1Q22 Private Credit Trends

As credit spreads have compressed, institutional investors have pushed into private credit in search of yield, with a balanced private credit allocation to a mix of top quartile to median performers offering a levered return in the 8% to 10% range.

- Yield and income-generating characteristics remain attractive in a low-rate environment.

- Alpha generation can be magnified through strategies that extract a complexity premium.

- Many direct lending assets are floating rate, which can add protection against rising rates.

- Portfolios were resilient during the COVID dislocation due to liquidity injected into the economy; valuations are back to 2019 levels but the space remains crowded.

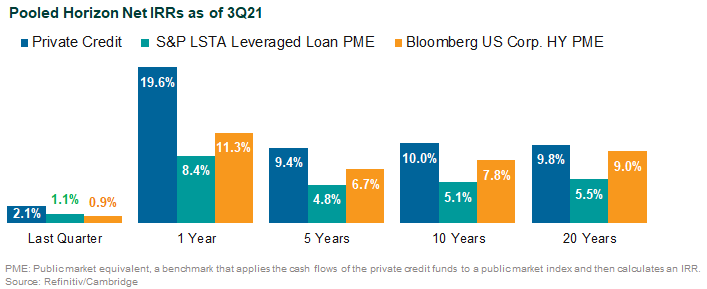

- Private credit performance varies across sub-asset class and underlying return drivers. On average, the asset class has generated net IRRs of 8% to 10% for longer-term trailing periods ended Sep. 30, 2021. Higher-risk strategies performed better than lower-risk strategies.

Fundraising in 2022 seasonally slow

- Private credit fundraising tapered off in 3Q20 due to COVID-related disruption but significantly rebounded in 4Q20 and 1H21; 1Q22 has been seasonally slow with fewer funds in the market but with larger fundraise targets.

- Fundraising in the first part of 2022 focused on diversifying strategies such as specialty finance, specialized industry lending, and non-sponsor/opportunistic lending.

- Traditional sponsor-backed strategies are coming to market with evergreen structures for which there is growing demand.

- There is continued strong private credit fundraising activity from large credit shops as well as new offerings from traditional fixed income managers.

- Industry consolidation is in full swing with large traditional firms acquiring alternative credit managers, such as T. Rowe Price acquiring Oak Hill Advisors and Alliance Bernstein’s acquisition of CarVal.