Listen to This Blog Post

Private real estate saw gains in 1Q25, with most of the return from income. Redemption queues for ODCE funds are sharply decreasing after peaking in 1Q24. Transactions are below a five-year average, although they are increasing on a rolling four-quarter basis.

REITs in every region saw gains in the quarter, with U.S. REITs topping equities.

1Q25 Real Estate Performance Summary

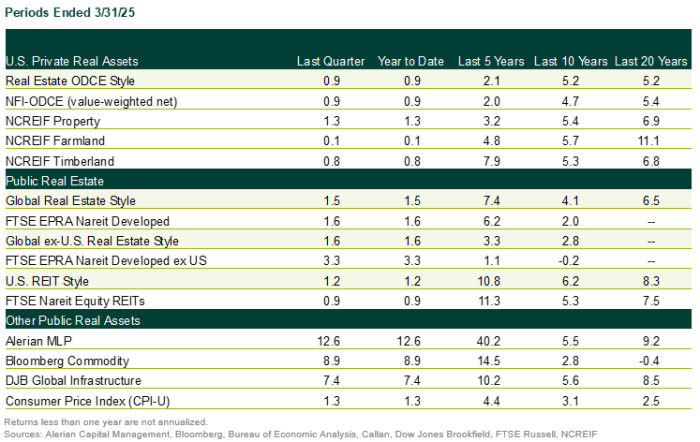

Private Real Estate | The NCREIF Property Index, a measure of U.S. institutional real estate assets, rose 1.3% during 1Q25. The income return was 1.2% while the appreciation return was 0.1%.

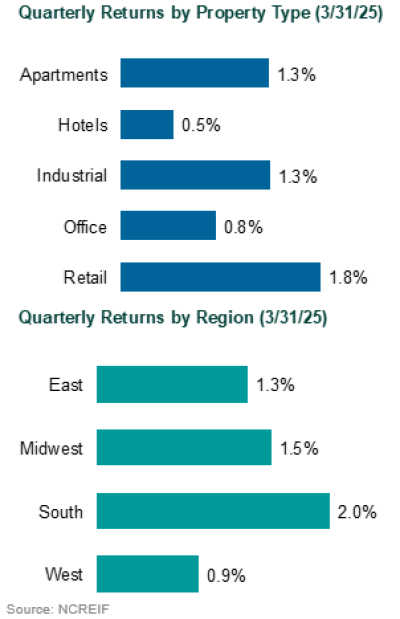

Retail led property sector performance with a gain of 1.8%. Office finished last with a gain of just 0.8%.

Regionally, the South led with a gain of 2.0%, while the West was the worst performer with a gain of 0.9%.

The NCREIF Open-End Diversified Core Equity (ODCE) Index, representing equity ownership positions in U.S. core real estate, rose 1.1% during 1Q, with an income return of 1.0% and an appreciation return of 0.1%.

Redemption Queues | ODCE redemption queues are approximately 13% of net asset value (NAV). This compares to the Global Financial Crisis, when queues peaked at approximately 15% of NAV. Outstanding redemption requests for most large ODCE funds are approximately 0% to 49% of NAV.

Redemption queues are now sharply decreasing after having peaked at 19.3% of NAV in 1Q24. This has been driven primarily by rescissions of redemption requests within a handful of managers with large queues and increased redemption payments due to increased transactions.

Transactions | Transaction volume is increasing on a rolling four-quarter basis yet remains below five-year averages. In 1Q25, transaction volume slightly increased on a quarter-over-quarter basis despite a modest decline in the number of properties sold. Transaction volume remains lower compared to 2022.

The volatile rise in interest rates is the driving force behind the slowdown in transactions. Increasing transactions are driven by increasing confidence in multi-family and industrial values. Valuations have largely adjusted to increased borrowing costs.

REITs | The FTSE EPRA Nareit Developed Index, a measure of global real estate securities, gained 1.9% during 1Q25. U.S. REITs, as measured by the FTSE EPRA Nareit United States Index, increased 1.0%. The FTSE EPRA Nareit Asia Index (USD), representing the Asia/Pacific region, rose by 3.9%. European REITs, as measured by the FTSE EPRA Nareit Europe Index (USD), advanced 3.1%.

U.S. REITs outperformed the S&P 500 (-4.3%), driven by uncertainty over policies focused on tariffs and cost cutting impacting growth, which pressured REITs and equities. Defensive sectors—namely health care, net lease, and towers—outperformed, while more cyclical property types like office and hospitality lagged. Data centers also faced headwinds, reflecting the broader softness of the Magnificent 7 tech stocks.

Asia delivered the strongest regional performance, with gains led by Japan and Hong Kong. Japanese developers rallied following reports of an activist investor engagement, while Hong Kong benefited from renewed Chinese policy support for tech entrepreneurship. Data centers underperformed, as investors appeared to take a more measured view on valuations following the launch of several well-received Chinese AI models. Meanwhile, Australia underperformed, dragged down by a large industrial equity raise and continued weakness in data center–exposed stocks.

European property stocks performed well, with retail leading gains amid growing momentum for defense and infrastructure spending, highlighted by Germany passing fiscal reform and allowing unlimited defense spending. The U.K. outpaced continental Europe, supported by its lower leverage profile and a notable uptick in M&A activity across the health care and industrial sectors. Meanwhile, bond proxy sectors like German residential underperformed, as euro zone yield curves steepened in anticipation of expanded fiscal stimulus.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.