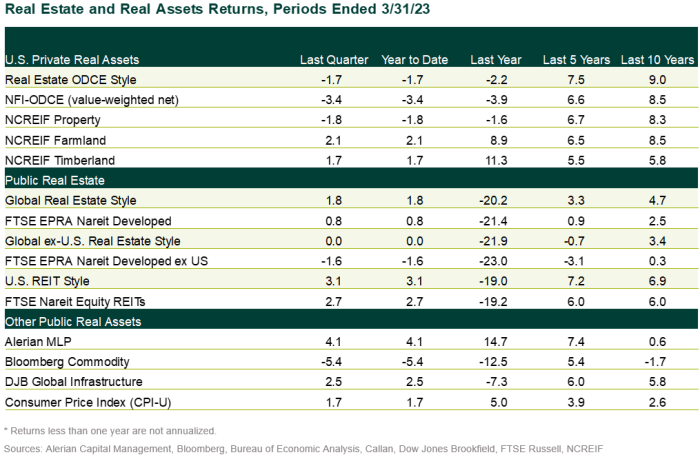

Private real estate indices fell in 1Q23. Public real estate indices gained but lagged comparable equity indices. Real assets were mixed in 1Q but generally underperformed global equities.

Private Real Estate

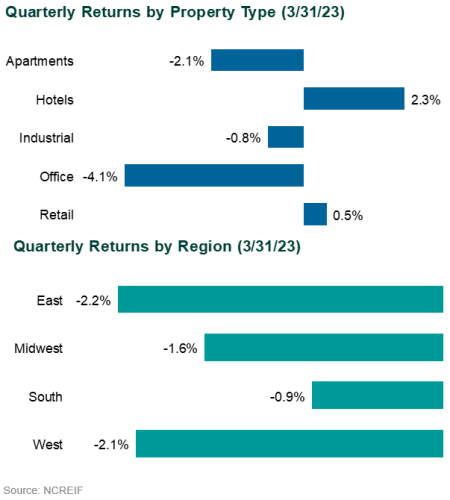

The NCREIF Property Index, a measure of U.S. institutional real estate assets, fell 1.8% in 1Q23, with an appreciation drop of 2.8% overcoming an income gain of 1.0%.

Income returns were positive across sectors and regions. All property sectors and regions, except for Hotel, experienced appreciation declines, and all sectors and regions, except for Hotel and Retail, saw overall returns drop.

The NCREIF Open-End Diversified Core Equity (ODCE) Index, representing equity ownership positions in U.S. core real estate, plunged even more, down 3.4%, with an income gain of 0.6% failing to overcome an appreciation drop of 4.0%.

Public Real Estate

The FTSE EPRA Nareit Developed REIT Index, a measure of global real estate securities, rose 0.8% during 1Q23. U.S. REITs, as measured by the FTSE Nareit Equity REITs Index, increased 2.7%. U.S. REITs underperformed the S&P 500 (7.5%) but exhibited strong performance relative to REITs in Europe and Asia. After initial hopes of a soft landing and a pivot from the Federal Reserve, sentiment was upended by employment, retail sales, and inflation reports that were too strong for comfort. This raised expectations for “higher for longer” interest rates.

However, the sudden bank failures in March required swift intervention and changed the perceived path of future monetary policy actions. Markets displayed increased confidence that the aggressive interest rate cycle of the past year was close to an end despite two 25 basis point hikes during the quarter. The Fed also acknowledged that tighter credit conditions might substitute for future hikes.

Storage had the strongest performance due to M&A speculation, while industrial owners saw continued pricing power. Office lagged due to sluggish fundamentals and concerns about the troubled lending market. Office stocks lagged due to several high-profile technology companies announcing layoffs, continued headwinds related to remote work, and regional banks’ linkage to the Office sector as a significant debt provider.

U.S. REITs raised $14.4 billion during the quarter, including 14 secondary equity offerings raising $3.6 billion and 14 unsecured debt offerings raising $10.9 billion.

The FTSE EPRA Nareit Developed Asia Index (USD) fell 1.5% during the quarter. The Asian real estate market had mixed performance during the quarter, with positive returns from Singapore and Hong Kong, but lagging performance from Japan. The defensive Singapore REIT space benefited from rotational flows as local investors positioned for a global slowdown, while Hong Kong was supported by improving momentum in its border reopening with China, retail sales, and residential home prices. The Singapore dollar was strong, whileJapan lagged due to pressure on JREITs from the BOJ’s policy to let the 10-year government bond yield rise.

Australian diversified REITs with residential exposure performed well on expectations of the Reserve Bank of Australia ending its rate hike cycle. However, a rights issue by a retail REIT impacted the share price in Hong Kong, raising concerns that REITs may take similar actions.

The FTSE EPRA Nareit Developed Europe Index (USD) declined 3.0% during the quarter. U.K. property stocks outperformed due to their strong balance sheets and moderation in asset price declines. European stocks started strong backed by solid economic data and moderating inflation, but concerns over banking sector health and core inflation outweighed the gains. German, Swiss, and Swedish housing companies struggled due to being leveraged or cutting or suspending dividends to preserve cash. Meanwhile, Belgian and Dutch firms performed well, driven by self-storage and student housing sectors’ defensive positioning, resilient valuations, and strong operational growth.

Real Assets

Gold (S&P Gold Spot Price Index: +8.8%), REITs (MSCI US REIT: +2.7%), infrastructure (DJB Global Infrastructure: +2.5%), and TIPS (Bloomberg TIPS: +2.0%) all posted positive returns.

The S&P GSCI Index fell 4.9% with oil down about 7%. WTI Crude closed the quarter at $74/barrel, just before OPEC announced its intention to cut production in May.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.