Since central bankers began the Zero Interest Rate Policy experiment following the Global Financial Crisis in 2008-09, including a revival of the policy in 2020 post-COVID, the market has bemoaned the lack of meaningful interest rates for debt investors. Investors spent the 2010s wishing for a “return to normal” in interest rates, which means a real return to investing in cash (a small premium over inflation); an upward sloping yield curve; and a 10-year Treasury rate that roughly equals nominal GDP growth.

What does that really mean? In a world of, say, 2% inflation (the Fed’s target), and real GDP growth of 2.0%-3.0% (let’s call it 2.5%), then cash would yield about 2.5%, 10-year Treasuries would yield about 4.5%, both savers and retirees would be satisfied with a positive real return to holding debt, and the economy could function on a real cost of capital that looks like the long-term average.

Today inflation is at 3.5% (March 2024), and economic growth has come in hotter than expected, meaning the Fed’s inflation-fighting efforts may not yet be over. The U.S. economy and global capital markets are not back to this mythical equilibrium, but one could argue there is a decent chance of getting there within the next year or so.

So we achieved the yearned-for goal of normal interest rates, and the markets should be happy about this achievement. Right? Not so—almost from the moment we began raising rates in 2022, moving in quick steps toward normalization, the capital markets have priced in an imminent recession and a reversal of interest rates, the very counter to normalization. What gives? Are we (the market) a giant collection of irrational actors? Did we regret our wished-for goal of normal interest rates once we saw what the goal would mean for the cost of debt, for mortgages, for short-term borrowing?

When I say the markets called for a reversal of rate hikes, it means the yield curve inverted, just three months after the Federal Reserve began raising rates. An inverted yield curve is simply the expression of market participants’ belief that interest rates will come down at some point in the future, and it happens when bond investors move into longer-dated debt to pick up a bigger price gain when rates come down. This investor move drives up the price of longer bonds and drives down their yield. Why would investors expect rates to fall? They believe the rate hikes enacted by the Fed will slow the economy enough to cause recession and spur the Fed to start cutting rates to stimulate growth.

To the casual observer, this explanation of the path from investor expectations to an inverted yield curve to an economic forecast looks like a long way to go. What makes the current situation particularly interesting is that many market participants, simply by virtue of the experience since 2009 and their age, have never lived through inflation greater than 2% and interest rates anywhere near their current level. We can talk about a return to normal, but for many, the 10-year plus period of ZIRP was their “normal.”

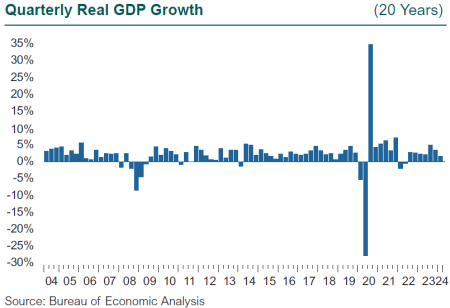

All forecasters expected the rate hikes begun in 2022 to cause a slowdown and likely a recession by 2023, and most certainly by 2024. GDP growth defied all forecasters and got stronger as 2023 progressed, finishing the year 2.5% higher than 2022. Driving the growth was a phenomenal year in the job market, as almost every industry segment finally surpassed its pre-pandemic peak.

1Q24 GDP growth came in at 1.6%, which is softer than the forecasts that led up to its release, and the first time growth has been below 2% in seven quarters, all the way back to the anomalous GDP losses in 1Q and 2Q in 2022. The Fed’s Open Market Committee voted on May 1 to hold the Fed Funds target at 5.25%-5.5%. The Fed directly referenced final sales to domestic purchasers as reason for holding rates steady, as these sales grew at 3%, 3.3%, and 3.1% over the last three quarters (through 1Q24).

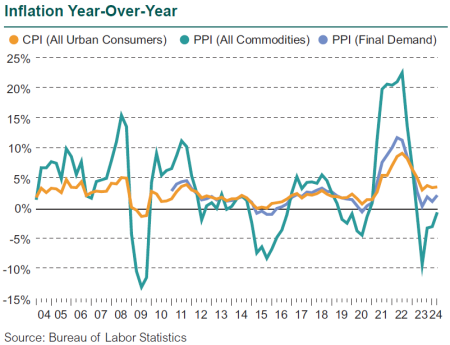

The Fed has also changed its tone regarding inflation, after inflation rose in the first quarter, with the CPI hitting 3.5% in March. CPI dropped to 3.0% in June 2023, bounced around in the fall and started 2024 at 3.1%, but the persistence of inflation is humbling to the Fed.

The logical conclusion is that the current strength of the economy is both a sign that there is no urgent need to lower rates, and that this strength and the current rate of inflation are not in alignment with the Fed’s goal of 2% inflation. So long as progress on inflation remains stalled, it will take longer than expected before the FOMC believes it will be appropriate to lower rates.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.