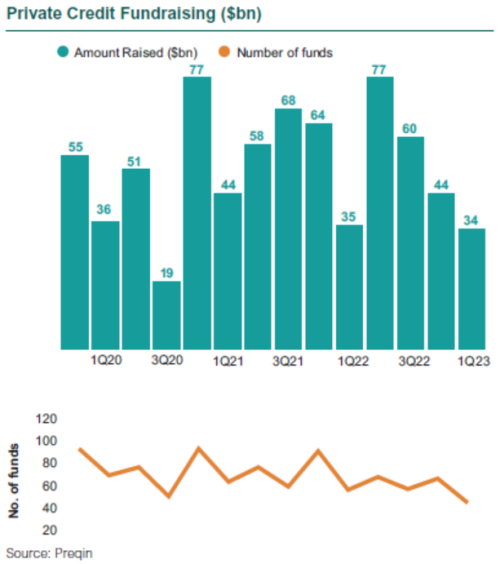

Private credit fundraising has remained strong through 1Q23. In the current rate environment, a renewed focus has been placed on relative value, downside protection, and managers’ internal workout resources.

There is also interest in strategies with strong collateral protection such as asset-based lending. And larger sponsor-backed lending is seeing a new focus due to the high yield/BSL disintermediation by private debt.

- As interest rates declined after the GFC, private credit attracted increased interest from institutional investors.

- Private credit fundraising was robust leading into the COVID dislocation with a particular focus on direct lending, asset-based lending, and distressed strategies.

1Q23 Private Credit Fundraising Trends

- During 1Q23, clients took a new look at upper-middle-market direct lending as all-in spreads have widened by over 400 bps and lenders are able to get tighter terms. Strong deal volume was driven partially by a shift from public to private market debt financings in the recent market environment.

- As economic headwinds are expected to create stress on over-levered companies, there is also interest in stressed and distressed investment opportunities.

- Demand continued to be strong for less-competitive areas of private credit with high barriers to entry and attractive risk/reward opportunities such as specialty finance and opportunistic lending.

- The recent bank dislocation has provided new opportunity to pick up regional bank assets at a discount as well as to provide capital solutions to bank balance sheets.

- LPs are seeking alternative structures designed to streamline the investment process while improving underlying liquidity. A number of GPs are launching evergreen structures and private, non-tradeable business development companies as a response to LP interest.

- U.S. sub-investment grade corporate yields rose dramatically at the beginning of 2022 with yields peaking in September. This was a combination of higher interest rates due to tighter Fed policy and a widening of high yield spreads.

- Spreads widened during the first half of 2022 due to weaker credit conditions as the U.S. economic outlook worsened. This has since moderated.

- Default rates for U.S. corporate bonds ticked up in 1Q but remained well below the historical average of 3%-4%. Callan expects defaults to increase somewhat in coming months as economic growth slows and potentially turns negative.

- The Corporate Bond Market Distress Index (CMDI) rose rapidly during the first nine months of 2022, especially for investment grade bonds, highlighting market volatility and a drying up of liquidity, but has fallen since then.

- In 2023, as the IG distress index continues to fall, the HY bond indicator is on the rise. The CMDI incorporates a range of indicators, including new issuance and pricing for primary and secondary market bonds and relative pricing between traded and nontraded bonds.

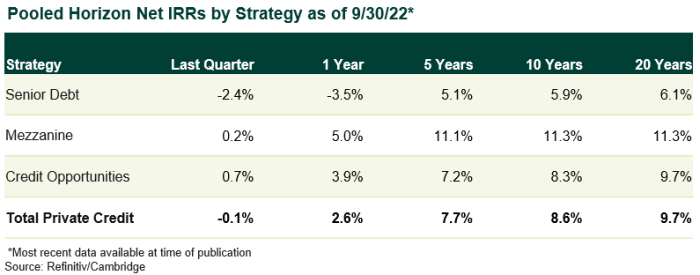

- Private credit performance varies across sub-asset class and underlying return drivers. On average, the asset class has generated net IRRs of 7% to 10% for trailing periods ended Sept. 30, 2022. Higher-risk strategies performed better than lower-risk strategies.

Disclosures

The Callan Institute (the “Institute”) is, and will be, the sole owner and copyright holder of all material prepared or developed by the Institute. No party has the right to reproduce, revise, resell, disseminate externally, disseminate to any affiliate firms, or post on internal websites any part of any material prepared or developed by the Institute, without the Institute’s permission. Institute clients only have the right to utilize such material internally in their business.