Listen to This Blog Post

U.S. equity markets ended 1Q25 lower, as the DOGE-driven cutting of government jobs and programs caused confusion in Washington, and rising concerns over tariffs as well as signs of a weakening consumer stoked fears of a recession. The Federal Reserve kept monetary policy on hold, even while cutting its forecast for economic growth this year, citing the risk of inflation from evolving trade policy. Credit markets were relatively unmoved, as high-yield credit spreads widened during the quarter but remained tight by historical standards.

The S&P 500’s performance was led lower by Consumer Discretionary and Technology, which were hurt by a weaker growth outlook, offset by gains in Energy as well as Health Care and Staples in a rotation to defensives.

1Q25 Hedge Fund Performance

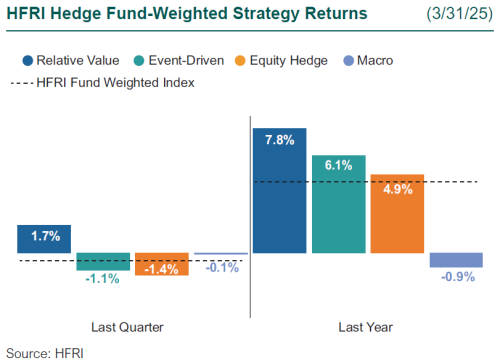

Hedge funds ended the quarter mixed, as credit and interest rate-sensitive fixed income-based relative value strategies drove the majority of performance to start off the year. Macro strategies ended slightly higher as performance was mixed on interest rate volatility and a declining U.S. dollar. Equity hedge strategies ended lower, as strategies that were focused on technology suffered declines on trade/tariff volatility. Event-driven strategies also suffered losses during the quarter, as corporate activity ground to a halt during the quarter.

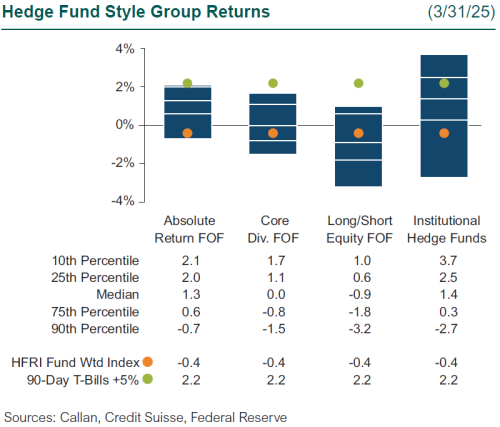

Serving as a proxy for large, broadly diversified hedge funds with low-beta exposure to equity markets, the median Callan Institutional Hedge Fund Peer Group rose 1.4%. Within this style group of 50 peers, the average hedge credit manager gained 2.1%, driven by interest rate volatility during 1Q. Meanwhile, the average hedge equity manager moved 1.7% lower, as those with longer biased exposure to technology experienced lower performance. The median Callan Institutional hedge rates manager fell 0.5%, largely driven by interest rate volatility across the curve.

Within the HFRI indices, the best-performing strategy was relative value, up 1.7%, as managers profited from the volatility in credit and interest rates. Macro strategies ended down 0.1%, as managers were actively trading around interest rates, U.S. dollar positions, and volatility during the quarter. Equity hedge strategies ended 1.4% lower, as managers with a focus on technology experienced negative performance, as tariff talk heated up during the quarter. Event-driven strategies ended 1.1% lower, as the expected increase in corporate activity during 1Q had yet to materialize.

Across the Callan Hedge FOF database, the median Callan Absolute Return FOF ended 1.3% higher, as exposure to lower equity beta managers and macro managers drove performance. The median Callan Core Diverse FOF ended flat, as equity hedge and event-driven strategies were a drag on performance. The Callan Long/Short FOF ended 0.9% lower, as an overweight to higher equity beta strategies drove performance lower.

Since the Global Financial Crisis, liquid alternatives to hedge funds have become popular among investors for their attractive risk-adjusted returns that are similarly uncorrelated with traditional stock and bond investments but offered at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate known risk premia such as value, momentum, and carry found across the various capital markets. These alternative risk premia are often embedded, to varying degrees, in hedge funds as well as other actively managed investment products.

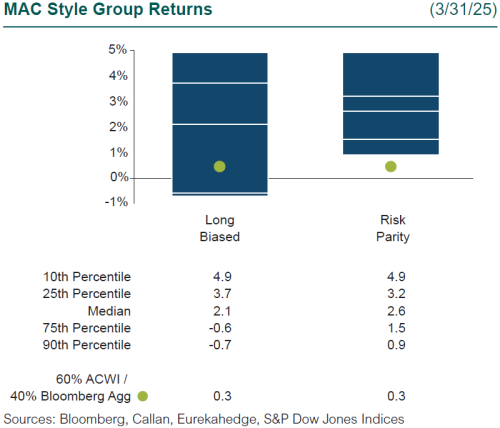

Within Callan’s database of liquid alternative solutions, the Callan MAC Risk Parity peer group rose 2.6%, as fixed income and commodity performance offset negative performance from the U.S. dollar and U.S. equities. The Callan Long Biased MAC peer group rose 2.1%, as fixed income and commodity performance offset negative equity performance.

Markets entered 2025 with optimism, supported by strong momentum in U.S. equities, technological innovation, and a resilient U.S. economy. Policy shifts, geopolitical shocks, and evolving investor expectations contributed to a sharp increase in volatility. With all of this complexity, opportunity presents itself for hedge fund strategies. Elevated dispersion across sectors, countries, and asset classes is creating opportunities for active managers, especially those that have the ability to dynamically manage risk. Hedge funds are well positioned in this market environment where capital preservation is key.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.