Private equity started the year off slowly, following a drop-off in activity across the board in 2023.

Details on 1Q24 Private Equity Activity

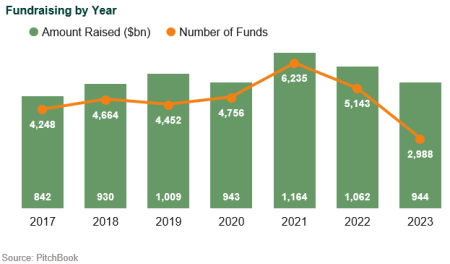

Fundraising | In 2023, the number of funds raised declined sharply by ~50% from the highs of 2021–22. The 2023 vintage experienced the full impact of the denominator effect, which when combined with slower deal activity and exits, left minimal capital for new commitments.

Buyouts | Buyout activity in 2023 declined by about a third compared to the highs of 2021-22, reflecting high interest rates, a wide bid-ask spread, and lingering effects from the slowdown in the public markets. 3Q23 appears to be the trough in buyout dealmaking, with early 2024 seeing improved liquidity conditions and higher public markets comps. Average deal size has declined; larger buyouts have been more difficult to finance, leading to greater activity for small/mid buyouts and add-on acquisitions.

Venture Capital and Growth Equity | 2023 saw a substantial decline of ~50% in venture capital and growth equity activity, following the highs of 2021. There is a bifurcation by stage: An artificial intelligence “supercycle” is accelerating early-stage deal activity and buoying valuations, while late-stage companies struggle with slower growth, falling valuations, and lack of exit prospects.

Exits | Exits in 2023 have declined dramatically by over 50% compared to their all-time record in 2021. Only 8% of total private equity AUM generated liquidity in 2023 (the lowest level ever, lower even than in the depths of the Global Financial Crisis).

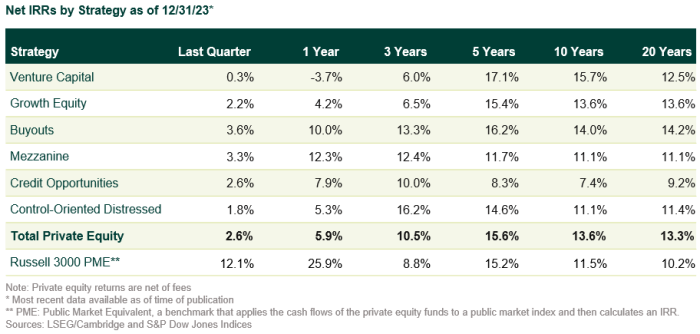

Returns | The strong recovery of the public equity market in 2023 (led by the “Magnificent Seven” technology stocks) has left private equity in its wake. Private equity doesn’t recover as quickly as the public markets because the smoothing effect dampens private equity returns in both up and down markets.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.