Global market volatility spiked during 1Q22 following Russia’s invasion of Ukraine. Economic sanctions on Russia caused oil prices to hit their highest levels since 2014, intensifying inflation concerns as central banks increased their hawkish rhetoric. Asia was not immune to this market volatility, as Chinese stocks declined as well, likely sparked by the underperformance of growth-oriented companies globally. Investors continue to seek clarity around China’s worsening COVID-19 outbreaks and lockdowns in major cities including Shenzhen and Shanghai.

Despite the ongoing conflict in Europe, the Federal Reserve moved ahead with a 25 basis point increase in its policy rate, its first since 2018, and projections showed six more hikes for the remainder of the year. The U.S. Treasury 10-year yield rose by 70 bps to 2.33%, as the Fed began the process of being more aggressive in combating rising inflation.

The S&P 500 fell 4.6% in a volatile quarter that included a maximum drawdown of more than 12%, as significant dispersion by style, sector, and country had a major influence on underlying stock performance. The rotation into cyclical re-opening stocks that began in 2021 continued into 1Q22. Value-oriented and cyclical sectors such as Energy, Financials, and Industrials outperformed growth-oriented sectors such as Technology and Health Care. Growth companies lacking current profitability and with valuations based on prospects longer into the future underperformed the most, as investors favored companies with current earnings. Hawkish monetary policy drove bond yields higher and prices lower, as the Bloomberg US Corporate High Yield Bond Index outperformed the Bloomberg Investment Grade Corporate Bond Index, but both ended the quarter negative.

Hedge funds ended the volatile quarter with mixed results, as equity hedge managers had a difficult time; net long exposure to tech, media, and telecom (TMT) was a drag on their performance. Equity managers with a focus on energy and industrials had a solid quarter but were not able to offset those with exposure to the TMT space. Event-driven strategies also ended lower, due to a higher weight to equities vs. credit to start off the year. Macro strategies soared, as commodities spiked on inflation fears and supply issues tied to the Russian invasion of Ukraine. Relative value managers ended slightly higher, as they were able to profit off an increase in rate volatility throughout the quarter.

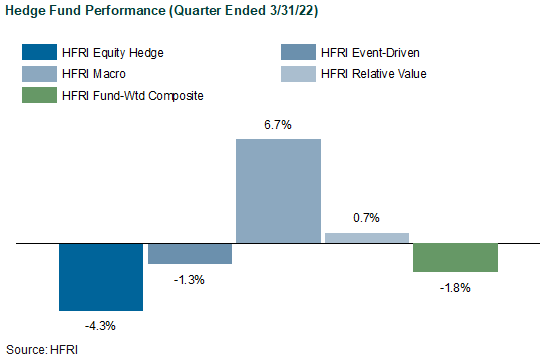

1Q22 Hedge Fund Performance

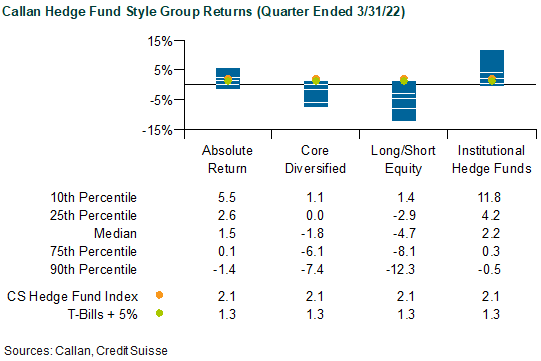

Representing a raw collection of hedge funds reporting performance without implementation costs, the HFRI Fund-Weighted Composite Index lost 1.8% for 1Q. As an actual hedge fund portfolio net of all fees, the median manager in the Callan Hedge Fund-of-Funds (FOF) Database Group detracted 1.3%. Serving as a proxy for large, broadly diversified hedge funds with low-beta exposure to equity markets, the median Callan Institutional Hedge Fund Peer Group manager rose 2.2%. Within this style group of 50 peers, the average rates manager gained 5.0%, driven by managers actively trading interest rate volatility throughout the quarter. Hedged credit managers also gained (4.3%), as they were able to opportunistically allocate capital during a volatile quarter. The average equity hedged manager added 2.2%, as this group tends to run with a low net exposure and lower beta to equity indices.

Within the HFRI indices, the best-performing strategy last quarter was Macro (+6.7%), aided by its exposure to commodities. Volatility across interest rates helped Relative Value funds advance (+0.7%). Equity Hedge strategies (-4.3%) had a difficult quarter, as those that were overweight to growth performed worse than those with a value bias in their holdings. Event-driven strategies fell 1.3%, as an overweight to equities during the quarter hurt performance.

Across the Callan Hedge FOF Database Group, the median Absolute Return FOF gained 1.5%, as a focus on lower beta strategies performed well during the quarter. Meanwhile, the Callan Long-Short Equity FOF fell 4.7% as a growth bias was a drag on performance. The median Callan Core Diversified FOF declined 1.8%, as equity positioning and interest rate volatility offset macro outperformance during the quarter.

Since the Global Financial Crisis, liquid alternatives to hedge funds have become popular among investors for their attractive risk-adjusted returns that are similarly uncorrelated with stock and bond investments but offered at a lower cost. Much of that interest is focused on rules-based, long-short strategies that isolate risk premia such as value, momentum, and carry found across the capital markets. These alternative risk premia are often embedded in hedge funds as well as other actively managed investment products.

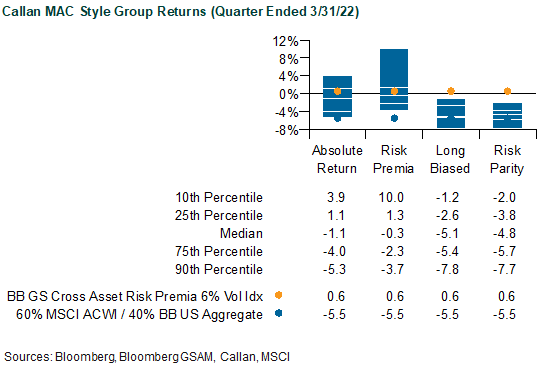

Measuring the quarter’s performance of these alternative risk premia, the Bloomberg GSAM Risk Premia Index increased 0.6% based upon a 6% volatility target. Within the underlying styles of the Index’s derivative-based risk premia, Equity Value L/S (+8.7%), Futures Trend (+5.2%), Commodity Trend (+5.1%), and FX Carry (+4.5%) profited off strength in value equities, commodities, and foreign exchange throughout the quarter. The weakest risk premia was Bond Futures Carry (-5.1%), as interest rate volatility hurt fixed income throughout the quarter.

Within Callan’s database of liquid alternative solutions, the median managers of the Callan Multi-Asset Class (MAC) Style Groups generated negative returns for the quarter, gross of fees, consistent with their underlying risk exposures. For example, the median Callan Long Biased MAC manager fell 5.1%, as exposure to equity and fixed income was a drag on performance. The Callan Risk Parity MAC index, which typically targets an equally risk-weighted allocation to the major asset classes with leverage, was down 4.8%. The Callan Risk Premia MAC held up the best during the quarter, down 0.3%.

The start of 2022 has already created a macroeconomic environment full of uncertainty and thus volatility in securities markets, with all signs pointing for this to continue over the coming months. The unknowns continue to pop up, as the global economy works its way through concerns about geopolitical events, supply chain issues, inflation, and changing central bank policies. Hedge fund managers have a lot to juggle when positioning portfolios in this current market environment.

We continue to suspect macro hedge fund managers are well-positioned to profit off global market volatility across asset classes. Relative value managers also have the ability to opportunistically allocate capital in a volatile interest rate environment. Equity hedge managers that have a focus on value investing and a history of shorting should be able to profit off the rotation from growth to value.