016, up 183% over their 2008 level.

- Decommissioning costs totaled approximately $91 billion in 2016, up 165% over their 2008 level.

- Total contributions were $562 million in 2008 but are now under $300 million.

While the nuclear energy industry looks relatively healthy on the surface, a number of issues are threatening the viability of nuclear power as a source of reliable and relatively clean energy in the U.S., with recent headlines telling the story:

- How the Dream of America’s ‘Nuclear Renaissance’ Fizzled

- Billions lost in nuclear power projects, with more bills due

- Nuclear power struggles to compete with natural gas

- Westinghouse Bankruptcy Shakes the Nuclear World

- Why nuclear could become the next ‘fossil’ fuel

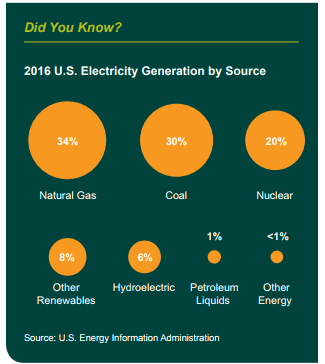

Today nuclear energy generates approximately 20% of the nation’s electricity, but the fleet is aging. Of the 99 operating reactors, 84 have already received their 20-year license extensions. And 54 of the operating reactors have licenses that expire sometime in the next two decades, though 12 can apply for a 20-year license renewal. Add to that the intention by several owners to shut down some of their units prematurely, largely due to economic reasons, and nuclear energy as a continuing source of meaningful electricity generation in the U.S. is in question.

After the Three Mile Island incident in 1979, U.S. nuclear power expansion ground to a halt. But as memories of the incident began to fade—and amid an expected rapid rise in energy demand in the coming decades—the nuclear power industry began to re-emerge with the backing of the federal government. As a result, utility owners began to apply for permission to build new reactors.

But delays, cost overruns, the Fukushima nuclear power disaster, the Global Financial Crisis, and a flood of cheap natural gas put most of those plans on hold. Two reactors closed in recent years (Vermont Yankee in 2014 and Fort Calhoun in 2016), while Watts Bar 2 in Tennessee opened in 2016, becoming the first nuclear reactor to come online in the U.S. since Watts Bar 1 in 1996. Only one project in Georgia is still being built.

Add to that increased output from renewable energy, the still unresolved issue of a national repository for spent nuclear fuel, millions of dollars in upgrades required after Fukushima, the risk of rising seas and potentially catastrophic storm surges from climate change, and owners are finding that many new and existing plants are no longer economically or politically viable. Lastly, the recent bankruptcy of Westinghouse, the builder of the AP1000 pressurized water reactor, sent shock waves through the industry and may have been the final straw on the back of the nuclear energy industry’s future in the U.S.

While the future of nuclear power in the U.S. may be in question, there is a significant push toward nuclear power in many areas of the world. According to the Nuclear Energy Institute, as of November 2016 there were 56 reactors under construction outside the U.S., including 20 in China, 7 in Russia, 5 in India, and 4 in the United Arab Emirates.

The global nuclear industry is also working to develop highly advanced reactors based on new technologies that should improve safety and economics. One such advancement is small modular reactors (SMRs). SMRs have many useful applications, including the ability to generate emission-free electricity in remote locations where there is little to no access to the power grid. Small modular reactors can be built in a factory and delivered and installed at the site in modules, hence their name. In addition, some SMRs will have long operating cycles between refuelings and others can be air-cooled, making them a good fit for arid regions. A more advanced set of nuclear technologies is also being developed that includes molten salt reactors, liquid-metal-cooled reactors, and high-temperature gas reactors.

While building a nuclear power plant today is costly and time consuming, once it is up and running it produces reliable and relatively cheap electricity without generating greenhouse gas emissions. The industry’s hope is that the new, highly advanced reactors will be safer, cheaper, and more efficient, and that nuclear power will remain a meaningful source of electricity both at home and abroad. In the meantime, decommissioning funding for existing plants here in the U.S. remains healthy on the whole, indicating that the industry has been responsible in ensuring that the funds are there to cover decommissioning costs.

$64

The amount, in billions, in nuclear decommissioning trust fund assets in 2016, up 183% over their 2008 level.